The fintech sector keeps accelerating, with the global market projected to reach USD 828.4 billion by 2033, growing at a CAGR of 15.82%. For many companies, launching a fintech app isn’t just an innovation, it’s a strategic move to stay competitive and enhance customer trust.

Yet, for many C-level leaders, turning that idea into a secure, compliant, and scalable product remains a challenge.

This guide walks you through the 6 essential steps to create a fintech app, covering the right tech stack, security foundations, and best practices to help you plan effectively and build with confidence.

Let’s get started.

Why creating a fintech app is a smart move for your business

Launching a fintech app today is more than a trend, it’s a strategic lever to transform how your business operates, interacts with customers, and scales in the digital age. Here’s the details:

1. Tap into multiple business model & revenue streams

Fintech apps span digital banking, payments/e-wallets, lending/P2P, insurtech, wealthtech, regtech, and more. You can monetize via transaction fees, subscription/premium services, interest spread, or API monetization.

Case in point: Revolut, with its diversified offerings across payments, exchange, subscription services, and investing, scaled dramatically.

2. Lower operational costs & boost efficiency

Automate core financial operations (payments, reconciliation, transfers, compliance checks) to reduce manual workload and cut costs.

Digital solutions often cut transaction processing costs, as seen by many fintech platforms reducing fee margins in legacy banking.

3. Expand your market reach & competitive edge

A well-designed fintech app lets you reach customers across geographies, demographics, and underserved segments. You can offer localized features (multi-currency, cross-border transfers), embed financial services into other platforms (embedded finance), or provide niche financial tools (microloans, credit scoring).

4. Increase trust, loyalty & stickiness

When customers use your app for core financial actions – payment, transfers, saving – they stay longer.

Intefrating security measures (MFA, encryption, fraud detection), compliance (KYC, AML, regulation), and transparen UX/UI builds customer confidence and retention.

Clearly, building a fintech app to serve businesses or individual customers is a smart move. It offers numerous advantages and positions your business for long-term growth.

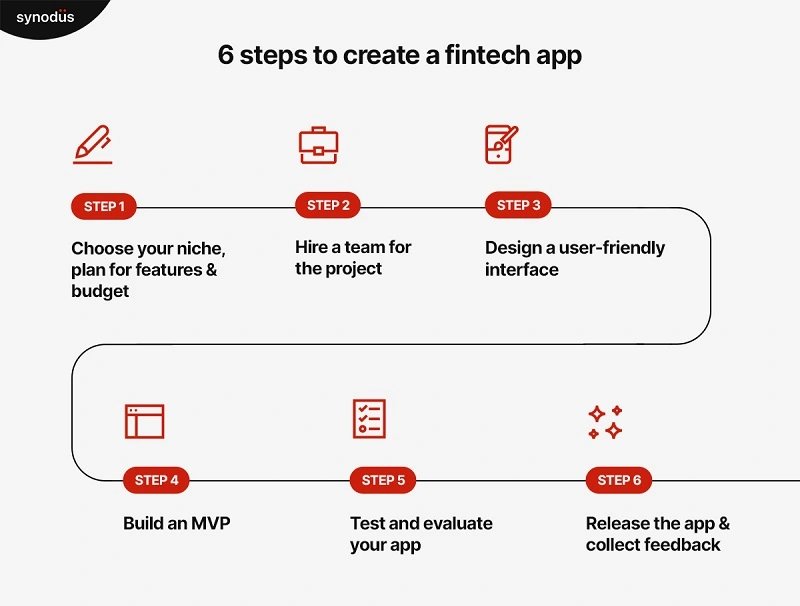

How to create a fintech app in 6 easy steps

Developing a fintech app is a strategic exercise that blends innovation with responsibility – balancing user experience, compliance, and technical scalability from day one.

Here’s a proven 6-step roadmap to help you turn your idea into a compliant, scalable, and profitable fintech product.

Step 1. Ideate and validate your concept

Every successful fintech app begins with a clear value proposition. What financial problem are you solving – faster payments, smarter investing, easier budgeting, or access to credit?

Start by conducting market research to understand your audience’s pain points and how competitors like Wise, Cash App, or Monzo address them. Analyze user reviews, app store feedback, and compliance requirements in your target region.

Before diving into full development, validate your idea with an MVP (Minimum viable product) or a Proof of concept (PoC). These low-risk approaches let you test real demand, refine features, and attract early investors.

Pro tip: Use surveys or low-code MVP tools like Bubble or Glide to collect user feedback early. It can save months of development and thousands in rework.

Step 2. Define core features and user experience

Before writing a single line of code, define what your app will actually do, and how users will experience it.

Key fintech features to consider include:

- User onboarding & authentication with biometric login

- KYC/AML compliance systems integrated via APIs like Trulioo or Onfido

- Payments & transfers via Stripe, PayPal, or Plaid APIs

- Data visualization dashboards for transparency

- In-app chat or support center for real-time user engagement

Action tip: Focus only on what delivers your core value first. If your app is for personal finance, prioritize payment flow. If it’s for investment, prioritize performance tracking.

Now, visualize your app from the user’s point of view. Map how different user types (customers, admins, merchants) move through key touchpoints:

- Signing up and verifying identity

- Performing core actions (send, invest, analyze)

- Solving issues or asking for help

This helps spot friction early and build trust through small UX details.

Example: When Revolut simplified its onboarding to 3 steps, completion rates jumped significantly – proof that fewer clicks often mean higher conversions.

Step 3. Design the architecture and integrations

Now it’s time to turn your product idea into a working system that is secure, flexible, and ready for growth.

Start by choosing an architecture that aligns with your business goals. If you are building an MVP, a monolithic setup will help you keep things simple. If you are aiming for long-term scalability, microservices allow you to deploy faster and scale individual modules such as payments, user management, and analytics independently.

Once the structure is clear, focus on your infrastructure and integrations:

- Use cloud platforms like AWS or Google Cloud to ensure scalability and compliance (PCI DSS, ISO 27001).

- Integrate trusted payment gateways (Stripe, PayPal, MoMo), banking APIs (Plaid, SaltEdge), and KYC/AML tools (Sumsub, Trulioo).

- Always test these integrations in a sandbox environment to avoid compliance risks.

Finally, reinforce the foundation with data security and scalability planning. Apply encryption (AES-256), SSL/TLS for secure transactions, and role-based access control. Regular penetration testing and continuous monitoring help prevent breaches and downtime.

Pro tip: Many successful fintechs, like Revolut and Chime, started with modular cloud-based systems – letting them adapt quickly without major rebuilds.

Step 4. Develop and test

This is where your fintech app takes shape, and where execution speed meets reliability.

Most teams start with short Agile sprints, releasing working modules every few weeks instead of waiting months for a full build. This rhythm helps you spot usability issues early and gather feedback before investing too much.

A CI/CD pipeline keeps delivery smooth. Every code push triggers automated tests, ensuring new updates don’t break existing features. It’s the same approach used by leading fintechs like Revolut, allowing them to roll out frequent updates without downtime.

Testing isn’t a final checkbox – it runs parallel to development. Combine unit testing for logic accuracy, penetration testing for security, and compliance checks to stay aligned with standards like PCI DSS or GDPR.

Keep the feedback loop tight between developers, QA, and product owners. When everyone sees test results in real time, you fix faster, cut rework, and keep momentum steady.

Pro tip: Teams that embed QA and compliance early often deliver up to 30% faster while reducing post-launch bugs — a major competitive edge in fintech.

Step 5. Launch and monitor

Once your fintech app is built, launch carefully. The goal isn’t to go viral overnight, but to collect reliable data and refine performance before scaling up.

Start with a closed beta launch to a small group of users or partners. Observe how they interact with your app in real-world conditions, identify bugs, and validate assumptions from your earlier testing.

Then, as you move toward a wider release:

- Run A/B tests on critical user journeys such as onboarding, payments, and transaction confirmations.

- Monitor live metrics – conversion rate, failed transactions, and response time – to spot issues early.

- Collect feedback directly in-app, so product and dev teams can act on real user insights.

Once you have the data, feed it into your DevOps cycle. Continuous monitoring and small, frequent updates will keep your app stable while improving performance over time.

Also, don’t forget to review security and compliance logs regularly to maintain trust and reliability.

Step 6. Optimize and scale

Once your app is live, focus on refining and expanding it. Review performance data, gather user feedback, and turn insights into improvements.

Next actions to keep your fintech app growing:

- Collect user feedback through in-app surveys and analytics tools.

- Track performance metrics like churn rate, session duration, and transaction speed.

- Release regular updates to improve UX, fix issues, and introduce new features.

- Explore partnerships or integrations to expand your service ecosystem.

Now, let’s find a partner that can help you all with the development process.

- Suggested for you: How to build a P2P payment app: A step-by-step guide

Should you build in-house or hire a vendor?

There’s no universal answer to this question, but there is a practical one. It depends on your priorities: speed, control, cost, and expertise.

If your goal is to experiment fast and validate a product concept, building everything in-house may slow you down. Recruiting the right engineers, setting up infrastructure, and meeting fintech compliance standards can take months before you even reach MVP. The learning curve is steep, and the cost of missteps is high – especially in regulated industries like finance.

