Many have known that influential firms such as Tesla, Mastercard, BNY Mellon have embraced cryptocurrency, with some creating their own financial token. This is enough to show that the booming token market will only attract more and more attention. With these tokens come ICOs (Initial Coin Offerings) and STOs (Security Token Offerings), which are digital tokens used to promote crowdfunding initiatives and perform transactions.

Let’s find out the difference between ICOs and STOs in this article!

Disclaimer: Please keep in mind that the material in this article is NOT financial advice and is provided primarily for informing! If you are thinking of investing in any of these three processes, please proceed with caution to avoid fraud or potential losses.

What Are ICOs (Initial Coin Offerings)?

Initial Coin Offerings, or ICOs, were the first crowdfunding option to emerge in the blockchain community, which is referred to as the cryptocurrency equivalent of IPO (Initial Public Offering). This kind of offering allows vast investor populations to sponsor the growth of a project or initiative. An ICO gives investors tokens in exchange for their investment in the business in accordance with the smart contract which is coded and stored in the blockchain.

Unlike an IPO, you must first go through legal frameworks before investing in the venture. The token shared with the investor represents future return on investment (ROI) that the project will provide to them based on the smart contract.

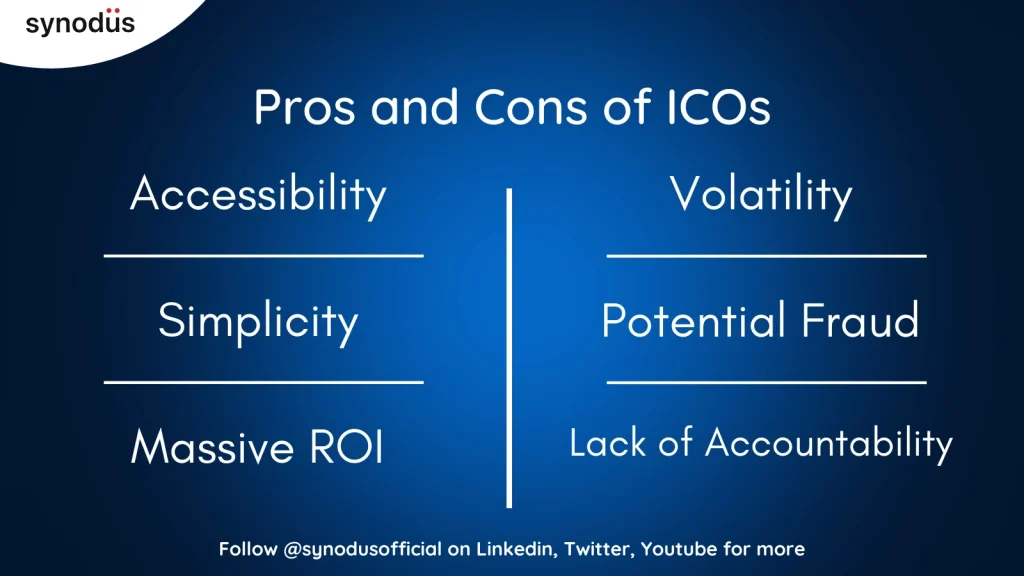

Pros

- Accessibility: Companies that embrace cryptocurrencies as investment tokens have greater access to a broader range of investor populations at various economic levels.

- Simplicity: Since ICOs depend on blockchain technology to retain a record of their transactions, less paperwork is needed and data is updated in real-time.

- Massive ROI: Some noticeable examples include Tatatu (raised %575 million), Dragon Coin (hit $320 million), HDAC (attracted $258 million), and so forth.

Cons

- Volatility: With so many elements influencing the price, investors can anticipate quick extreme price swings in value. This could definitely make an investor’s day or break them.

- Potential fraud: Since ICOs are not subject to regulatory scrutiny as IPOs or other conventional assets, it also makes them open to fraud and other nefarious tactics, allowing illegitimate firms to rob unsuspecting investors.

- Lack of accountability: To aggregate the previous point, the firm hosting the ICO is not liable for the actual delivery of its promise; consequently, investors may not receive any return at all.

What Are STOs (Security Token Offerings)?

Similar to ICO, an STO investor receives a cryptocurrency or token in exchange for their funding; however, unlike an ICO, a security token reflects a smart contract linked to an underlying investment instrument, which can be real estate, stocks, bonds, or funds. Security is described as a fungible financial instrument that retains some form of monetary value, which is, in this case, an investment product backed by a tangible asset.

It is no secret that Initial Coin Offerings are plagued by fraud. Since ICO lacks a regulated environment and the collateral backing up the token, it provides a low barrier to entry and increases the likelihood of scams. Before launching, STO requires enterprises to execute all regulatory requirements. Due to having a governing entity, STO overcomes the limitations of ICOs in this regard.

