Every fintech founder begins with a big vision: to create faster payments, smarter lending, or a more secure way to invest in digital assets. Yet, when development starts, many quickly realize that the real cost is far more complex than they expected.

From choosing between white-label and custom solutions to meeting compliance standards and integrating KYC or payment APIs, every decision affects the overall budget. Without a clear cost plan, startups can easily overspend and struggle to bring their product to market.

As the fintech industry continues its strong growth through 2026, understanding the true cost of fintech app development has become essential for startups and enterprises alike. This article explores how these costs are structured, what drives them, and how to manage your development budget effectively to build a scalable, high-performing fintech app.

Fintech app development cost estimation in 2026

The fintech app development market continues to expand in 2026, and so does the cost of building one. Depending on complexity, features, integrations, and compliance requirements, development budgets typically range from $40,000 for an MVP to over $300,000 for enterprise-grade solutions.

Let’s break this down more clearly to understand how complexity and app type influence total cost.

Fintech app development cost by complexity

The complexity of a fintech app plays a major role in determining its development cost. Simpler apps require fewer resources and less time, while advanced solutions with AI, blockchain, and high-security demands involve more effort, specialized teams, and longer timelines. Below is a breakdown of fintech app development costs based on complexity levels.

| Key features | Estimated cost | Development time | |

|---|---|---|---|

| Basic app | – User registration and login – View account balances – Simple payment processing (e.g., single currency) – Standard UI/UX templates | $40,000 – $80,000 | 3 – 5 months |

| Moderately complex app | – Multi-currency support – Integration with payment gateways or APIs – Two-factor authentication – Custom, responsive UI/UX | $80,000 – $200,000 | 6 – 9 months |

| Highly complex app | – AI-driven analytics – Real-time data processing – Blockchain integration – Biometric login & fraud detection – Scalable architecture | $200,000 – $300,000+ | 9 – 12 months+ |

Fintech app development cost by type

Beyond app complexity, the specific category of your fintech product also plays a crucial role in shaping the overall budget. Each fintech vertical, including digital wallets, neobanks, lending, and BNPL, requires its own architecture, integration setup, and compliance standards.

| App type | Key features | Estimated cost range | Dev time |

|---|---|---|---|

| Mobile wallet app | P2P transfer, QR payments, linking bank accounts | $30,000 – $100,000 | 4-6 mo |

| Neobank | KYC, money transfer, virtual card, account management | $100,000 – $250,000+ | 6-9 mo |

| Lending app | Credit scoring, loan request, EMI schedule | $60,000 – $150,000+ | 5-8 mo |

| Investment App | Real-time data, portfolio tracking, trading interface | $80,000 – $200,000 | 5-9 mo |

| BNPL | Merchant API, risk engine | $100,000 – $250,000 | 6-10 mo |

Fintech app development cost by development phase

Every fintech app moves through several stages before launch, and each stage adds a distinct layer of cost. Knowing where most of the spending goes helps you plan a realistic budget from the start.

In the planning stage, expenses focus on research, UX design, and prototyping. It usually accounts for 10–15% of the total budget, laying the groundwork for what follows.

The core development stage takes the largest share around 50-60%, covering backend and frontend coding, API integration, and initial testing.

Finally, the launch and maintenance stage includes quality assurance, security audits, and compliance tasks such as PCI DSS, GDPR, or PSD2. This final stretch typically makes up 25–30% of the cost.

Quick overview of cost distribution:

| Development phase | Main activities | Typical cost share |

|---|---|---|

| Planning & Design | Research, UX/UI, prototyping | 10-15% |

| Core Development | Coding, API integration, testing | 50-60% |

| Launch & Maintenance | Security audits, compliance, updates | 25-30% |

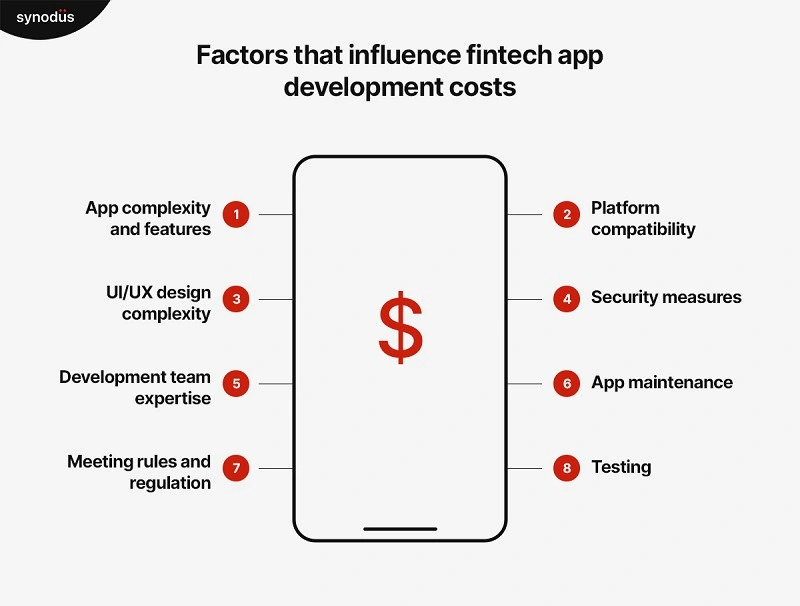

Factors that influence fintech app development costs

The total cost of a fintech app doesn’t just depend on how many features you add or how long it takes to build. Several key factors drive the budget up or down:

1. Platform compatibility

When building a fintech app, choosing which platform to support – iOS, Android, or both – can have a big impact on your budget. Each platform uses different programming languages and design rules. If you want your app to run smoothly on both, it usually takes more time, effort, and money.

For native apps, developers often need to build two separate versions and test everything twice. That means more work and higher costs. Even if you use cross-platform tools to share most of the code, some features still need extra tweaks to make sure they work well on each device, especially when handling sensitive financial data.

The table below compares the cost impact based on the platform you choose:

| Platform type | Estimated cost |

|---|---|

| iOS or Android (single platform) | $20,000 – $60,000 |

| Native for both platforms | $40,000 – $120,000 |

| Cross-platform (Flutter, React Native) | $30,000 – $90,000 |

3. UI/UX design complexity

The way your fintech app looks and feels plays an important role in user experience, and in development cost. A basic design using standard templates is faster and cheaper to build. It’s a good option for early-stage startups or MVPs.

However, if you want a more polished experience with custom visuals, smooth animations, and interactive elements, the cost will go up. These advanced features require experienced designers and more time to design, test, and fine-tune every detail.

| Design complexity | Description | Estimated cost |

|---|---|---|

| Basic | Standard templates | $5,000 – $15,000 |

| Moderate | Custome layout, some animations | $15,000 – $30,000 |

| Advanced | High-end visuals, interactive UX, micro-animations | $30,000 – $60,000+ |

4. Security measures

In fintech apps, security is not optional – it’s a core requirement. However, the level of security you implement can significantly impact your development budget.

Basic security features such as password–based login, HTTPS encryption, and secure data storage are relatively quick and cost-effective to build. These are often enough for early-stage apps or MVPs that don’t handle sensitive data.

However, if your app needs stronger protection, the development cost will increase. Features such as multi-factor authentication, biometric logins like fingerprint or facial recognition, and real-time fraud detection systems involve greater technical complexity. They often require the use of third-party tools, more experienced developers, and thorough testing. Additionally, meeting security standards and compliance regulations such as PCI DSS or GDPR adds further time and resources to the project.

5. Development team expertise

The skill level of your development team has a direct impact on both the quality of your fintech app and the overall cost. Working with a highly experienced team may require a bigger budget, but it often leads to better performance, cleaner code, and faster problem-solving.

Depending on your project needs and budget, you can choose from different team structures, each with its own cost implications and level of control:

- In-house team: Gives you full control and close collaboration but comes with higher costs for salaries, benefits, and office setup. Best for startups aiming for long-term, ongoing development.

- Outsourced team: More budget-friendly, especially when working with teams in lower-cost regions. Requires clear communication and good project management to stay on track.

- Hybrid team: Combines the control of in-house with the cost savings of outsourcing. A smart option for accessing specialized skills without hiring a full team internally.

Besides the differences in cost between team types, location also plays a big role in how much you’ll spend. Hiring a team in the US or Western Europe will usually cost much more than working with teams in Southeast Asia or other lower-cost regions. The table below gives you a clearer picture of how location affects the overall development budget.

| Team type | US/Canada | Western Europe | Southeast Asia/India |

|---|---|---|---|

| In-house | $150,000 – $500,000+ | $120,000 – $400,000 | $40,000 – $100,000 |

| Outsourced | $100,000 – $300,000 | $80,000 – $250,000 | $20,000 – $80,000 |

| Hybrid | $120,000 – $400,000 | $90,000 – $300,000 | $30,000 – $100,000 |

The hidden costs in Fintech app development

These factors may not be immediately apparent but can add to the cost over time. The factors are:

1. Regulatory delays

Navigating complex compliance requirements can take longer than expected. Every delay in approvals or audits adds to project expenses, even if the development team is efficient.

2. Security remediation

Despite thorough testing, new vulnerabilities may appear during or after launch. Addressing these issues often requires urgent development and extra budget.

3. Integration challenges

Connecting with third-party APIs or legacy banking systems can be unpredictable. Unexpected bugs, data mismatches, or version updates may increase both time and cost.

4. Ongoing maintenance and scaling

As your user base grows, infrastructure costs rise. Scaling servers, updating databases, and optimizing performance are ongoing expenses that can quietly add up.

5. Unexpected feature requests

Stakeholders or early users may request new functionalities after launch. Even minor additions can impact timelines and budgets significantly.

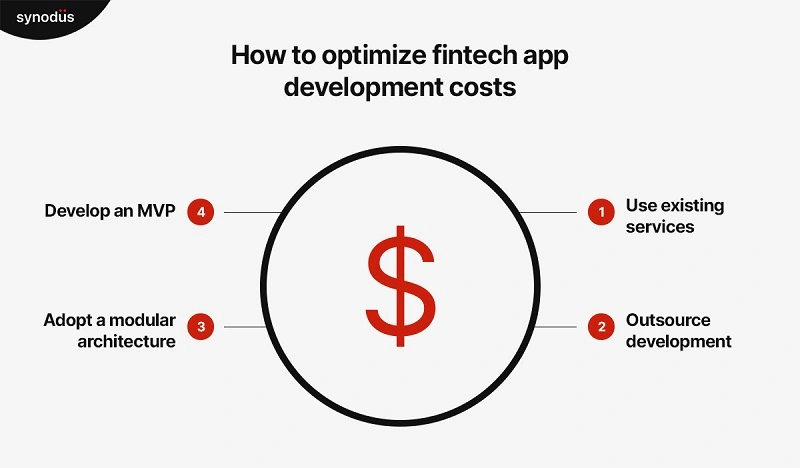

How to optimize fintech app development costs

While building a strong and scalable fintech app is necessary, there are strategies to manage expenses effectively without compromising on quality or functionality. Here are the strategies that have been proven to lower the development cost and have been used by many fintech companies:

1. Using existing services

Many fintech companies save money by using existing payment systems or services instead of building everything from scratch.

For example, a fintech company that needs a strong payment system can use a white-label solution like Stripe or Braintree. These platforms already provide secure payment processing and fraud protection, and the company can focus on building the unique aspects of their app. By using these services, the company avoids the costs of building a custom payment gateway from scratch and can launch their product much faster.

2. Outsourcing development

Fintech companies often outsource some of their development work to countries with lower labor costs (offshore or nearshore). For example, developing an app in the U.S. could cost $50 to $150/ hr, but doing the same in Asian countries like Vietnam or India might cost only $15 to $50/ hr. Developers in these regions can provide high-quality work at more affordable rates and this can save a lot of money.

Also, Forbes notes that nearshore and offshore teams enable small- and medium-sized businesses to access necessary talent without straining their budgets. This flexibility allows these businesses to scale quickly while avoiding the high costs associated with local hiring.

3. Modular architecture

Building the app in smaller parts (modules) lets fintech companies develop and update each part separately. This makes it cheaper and easier to scale and improve the app over time.

For example, if one part of the app needs a major update, only that specific module needs to be changed, not the entire system. This modular approach reduces costs, especially when adding new features or addressing bugs.

4. Develop an MVP

Developing an MVP is another cost-effective strategy. An MVP allows fintech businesses to launch with just the essential features that solve the main problem for their users. This approach helps them enter the market quickly while gathering valuable feedback from users.

For example, if a fintech company wants to build an app for personal budgeting, they can first create a simple version with basic features like expense tracking and budgeting reports. Instead of adding advanced features like investment tracking or credit score monitoring, they focus on solving the core problem. After launching the MVP, they can gather feedback, understand user needs, and improve the app with more features based on that feedback. This helps save money and time on features that might not be needed right away.

Building a fintech app with Synodus at a reasonable price

Choosing Synodus as your fintech app development partner brings significant advantages to startups, particularly in terms of cost-effectiveness, a clear roadmap, and strategic consulting.

Competitive pricing

You’ll benefit from cost-effective solutions without sacrificing quality. With a competitive pricing model ranging from just $16 to $30 per hour and backed by 9 years of expertise in the fintech sector, you’re guaranteed the best value for your investment. Plus, you’ll experience complete transparency, with no hidden costs along the way.

Clear development roadmap

From initial consultation to final delivery, Synodus provides a well-defined roadmap that guides you through every stage of the project. Our process includes four key phases: Consultation, Development, Maintenance, and Achieving Results. This structured approach ensures that your app is developed on time and within budget, with clear milestones along the way.

Strategic consulting

Beyond technical expertise, Synodus excels in strategic consulting. Our team of fintech experts brings deep industry knowledge and real-world experience to the table, offering insights that go beyond mere development. We help you navigate the complexities of the fintech market, ensuring that your app not only functions perfectly but also aligns with your broader business goals.

Got a fintech app idea? Let’s make it happen!

Conclusion

Developing a fintech app is a complex, long-term investment that requires careful planning and attention to detail. The costs involved are influenced by a wide range of factors, and understanding these is essential for making informed decisions.

Optimizing development costs isn’t about cutting corners – it’s about making strategic choices. By adopting a modular architecture, leveraging existing infrastructure, and focusing on scalability, you can create a robust, scalable fintech app that excels in the market. With the right approach and a reliable partner like Synodus, your fintech startup is poised for success.

FAQs

*Note: All the data is based on reports and studies by Statista, Clutch, Goodfirms, Deloitte, and other trustworthy market research companies.

Developing a fintech app with advanced AI and blockchain features can cost anywhere from $100,000 to $500,000, depending on complexity and functionality.

If you prefer a clear cost upfront and have a fixed budget, the Fixed-price model is ideal. However, value quality and flexibility and can adjust your budget. The Time and Material or Dedicated Team models might be more beneficial, even though they may have higher initial costs.

Ongoing costs for maintaining and updating a fintech app after launch typically range from 15-20% of the initial development cost annually.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.