Working with an experienced vendor, on the other hand, compresses the learning curve. Their teams already understand how to build with PCI DSS, PSD2, and KYC/AML in mind. They know which cloud setups pass audits, which APIs are most stable, and which design patterns prevent compliance issues down the road.

In other words, you’re not paying for hours, you’re paying for accumulated experience.

That doesn’t mean outsourcing everything.

Many successful fintech companies choose a hybrid model: keep core product ownership and strategy in-house while partnering with specialized vendors for technical execution or integration-heavy modules.

This balance allows startups to move faster without compromising control or security.

- Suggested for you: 13+ Best fintech app development companies in 2026

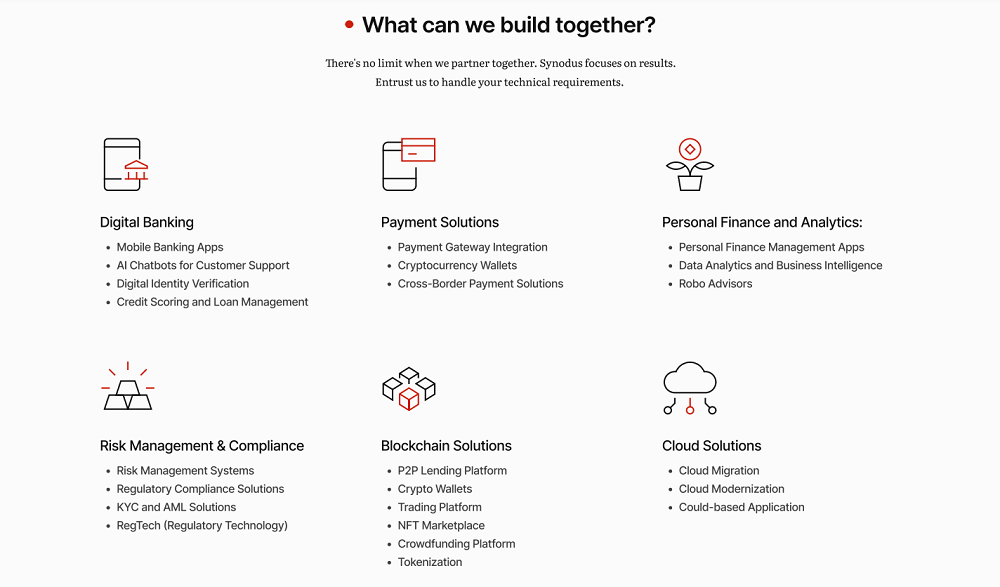

Building Fintech apps with Synodus

When you partner with Synodus for your fintech app development, you’re choosing more than just a service provider – you’re gaining a trusted partner who will drive your business forward. Here’s what you’ll get by working with us:

- Get to the market faster with our efficient development process and quick MVP development.

- Save money without losing quality with our affordable rates of $16-$30 per hour and our extensive experience in Fintech.

- Get expert guidance at every stage of the project from our strategic advisors.

With over 6 years of experience in the fintech world, we’ve worked with companies across all areas of financial services, including banking, payments, insurance, wealth and asset management, and capital markets.

At Synodus, we offer a wide range of fintech app development services to meet your needs:

Our clients include major names like BOC Aviation, KPMG, Vietcombank, Techcombank, MB, and many more. Together, we’ve achieved:

- 3x faster project launches without compromising on quality in an E-wallet project.

- $300,000 secured in seed funding for an ICP blockchain project.

- 150% increase in user engagement for a crypto exchange white-label project.

- 226,818,268 DFY Tokens sold before listing in a P2P lending platform development project.

We’re immensely proud of the team’s progress and eagerly anticipate future collaborations.”

As said by Jinny Park, Product Owner of Arctx Solutions, who’s been with us for 2 years

And we understand that keeping up with the with the fast-changing world of financial services can be tough. Let us be your partner in this journey. We can handle the tech challenges your business faces as you grow and reach millions of users. Plus, our flexible team structure means you can add or remove team members as needed.

Summary

Building a fintech app isn’t just about coding features – it’s about designing a secure, compliant, and user-focused product that solves real financial problems. As digital banking, payments, and lending continue to evolve, fintech solutions will shape how businesses grow and how consumers manage money.

Whether you’re a traditional bank modernizing your systems or a startup entering the market, now is the time to invest in innovation that lasts.

If you’re looking for expert guidance on your fintech journey, Synodus is here to help you turn your idea into a product that scales – securely, efficiently, and with confidence.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.