Why startups should choose decentralized crypto wallets

First things first, what is a decentralized crypto wallet? A crypto wallet decentralized, also known as a non-custodial wallet, enables users to maintain complete control over their private keys and digital assets. Unlike centralized wallets, which rely on third parties to manage assets, decentralized wallets empower users to engage directly with their cryptocurrencies for security and autonomy.

Startups should consider integrating or developing decentralized wallets for the following main reasons:

Increased security – Users retain control over their private keys, significantly reducing the risk of hacks and unauthorized access. This self-custody model enhances user trust and safety.

Attracting users seeking autonomy – There are over 320 million cryptocurrency users worldwide as of 2022, with a substantial number gravitating towards decentralized solutions for the independence they offer.

Supporting ecosystem products – Decentralized wallets facilitate interactions with various decentralized finance (DeFi) applications, NFT marketplaces, and token staking platforms. This integration can enhance the utility of a startup’s offerings and attract a broader user base.

Revenue growth and reputation – By offering a secure, user-friendly wallet solution, startups can increase revenue through transaction fees from user activities like sending cryptocurrencies and engaging with decentralized applications. Also, prioritizing security and usability helps build a strong reputation.

Given these reasons, it is no surprise that the demand for decentralized crypto wallets is surging. More specifically:

- The DeFi market alone was valued at approximately $86 billion as of mid-2024, indicating a robust interest in self-custody solutions.

- There are approximately 6.68 million unique addresses actively engaging with DeFi applications, which implies a growing user base for decentralized wallets.

- Uniswap V3, one of the leading decentralized exchanges, recorded over 7.8 million monthly visits. This showcases the popularity and usage of platforms that require decentralized wallets for transactions.

Top 10 best decentralized crypto wallets in 2025

This table provides a comprehensive overview of what is the best decentralized crypto wallet with their characteristics. It allows you to compare them effectively as you consider your options in the decentralized crypto space.

| Name | Fee | Wallet types | Numbers of cryptos supported |

|---|---|---|---|

| Meta Mask | 0.875% (built into the exchange rate) | Hot wallet | 500,000+ |

| Trust wallet | No fees for sending; variable for swaps | Hot wallet | 200+ |

| Ledger Nano S | Commission built into the exchange rate | Cold wallet | 5,500+ |

| Exodus | Varies by currency and 3rd party | Hot wallet | 300+ |

| Trezor Model One | Approximately 4.5% to 6%, depending on the selected provider and cryptocurrency | Cold wallet | 1,200+ |

| Atomic Wallet | No extra fees for transactions, but swap fees apply | Hot wallet | 300+ |

| Margex wallet | Market makers pay a 0.019% fee, while market takers are charged 0.06% | Cold wallet | 100+ |

| Uniswap wallet | The swapping fee is 0.3%, with a potential future fee of 0.05% for liquidity providers only | Hot wallet | 1,800+ |

| Zengo | No fees for receiving or sending crypto. Offers discounts for Pro customers. Applies varying fees for transactions. | Hot wallet | 120+ |

| Sparrow | Free to use, with only standard Bitcoin network fees applied. | Hot wallet | Bitcoin |

Following the overview of the top decentralized crypto wallets, we will now provide a detailed assessment of these ten wallets. With it, you can make a more informed decision based on your specific needs and preferences.

1. Meta Mask – top Ethereum-focused decentralized wallet

MetaMask is a widely used decentralized crypto wallet with over 30 million users, primarily focused on Ethereum and ERC-20 tokens. Available as a mobile app and browser extension, it facilitates buying, selling, swapping, and staking of cryptocurrencies, featuring a built-in token-swapping tool for trades without centralized exchanges.

Best for: Ideal for both beginners and experienced crypto users who want to explore Ethereum, DeFi applications, and NFTs.