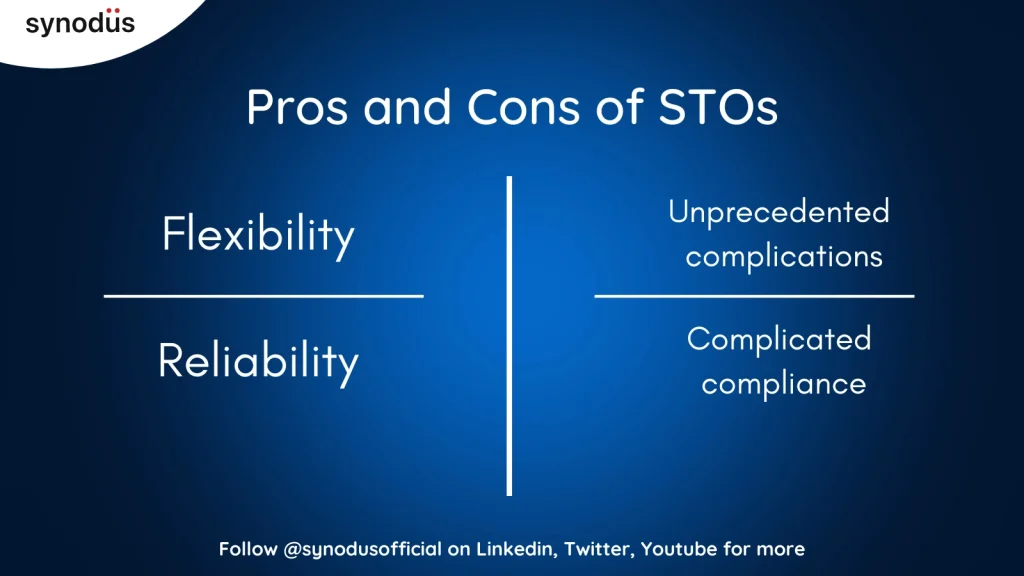

Pros

- Flexibility: After the initial sale, security tokens could be exchanged, which means they are considerably more liquid assets.

- Reliability: Security tokens have a more visible value based on the underlying, possibly tangible, assets; henceforth, a company is less likely to be shorted, even if there are only a few significant investors. Furthermore, the fact that STOs are properly regulated by regulating bodies protects the investor’s security.

Cons

A new market comes with unprecedented complications. The long-term effect and risks in this new space have not been tested extensively, meaning investors should still be wary.

Complicated compliance: Since security tokens are still subject to current securities legislation, a firm needs legal consultation in each area where it wishes to sell tokens to avoid violation of local securities regulations.

| Read more: What are ICO, IDO and IEO? | |

How ICOs Differ from STOs

Take a glance at the table below to see how ICOs differ from STOs:

| ICOs | STOs | |

| is considered as | a utility | a security backed by real-life assets |

| the time they have been around | an older model to crowdfund a project in the blockchain ecosystem | a more novel crowdfunding method for a blockchain project |

| legal differentiation | under utilities legislation. There are little to no regulations regarding ICOs | under securities legislation (similar to IPOs). They are heavily regulated in most regions around the globe |

| KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance | most do not have mandatory KYC/AML verification | required KYC/AML verification |

| price fluctuation | more volatile. Their worth is completely speculative, based on the anticipated value investors expect from them. | Less volatile, similar to stocks linked to a particular firm |

| barriers to entry | really low entry barrier, suitable for small start-ups to kickstart their projects in early-stage | more entry requirements compared to ICOs but less than IPOs. Before launching, firms must check governance, risk management and compliance (GRC) |

| scams and fraudulent activities | much more prone to scams due to low entry barriers and really limited regulations. Retrieving funds invested in a fraudulent project is almost impossible with no legislation protecting investors | less likely due to the levels of compliance and the backing of real-life assets. More trustworthy |

| amount of investment time | considered as a short-term solution | more long-term since the firm behind the STO must develop a scalable business plan, making the projects more sophisticated and reliable |

| anonymity | some allow anonymous investors | holders must be verified. The investor populations therefore are smaller |

Key Takeaways

In spite of STO vs ICO appearing to be identical at first glance, they are simply different models with similar goals. Whilst STOs aim to secure investments and comply with governments’ legislations, ICOs seek to make fundraising more accessible for every business, especially start-ups. Despite greater obstacles to lawfully issuing STOs, some investors still prefer to have their funds safeguarded. Meanwhile, an easy-to-invest ICO can still be a great option for anyone wanting a quick investment.

To find out more about models other than ICOs and STOs, follow Synodus to learn more.

More related posts from our Blockchain blog you shouldn’t skip: