The Buy Now, Pay Later (BNPL) sector has become one of the fastest-growing segments in fintech, projected to reach $178.52 billion by 2032. Giants like Afterpay, Klarna, and Affirm are reshaping consumer behavior by offering instant credit with flexible repayment terms.

As more merchants and startups look to build their own BNPL solutions, a common question arises: How much does it cost to develop a BNPL app in 2026? The truth is, there’s no universal answer. Costs vary based on feature complexity, technology stack, region, and regulatory scope.

In this guide, we’ll break down the development costs for BNPL apps, comparing MVPs and full-scale platforms, and outline key budget considerations for fintech founders and product leaders.

Overview of the cost to develop a BNPL app

The BNPL app development cost can range widely, from $10,000 for a basic MVP to over $400,000 for a full-featured, enterprise-grade platform. For more details, see the following table:

| App type | Key features | Timeline | Estimated cost (USD) |

|---|---|---|---|

| MVP (Minimum Viable Product) | – User registration & logi – Basic product catalog – Cart & checkout – Payment gateway integration – Order history | 2–4 weeks | $10,000 – $50,000 |

| Full-Fledged basic app | – All MVP features – User profile management – Installment payment options – Basic analytics dashboard – Customer support chat | 2–4 months | $50,000 – $100,000 |

| Full-Fledged medium app | – All basic features – Credit assessment module – Advanced analytics & reporting – Multi-language & currency support – Enhanced security & compliance | 6–9 months | $100,000 – $200,000 |

| Full-Fledged complex app | – All medium features – AI-driven credit scoring – Real-time fraud detection – Merchant & admin dashboards – Customizable installment plans – Integration with multiple e-commerce platforms | 9–12 months | $200,000 – $400,000+ |

Factors affecting the cost of building a BNPL app

The cost of building a BNPL app is variable. It is determined by the combination of features, integrations, and UI requirements, along with the platform choice and the rate of the developers. Let us discuss each of these in greater detail.

Features

The BNPL app development cost is directly correlated with the number and complexity of its functionality. Simple modules such as user registration or goods browsing are low-cost. Concurrently, more complex features such as credit analysis provided by an AI tool, installment payment processing, multi-user role support, etc tend to drive up costs due to requirement of additional design as well as backend logic.

Now, we have this table below, one that we’ve investigated and collated the average cost ranges of the most popular features found in a BNPL app.

| Feature group | Included features | Estimated total cost |

|---|---|---|

| User management | – User registration & authentication – User profile management | $5,000 – $12,000 |

| Product interaction | – Product browsing & selection – Cart & checkout system | $9,000 – $18,000 |

| Payment features | – Payment gateway integration – Installment payment options | $5,000 – $17,000 |

| Credit & risk assessment | – Credit assessment module – Security & compliance | $10,000 – $30,000 |

| Transaction & notifications | – Transaction history & statements – Notifications & alerts | $3,000 – $9,000 |

| Customer support | – Customer support chat | $3,000 – $6,000 |

| Admin & merchant tools | – Admin dashboard – Merchant dashboard | $9,000 – $22,000 |

| Analytics & localization | – Analytics & reporting tools – Multi-language & currency support | $5,000 – $14,000 |

Third-party integrations

Third-party integrations are essential to any BNPL app, but they also increase development and maintaince costs. Each integration, whether for payments, credit checks, fraud detection, or analytics, requires custom development, security handling, and ongoing maintenance. For example, connecting to payment gateways like Stripe or PayPal isn’t just plug-and-play; developers must build and test secure flows, handle edge cases, and comply with regulatory requirements.

More advanced services like credit scoring or fraud monitoring demand even deeper integration and backend logic. Plus, many providers charge usage or licensing fees, adding to long-term operational costs.

Here are common third-party integrations of a BNPL app and their typical cost ranges:

| Integration type | Common example | Average cost |

|---|---|---|

| Payment gateways | Stripe, PayPal, Adyen | $2,000 – $10,000 per integration |

| Creadit scoring services | Experian, Equifax, TransUnion | $5,000 – $15,000 |

| Fraud detection tools | SEON, Sift, Riskified | $4,000 – $12,000 |

| Analytics platforms | Mixpanel, Amplitud | $1,000 – $5,000 |

| E-commerce platform connectors | Shopify, WooCommerce, Magento | $3,000–7,000 |

UI/UX design requirements

UI/UX design for a BNPL app is much more than just creating screen layouts. It requires smooth and secure flows for sensitive tasks like credit checks, payment scheduling, and identity verification.

If you want a unique and branded experience, consider investing in custom UI/UX design, including tailored interfaces for different user roles and a custom logo. While this increases cost, it provides a more secure and intuitive experience for users.

Advanced features like animations, 3D elements, or complex interactions can add a visually appealing touch but also increase development time and costs.

In short, the total design cost depends on how complex the app is, how many design rounds are needed, and whether it’s built from scratch or adapted from templates. Below is a breakdown of estimated rates for different design roles:

| Role | Junior (0-2 yrs) | Mid-Level (2–5 yrs) | Senior (5+ yrs) |

|---|---|---|---|

| UX Designer | $30 – $50/hr | $50 – $75/hr | $75 – $100+/hr |

| UI Designer | $25 – $45/hr | $45 – $70/hr | $70 – $90+/hr |

| UX Researcher | $30 – $50/hr | $50 – $75/hr | $75 – $100+/hr |

Platform selection

The choice of development platform, native or cross-platform, has a significant impact on the cost of building BNPL app:

- Native development involves creating separate applications for iOS and Android using platform-specific languages (Swift for iOS, Kotlin/Java for Android), which ensures optimal performance, better security, and full access to device features. However, this also means maintaining two codebases, employing separate development teams, and duplicating testing efforts, which can double the initial development and long-term maintenance costs.

- In contrast, cross-platform frameworks like React Native or Flutter enable developers to write a single codebase for both platforms, reducing initial costs by 30 – 40% and accelerating time to market. This approach is ideal for MVPs or less complex apps, but it may introduce limitations in performance, native integrations, and long-term scalability.

In addition, hourly rates vary depending on the platform and developer seniority. Senior cross-platform developers often command rates similar to or even higher than native specialists due to the demand for optimization skills.

| Platform | Junior rate (0-2 yrs) | Mid-level rate (2-4 yrs) | Senior rate (5+ yrs) |

|---|---|---|---|

| Native iOS | $30 – $60/hr | $60 – $100/hr | $100 – $150+/hr |

| Native Android | $25 – $50/hr | $50 – $90/hr | $90 – $140+/hr |

| Cross-platform | $40 – $70/hr | $70 – $120/hr | $120 – $200+/hr |

Development team

The composition and size of the development team directly affect the total cost of building a BNPL app. A standard team includes roles like project manager, UI/UX designer, frontend/backend developers, mobile developers, and QA engineers. The more complex the app, the larger the team required, increasing both time and cost.

Developer experience level also plays a key role. Senior developers deliver higher quality and work faster, but charge more per hour. While junior talent is more affordable, it often requires more oversight, which can offset savings in time-critical projects.

Location matters too. Offshore teams in regions like Southeast Asia or Eastern Europe offer significantly lower rates compared to onshore teams in the US or Western Europe. Outsourcing can reduce costs by 50–70%, but it requires clear communication and strong project management to maintain quality and avoid delays. For businesses looking to hire the right BNPL app development company, choosing the right partner is crucial.

The following table compares typical hourly rates by platform:

| Role | Level | US & Western Europe | India & Vietnam |

|---|---|---|---|

| Backend Developer | Junior | $50 – $80 | $15 – $30 |

| Mid-Level | $80 – $120 | $30 – $45 | |

| Senior | $120 – $160+ | $45 – $70 | |

| Frontend Developer | Junior | $45 – $70 | $15 – $25 |

| Mid-Level | $70 – $100 | $25 – $40 | |

| Senior | $100 – $140+ | $40 – $60 | |

| Mobile Developer | Junior | $50 – $80 | $15 – $30 |

| Mid-Level | $80 – $110 | $30 – $45 | |

| Senior | $110 – $150+ | $45 – $65 | |

| DevOps Engineer | Junior | $60 – $90 | $20 – $35 |

| Mid-Level | $90 – $130 | $35 – $50 | |

| Senior | $130 – $170+ | $50 – $70 | |

| QA Engineer | Junior | $40 – $60 | $10 – $20 |

| Mid-Level | $60 – $90 | $20 – $30 | |

| Senior | $90 – $120+ | $30 – $45 | |

| Project Manager | Junior | $60 – $90 | $20 – $35 |

| Mid-Level | $90 – $130 | $35 – $50 | |

| Senior | $130 – $170+ | $50 – $70 |

While development costs in the US and Western Europe can be high, Vietnam and India offer more budget-friendly options without sacrificing quality. Synodus, a custom software development company based in Vietnam, can help you achieve your BNPL goals cost-effectively.

Other hidden costs

Hidden costs in BNPL app development often go unnoticed during initial budgeting but can significantly impact the total cost if not accounted for early:

- Maintenance and scaling: After the app launches, you’ll need to keep it running smoothly. That means fixing bugs, improving performance, and supporting more users. As the app grows, costs for cloud storage, servers, and tools like CI/CD pipelines will rise.

- Regulatory compliance: BNPL apps must follow strict rules to protect user data and prevent fraud. This includes standards like PCI DSS, GDPR, and KYC/AML. Meeting these rules requires extra development, legal advice, and ongoing audits – adding long-term costs.

- Marketing and support: Many teams overlook how much it costs to grow and support the app after launch. But setting up CRM systems, hiring support staff, and running marketing campaigns can eat up 15–25% of the total budget.

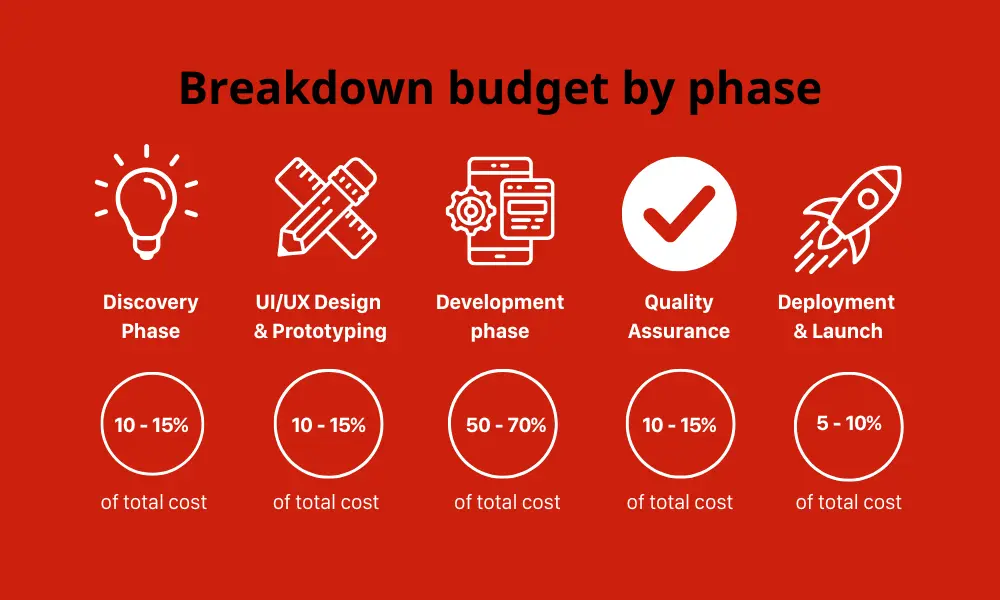

Breakdown of costs by development phases

Another way to assess the cost of BNPL app development is by breaking it down into distinc development phases. This method helps founders, product owners, and fintech teams identify which stages can be optimized for cost savings and which require full investment, allowing them to budget effectively and build smart from day one.