Pros:

- 30M+ global users, highly trusted

- Easy to use (browser & mobile)

- Full support for Ethereum & ERC-20 tokens

- Direct dApp, DeFi & NFT access

- Built-in token swap & staking

Cons:

- Limited mainly to Ethereum/Layer-2

- High Ethereum gas fees

- Risk of phishing for new users

- Extension can be heavy at times

What can you learn from them? Focusing on a user-friendly interface to attract beginners and integrating with popular dApps to enhance engagement. A non-custodial model fosters trust, while features like staking and token swaps improve user experience. Building a strong community can also drive growth and loyalty.

2. Trust wallet – user-friendly feature-rich crypto wallet decentralized

With over 60 million users, Trust Wallet allows individuals to securely store and manage cryptocurrencies and NFTs across more than 70 blockchains. It ensures that only users have access to their assets via a 12-word recovery phrase. The wallet features an intuitive mobile app and a Chrome extension, enabling users to buy, swap, and stake cryptocurrencies seamlessly.

Best for: Those seeking a secure, user-friendly wallet for managing a diverse range of cryptocurrencies.

Pros:

- Supports 200+ cryptocurrencies & millions of tokens

- Non-custodial: users fully control private keys

- 60M+ users worldwide, strong trust & adoption

- Built-in staking, swapping & Web3 browser

- Smooth integration with Binance ecosystem

Cons:

- Limited desktop support (mostly mobile app)

- Customer support can be slow

- Fewer advanced DeFi tools compared to MetaMask

- Occasional performance issues with large portfolios

What can you learn from them? One key lesson is the importance of multi-currency support, which allows users to manage a wide range of digital assets, enhancing user retention. Also, the wallet’s commitment to user privacy and non-custodial storage demonstrates the significance of building trust through transparency and security measures.

3. Ledger Nano S – secure offline self-custody wallet

The Ledger Nano S is a lightweight and secure hardware wallet from Ledger, a leading manufacturer in crypto space. Priced around $80, it supports over 5,500 cryptocurrencies and allows users to install up to 100 applications simultaneously. It offers offline storage for private keys while also supporting NFTs and staking for cryptocurrencies like Ethereum and Solana.

Best for: Those who want robust security features without the higher cost of the Ledger Nano X.

Pros:

- Hardware wallet with offline cold storage

- Strong security against hacks & malware

- Supports 5,500+ cryptocurrencies

- Easy setup & recovery process

- Works with 50+ third-party wallets + mobile app

Cons:

- Limited storage capacity (can’t hold many apps at once)

- Requires physical device for transactions

- Less convenient for frequent traders

- Initial cost higher than software wallets

What can you learn from them? This wallet provides great user experience and security with its intuitive interface and robust cold storage. Its support for a wide range of cryptocurrencies and NFTs shows the value of multi-asset compatibility. Plus, integration with the Ledger Live app provides a seamless mobile experience for convenient asset management.

4. Exodus – popular secure decentralized wallet with built-in exchange

Exodus is one of the most user-friendly decentralized wallets for crypto supporting over 300 cryptocurrencies, allowing asset management and swaps without KYC verification. It offers staking for coins like Cardano and Solana and can be paired with a Trezor wallet for enhanced security. While it lacks two-factor authentication, Exodus provides a simple recovery process and strong customer support, making it suitable for all users.

Best for: Beginners and experienced users wanting a user-friendly wallet with a focus on privacy and security.

Pros:

- Supports 300+ cryptocurrencies

- Built-in exchange for quick swaps

- User-friendly interface, great for beginners

- Desktop & mobile compatibility

- 24/7 in-app customer support

Cons:

- Closed-source software (less transparency)

- Higher swap fees vs. external exchanges

- Limited advanced DeFi features

- Non-custodial, but less secure than hardware wallets

What can you learn from them? The multi-asset support and built-in exchange feature highlight the value of offering diverse functionalities within a single platform, catering to varied user needs without relying on third-party services. Its commitment to privacy, such as not requiring KYC checks, fosters trust and encourages user adoption.

5. Trezor Model One – affordable beginner-friendly wallet

Trezor Model One is a $70 hardware wallet with strong security features, including a 50-digit PIN and offline storage. It supports over 1,200 cryptocurrencies and allows users to buy, sell, and swap assets through the Trezor Suite app. Its compact design and user-friendly interface make it great for beginners, providing excellent value and security in the cryptocurrency space.

Best for: Beginners and casual users seeking an affordable, secure hardware wallet for managing diverse cryptocurrencies.

Pros:

- Hardware wallet with strong cold storage security

- Affordable price, great for beginners

- Supports 1,000+ cryptocurrencies

- Simple interface & easy setup

- Open-source firmware for transparency

Cons:

- Limited coin support vs. Ledger (no XRP, ADA, etc.)

- Requires physical device for transactions

- Small display, less user-friendly than newer models

- Fewer advanced features compared to Trezor Model T

What can you learn from them? Prioritizing affordability without compromising security is what you can learn for this wallet’s success. It builds user trust with robust security features like PIN protection and offline storage. Its intuitive Trezor Suite app enhances usability, and USB compatibility allows seamless integration with various devices.

6. Atomic Wallet – universal multi-currency wallet

Atomic Wallet manages over 300 cryptocurrencies, combining storage and exchange functions. It enables atomic swaps and integrates with Shapeshift and Changelly for easy transactions. Users can also purchase cryptocurrencies like Bitcoin and Ethereum directly with a bank card.

Best for: Beginners and experienced users seeking a solution for managing and exchanging a diverse range of cryptocurrencies.

Pros:

- Supports 1,000+ cryptocurrencies in one wallet

- Built-in Atomic Swap & exchange feature

- Non-custodial: users keep full control of private keys

- Staking available for multiple coins

- Works on desktop & mobile devices

Cons:

- Closed-source software (less transparency)

- Past security breach raised trust concerns

- Limited customer support options

- Higher swap fees than external exchanges

What can you learn from them? Using a modular architecture for easy updates, prioritizing security-first design to build trust, and ensuring cross-platform compatibility for better usability. Integrating community-driven features also fosters engagement and valuable feedback.

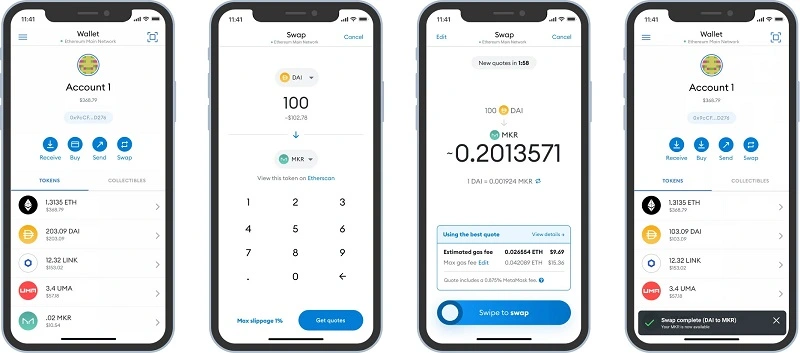

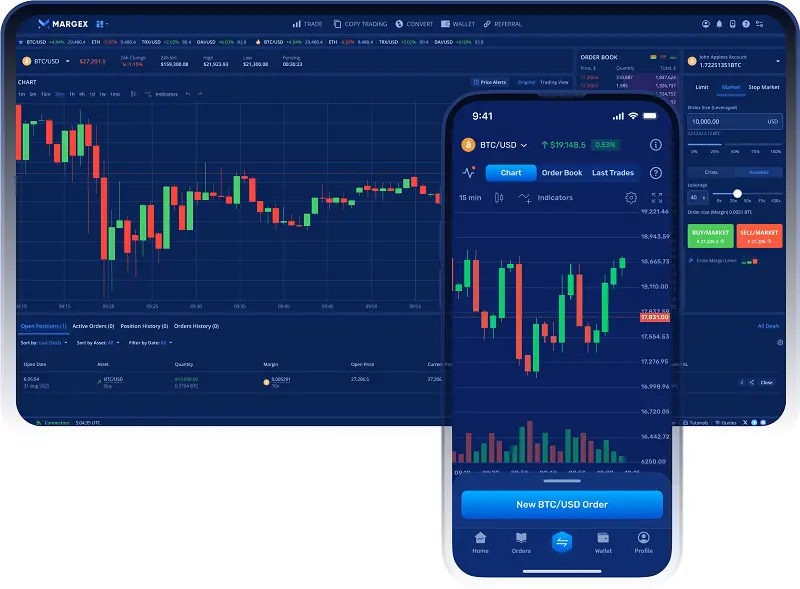

7. Margex Wallet – advanced trading crypto wallet

As one of the best decentralized crypto wallets, Margex wallet allows users to buy, sell, and withdraw cryptocurrencies directly, enhancing convenience but increasing exposure to online threats. To counter this, it employs robust security measures, including multisig cold storage, SSL encryption, and two-factor authentication.

Best for: Short-term traders and active investors who engage in leverage trading

Pros:

- Integrated with Margex exchange for advanced trading

- Supports multiple cryptocurrencies

- Leverage trading up to 100x

- User-friendly interface for both trading & storage

- Strong security with multi-signature cold storage

Cons:

- Primarily tied to the Margex platform (less versatile than standalone wallets)

- Not fully decentralized, exchange-dependent

- Limited DeFi/NFT integrations

- High risk for inexperienced users due to leverage trading

What can you learn from them? Integrating multiple features—like trading, staking, and copy trading—into one platform to enhance user experience. Prioritizing robust security measures builds trust, while offering unique financial products, like high-leverage trading, can attract risk-tolerant users. With these strategies, startups can create compelling offerings that resonate with their target audience.

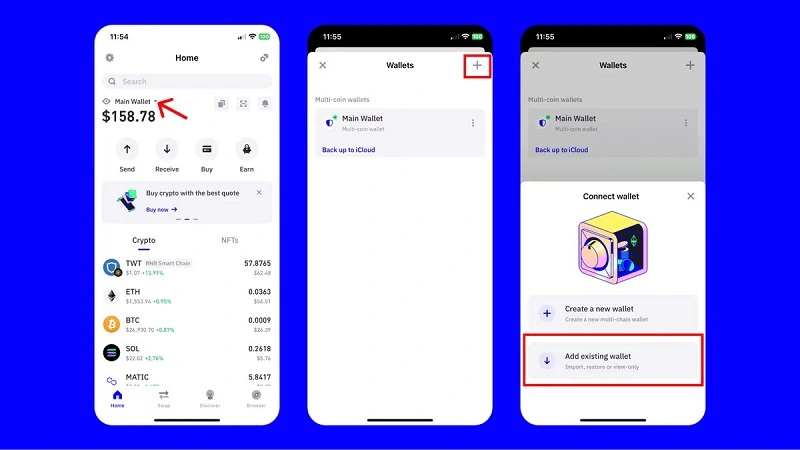

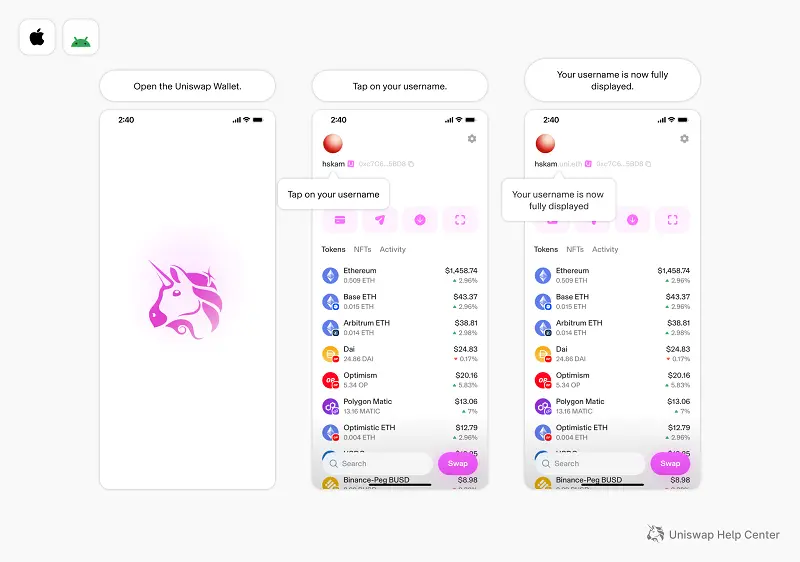

8. Uniswap Wallet – secure decentralized wallet for Uniswap DEX

This secure crypto wallet decentralized connects to the Uniswap exchange for easy cryptocurrency trading. Developed by Uniswap Labs, it offers non-custodial control of private keys, recovery via iCloud or seed phrase, and supports multiple Ethereum-based tokens with a unique swap feature.

Best for: DeFi enthusiasts and active traders managing Ethereum-based assets.

Pros:

- Native wallet for Uniswap DEX, ideal for DeFi users

- Non-custodial: full control of private keys

- Supports Ethereum, ERC-20, and Layer-2 networks

- Built-in token swaps with low slippage

- Simple, beginner-friendly interface on mobile

Cons:

- Limited mainly to Ethereum ecosystem (no multi-chain support yet)

- No hardware wallet integration

- Lacks advanced portfolio management tools

- High Ethereum gas fees during peak usage

What can you learn from them? Focusing on 3 key areas: enhancing user experience through a seamless and efficient interface to boost satisfaction, offering cross-chain functionality for easy management of diverse assets, and implementing innovative reward systems like “Swap to Earn” to increase user engagement.

9. Zengo – multi-chain wallet using MPC to eliminate seed phrases

Zengo Wallet enhances security with multi-party computation (MPC) technology, replacing traditional seed phrases with three-factor authentication using a 3D face scan, email, and recovery file. Launched in 2018, it has never been hacked and serves over one million users.

Best for: Users seeking secure, easy cryptocurrency management without seed phrases.

Pros:

- No seed phrase: uses MPC for secure keyless recovery

- Multi-chain support (Bitcoin, Ethereum, Polygon, etc.)

- Biometric login for quick, user-friendly access

- Built-in staking, DeFi, and NFT support

- 24/7 in-app customer support

Cons:

- Custody depends on Zengo’s MPC setup (not fully hardware-isolated)

- Limited advanced DeFi integrations vs. MetaMask

- Requires internet connection for full functionality

- Mobile-only (no desktop version yet)

What can you learn from them? Startups can learn from this wallet’s security, user experience, and business model innovation. By using MPC, Zengo builds user trust. Its intuitive interface makes technology accessible while the subscription model provides ongoing value. These strategies can help startups create sustainable and trustworthy products.

10. Sparrow Wallet – advanced Bitcoin wallet with multisig & privacy features

Sparrow Wallet is a non-custodial Bitcoin wallet designed for power users who prioritize privacy, security, and advanced transaction features. It supports multisig, hardware wallet integration, coin control, and detailed transaction analysis.

Best for: Advanced Bitcoin users, developers, and privacy-focused traders who want full control over their BTC.

Pros:

- Non-custodial with full user control of private keys

- Supports multisig setups and hardware wallets

- Detailed transaction breakdown with coin control

- Strong privacy features (Tor, Whirlpool mixing integration)

- Open-source and community-driven

Cons:

- Steep learning curve, not beginner-friendly

- Limited to Bitcoin only (no multi-chain support)

- Desktop-focused, no dedicated mobile app

- Interface can feel overwhelming for casual users

What can you learn from them? Sparrow shows how a crypto wallet can serve a niche audience extremely well: focusing on depth (advanced Bitcoin privacy & security) instead of breadth (multi-chain, beginner-friendly design). It’s a lesson in product positioning-owning a niche can build strong loyalty among expert users.

Integrating crypto wallets or building a new one – What are the differences?

To compare the integration of existing wallets versus building a new decentralized wallet, you should consider the benefits and challenges associated with each approach. Below is a summary table outlining these aspects, along with related recommendations.

| Aspect | Integration of Existing Wallets | Building a New Wallet |

|---|---|---|

| Benefits | Quick deployment and reduced development time | Tailored features to meet specific user needs |

| Access to established user bases and trust | Full control over security and user data | |

| Lower initial costs | Unique branding and competitive differentiation | |

| Challenges | Limited customization options | Higher development costs and longer time to market |

| Dependence on third-party services | Requires ongoing maintenance and updates | |

| Potential security vulnerabilities from third-party integration | Need for robust security measures from scratch | |

| Recommendations | Startups with limited resources may benefit from integration | Larger startups or those with niche markets should consider building their own wallet |

Pro tip: When deciding to build new decentralized crypto wallets for competitive advantage, startups should consider:

- Market gaps: Tailored wallets can attract users if existing options lack essential features.

- Unique value proposition: Standout features like enhanced security can differentiate the wallet.

- User experience: Intuitive design can draw users from wallets with poor interfaces.

- Adaptability: Custom wallets allow quick adjustments to changing trends and new features.

- Brand identity: This wallet fosters customer loyalty and aligns with the startup’s values.

- Long-term strategy: Building a wallet supports broader goals for growth in the cryptocurrency ecosystem.

Synodus – Your trusted partner in decentralized crypto wallet development

Synodus is one of the top-rated partners specializing in the development of the best decentralized crypto wallets, with extensive experience in blockchain projects. The company offers a comprehensive suite of services, including DApp development, DeFi solutions, NFT development, and crypto wallet integration into existing ecosystems.

Our expertise through successful case study

Overview: Synodus integrated a decentralized crypto wallet into the DeFi For You platform, allowing users to manage transactions without switching between multiple applications like MetaMask. This integration streamlined actions such as signing, fund approval, and transactions.

Key results:

- Project duration: 7 months

- Team size: 20 professionals

- Technical stack: Utilized Ethereum, Binance Smart Chain, Solidity, Flutter, iOS, Android, and TrustWallet Core.

- Security enhancements: Implemented robust encryption and secure storage of private keys.

- Interoperability achievements: Successfully integrated with major wallet standards and multiple blockchain networks.

- User experience improvement: Developed an intuitive interface that facilitated easy account management and seamless transactions.

Unique offerings for startups

Synodus provides competitive pricing for its services, ranging from $16 to $30 per hour, making it an attractive option for startups looking to develop decentralized wallets for crypto.

We also offer tailored packages for crypto startups, including the Funding Kickstart Package, Project Scope Blueprints, and Custom MVP Development, to streamline product launches. These packages address early-stage challenges by providing essential financial support, clear project planning, and rapid MVP development. This structured approach accelerates time-to-market, enhances market presence, and boosts growth potential.

Want to integrate or build a decentralized crypto wallet?

Conclusion

Decentralized crypto wallets are more than just a tool—they’re a gateway to innovation, user empowerment, and security in the ever-growing crypto space.

For startups, the choice to integrate or build a wallet isn’t just about technology; it’s about shaping a product that trully resonates with users and stands the test of time.

The top 10 decentralized crypto wallets have provided you with a deeper understanding of their features, the benefits they offer users, and valuable lessons you can apply if you decide to build your own wallet.

Remember, success lies in choosing the right partner and strategy to bring your idea to life. With the right tools and support, your journey to success in the decentralized world is within reach.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.