Buy Now, Pay Later is tranforming not just how people shop, but how fintech products are built. The market is exploding, projected to grow from 39.65 billion dollars in 2024 to a staggering 435.20 billion by 2033.

It sounds great for consumers with zero interest and flexible payments. But here’s the question many fintech founders still ask. How do BNPL companies actually make money?

In this article, we’ll break down how the model works, look at real examples like Klarna and Affirm, and share tips for startups looking to enter or grow in this space.

Overview of the BNPL model

What is Buy Now Pay Later?

Buy Now, Pay Later (BNPL) lets people buy things right away but pay for them little by little over time, often without needing a traditional creadit card. It offers flexible payment options that help users manage their cash flow better and enjoy a smoother shopping experience.

There are two common types on BNPL:

- Pay-in-4 (Interest-free installments): Customers split their payments into 4 parts over 6-8 weeks, usually with no interest if payments are made on time. This is the most popular model used by many BNPL providers.

- Long-term financing (Installments with interest): customers pay over a longer period, typically 6 to 24 months, with interest charged on the remaining balance. This model is similar to traditional credit but packaged within the BNPL framework.

Key players involved

- Consumers: The buyers who use BNPL to break up payments into smaller chunks.

- Merchants: Retailers or e-commerce platforms that accept BNPL payments to boost sales and conversion rates.

- BNPL providers: Fintech companies or financial institutions that offer BNPL services, manage credit risk, and handle collections.

- Banks/Lending Partners: Some BNPL providers partner with banks for funding or credit underwriting.

BNPL vs. traditional credit: What sets them apart

Both BNPL and traditional credit let people buy now and pay later, but they work differently.

Traditional credit, like credit cards or personal loans, usually has interest, complex approval processes, and sometimes hidden fees. BNPL offers simple, clear payment plans with little or no interest if you pay on time.

Getting approved for BNPL is usually faster and easier, so more people can use it. Traditional credit often has higher limits and longer repayment times.

For merchants, BNPL can boost sales by giving customers flexible payment choices without the hassle of traditional credit.

In short, BNPL is a friendlier and easier option compared to traditional credit. It focuses on simplicity and convenience, though both have their own benefits depending on what buyers need.

Main revenue streams of BNPL

Even though many BNPL services promote “interest-free” payments, these companies still have several ways to make money. Understanding these revenue sources is crucial for fintech startups wanting to build or add BNPL options.

1. Merchant fees

Most of BNPL’s income comes from fees merchants pay. Each time a customer uses BNPL, the merchant pays a percentage of the transaction, usually between 2% and 8%. While this fee can be higher than standard credit card fees, merchants accept it because BNPL often boosts sales and increases average order sizes.

Example: If a customer buys a $500 product using BNPL, the BNPL company might charge the retailer a 5% fee ($25), and the merchant receives $475.

2. Late payment fees

If customers miss or delay payments, BNPL providers may charge late fees or penalties. These fees encourage people to pay on time and help reduce losses from unpaid debts. However, some providers are moving toward more customer-friendly policies, reducing reliance on these fees.

3. Interest on longer-term plans

For BNPL plans that extend beyond interest-free periods (e.g., long-term financing over 6+ months), providers charge interest on the outstanding balance. This interest revenue can be significant, especially for customers opting for longer repayment terms.

4. Consumer fees and charges

Besides late fees and interest, some BNPL services may charge additional fees, such as account setup fees, payment processing fees, or monthly service charges. These vary depending on the provider and local regulations.

5. Data monetization and partnerships

BNPL companies collect valuable consumer purchase and payment data. Some monetize this data by offering insights to merchants or partnering with banks and financial institutions for co-branded products, marketing, or loyalty programs. Revenue can also come from affiliate fees, referral fees, or other marketing partnerships through referral models or co‑marketing initiatives, providing an additional stream beyond merchant and late fees.

Many providers are now pursuing embedded BNPL solutions, integrating their financing options into digital wallets, super apps, or e-commerce platforms. These BNPL integrations not only enhance the user experience but also create new opportunities for partnerships and customer engagement.

Unit Economics of BNPL

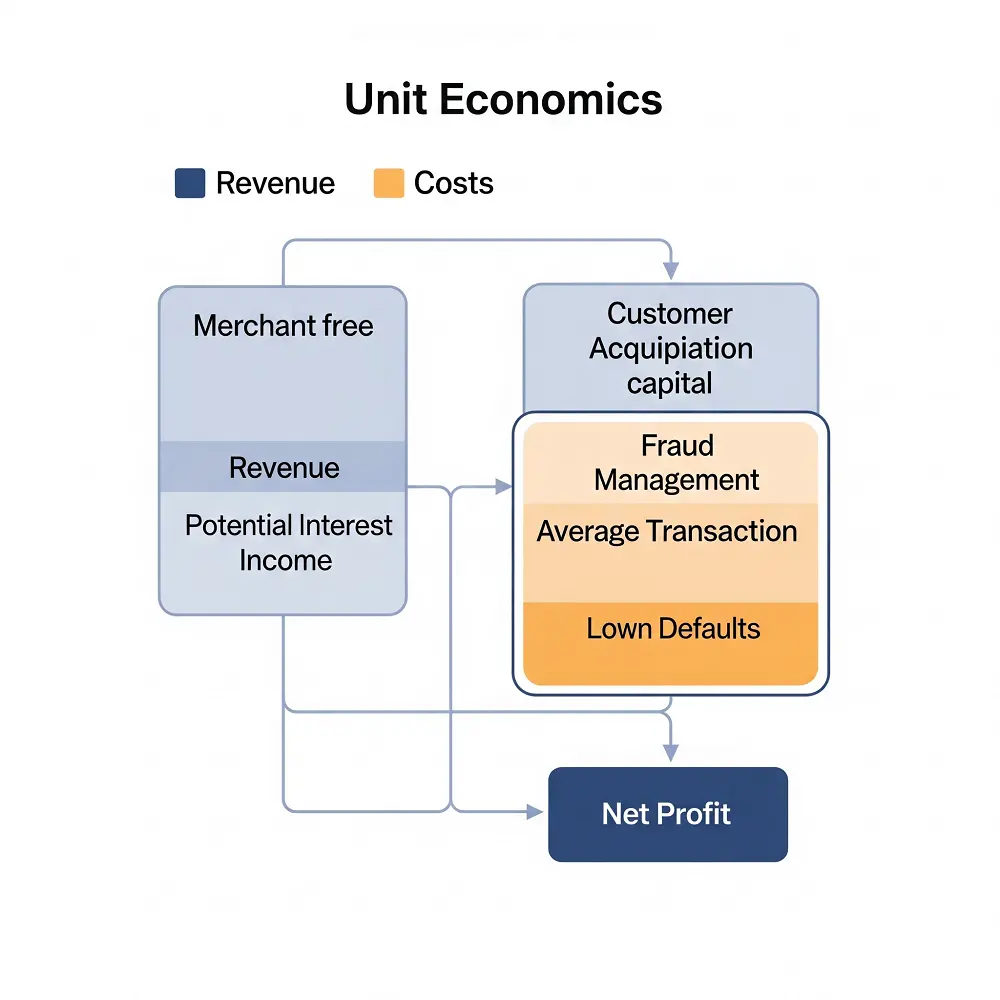

Knowing where the money comes from is just the beginning. To create a thriving BNPL business, startups must understand the detailed economics of each customer and transaction – this is called unit economics.

Unit economics looks at the balance between the revenue earned and the costs involved in serving one customer or transaction. Here are the key pieces to consider.

1. Customer acquisition cost (CAC)

BNPL providers invest heavily in marketing and partnerships to attract both merchants and consumers. The CAC includes advertising expenses, referral fees, and sales commissions. Keeping these costs under control is critical because high acquisition expenses can quickly eat into profits.

2. Average transaction value (ATV)

The average transaction value reflects the typical purchase amount consumers finance using BNPL. Higher ATV generally leads to higher revenue since merchant fees are a percentage of the transaction.

3. Take rate (Merchant fee percentage)

The take rate is the percentage fee BNPL providers charge merchants per transaction, usually ranging from 2% to 8%. This directly impacts revenue per transaction.

4. Default rate and credit losses

Since BNPL providers extend short-term credit, they face the risk of customers defaulting on payments. The default rate varies based on credit policies, user segments, and economic conditions. Losses from defaults reduce overall profitability and must be carefully managed with credit checks and collections.

5. Late payment fees and interest income

Late fees and interest from longer-term plans add to revenue and help offset losses. However, these must be balanced carefully so customer don’t feel discouraged.

6. Contribution margin per customer

By subtracting all direct variable costs (including CAC, credit losses, payment processing fees) from revenues per customer, providers calculate the contribution margin. Positive contribution margins indicate a sustainable business, while negative margins signal the need for business model adjustments.

Case studies: Klarna, Affirm, Afterpay – What are they doing?

Understanding the unit economics of BNPL in theory is important — but seeing how top players apply it in practice gives even deeper insight. Let’s take a look at how companies like Afterpay, Klarna, and Affirm structure their models, generate revenue, and maintain profitability.

The table below breaks down each company’s business model, revenue strategy, and the key factors behind their success:

| Company | Business model | Revenue streams | Sucess factors | Estimated annual revenue |

|---|---|---|---|---|

| Afterpay | Offers interest-free Pay-in-4 installments. Targets Gen Z and millennials. | Merchant fees (4–6%), late fees. | Strong branding, seamless integration for merchants, controlled credit risk. | $1.04B (2023) |

| Klarna | Provides multiple BNPL options: Pay-in-4, longer-term financing (with interest), and pay now. | Merchant fees, consumer interest on long-term loans, partnerships, and marketing services. | Wide product range, smooth UX, advanced risk management using data. | $2.81B (2024) |

| Affirm | Focuses on transparent, interest-bearing installment loans, typically longer-term. No late or hidden fees. | Interest income, merchant fees, partnerships with retailers. | Trust-centric model, clear terms, strong underwriting tech. | $2.32B (2024) |

Key takeaways:

- Merchant fees are the main revenue source for all BNPL leaders.

- Klarna and Affirm earn extra from consumer interest, unlike Afterpay.

- High revenues show big market potential but also tough competition.

- Startups must balance easy payments with solid revenue and risk control.

Read more: Cost of building a BNPL app like Afterpay, Klarna, or Affirm in 2026

Risks & challenges in building a BNPL model

Despite the rapid rise of BNPL, launching a successful product in this space is not without its hurdles. Fintech startups must tread carefully, as the path to success is lined with regulatory risks, customer trust issues, and operational complexities.

1. Credit risk and defaults

Since BNPL providers essentially extend short-term credit, there’s always the risk that some customers won’t repay on time, or at all. This can lead to over‑indebtedness, loan stacking, and an increased consumer debt burden, especially if transparency around repayment terms is lacking. High default rates can result in significant financial losses, so strong credit assessment and fraud prevention systems are critical.

BNPL usage can also affect a customer’s credit score, depending on whether the provider reports repayments to the credit bureau. Some providers perform credit reporting, while others do non‑reporting to credit bureaus, influencing a customer’s ability to access future credit. Understanding these practices is important for both consumers and startups offering BNPL services.

Tip: Use customer behavior or transaction data to improve credit scoring

2. Regulatory compliance

BNPL is attracting increasing attention from regulators worldwide. Startups must stay updated on evolving BNPL regulation and the broader regulatory framework, including consumer protection regulations, interest caps, data privacy, and disclosure requirements. Non-compliance or failure to follow market conduct supervision can result in heavy fines or business shutdowns.

Tip: Involve legal experts early when designing your product to avoid costly mistakes later. If you don’t have in-house legal support, consider partnering with a BNPL development company that understands local regulations and has compliance expertise built into their development process.

3. Customer experience balance

Offering easy, fast credit approval is essential to attract users, but it must be balanced against thorough risk checks. Too strict credit policies may reduce user acquisition, while too lenient policies increase defaults. Finding this balance is a constant challenge.

Tip: Test simple vs. detailed approval flows to balance speed and risk based on your target users.

4. Competition and market saturation

The BNPL market is crowded, with many players competing for merchants and customers. Differentiating your product through better terms, smoother UX, or value-added services is crucial to stand out and grow.

Tip: Target underserved niches (like healthcare or education) to avoid competing head-on with major players.

5. Managing cash flow and funding

BNPL providers pay merchants upfront while collecting from customers over time, creating a cash flow gap. Carefully managing this gap involves understanding funding costs and cost of capital, which may include warehouse funding or short-term financing, to maintain sustainable growth.

6. Data security and fraud prevention

Handling sensitive financial and personal data requires robust security measures. BNPL providers must also address data privacy concerns, as improper handling or data harvesting can expose users to risks.

Leveraging consumer data analytics and behavioral data helps improve fraud detection and credit assessment, but also raises potential data monetization risks. Fraud prevention remains critical since BNPL is attractive to fraudsters exploiting the fast approval process.

Conclusion

BNPL is not just changing how people pay. It is transforming the way fintech companies approach consumer credit. For startups, success depends on more than offering deferred payments. It requires a clear understanding of how BNPL companies make money, from interest charges to merchant partnerships. By getting the economics right and managing risks effectively, startups can turn BNPL into a scalable and sustainable business model.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.