Discovery phase

Discovery is the process of answering one question: What and why are we building? It concerns user research, market validation, feasibility analysis, and business case refinement. It reduces the risk of misalignment between technical teams and business goals.

Deliverables:

- Market research summary

- Competitive landscape mapping

- Clear product vision and feature prioritization

- Functional & non-functional requirements

- Technical feasibility reports

- High-level architecture outline

- Cost and timeline estimates for the MVP

Team involved: Business Analyst, Project Manager, sometimes a Technical Architect

Timeline: 1–2 weeks

Estimated cost: 10–15% of total budget

UI/UX design and prototyping

At this stage, abstract concepts become visual interactive prototypes. These prototypes help you spot design flaws early, save time and costs, and clarify how users will navigate the app to perform tasks like applying for credit or tracking installments. For BNPL in particular, clarity and reliability matter most; individuals should instantly understand repayment terms and conditions, interest fees, and credit acceptance.

Key activities:

- User persona development

- Wireframes and mockups (low to high fidelity)

- Interactive prototypes

- User journey mapping (checkout, KYC, repayment tracking)

- UI style guide and component libraries

Team involved: UI/UX Designer, Product Manager, occasionally a UX Researcher.

Timeline: 2–5 weeks

Estimated cost: 10–15% of total budget.

Development stage

This stage requires close collaboration among developers, testers, and project managers to ensure the product meets quality standards and deadlines. Any changes made during development can significantly increase costs and timelines.

Key activities:

- Frontend development (user dashboards, checkout, onboarding) based on UI/UX

- Backend development (user account management, transaction handling)

- Integration with third-party services: Stripe, PayPal, Equifax, SEON, etc.

- KYC/AML workflows

- Role-based admin and merchant dashboards

- CI/CD pipeline setup, environment configuration

Team involved: Frontend & Backend Developers, DevOps Engineers, API Specialists

Timeline: 3–6 months

Estimated cost: 50–70% of total budget.

Cost optimization tips:

- Develop iteratively with Agile sprints and periodic stakeholder demonstrations

- Deprioritize less critical features for V1

- Don’t over-architect before product-market fit

At Synodus, the development process is anchored in Agile delivery and Time & Materials contracts. It gives clients the flexibility of dynamically prioritizing features, altering scope as per feedback obtained, and avoiding sunk costs of fixed-scope overruns. Synodus’ teams deliver every other week in sprints with transparency and flexibility.

It averages 20–30% less overall development cost, specifically in the quickly evolving spaces of BNPL app, where compliance and the scope of features both change.

Quality assurance

QA in a BNPL app guarantees the app is stable, compliant with the industry standard, and protects financial details. Test assurance must stretch across user journeys, edge cases, hardware compatibility, and integration reliability.

Key activities:

- Check if every key feature like KYC, creadit checks, and payments scheduling works as expected.

- Test if users can easily navigate and complete sensitive flows smoothly.

- Make sure the app runs well on different devices and platforms.

- Verify the app smoothly even with high transaction volumes and large data loads.

- Confirm the BNPL app meets legal rules, privacy standards, and app store guidelines such as PCI-DSS and GDPR

- Validate accuracy of credit and payment data to avoid calculation errors.

Team involved: QA Engineers, Automation Specialists, occasionally Security Analysts

Timeline: 2–4 weeks

Estimated cost: 10–15% of total budget.

Deployment and launch

The final step is all about getting the app live. It’s all about building the production environment, ensuring that systems scale properly, submitting to the app stores, and launching with monitoring enabled.

Key activities:

- App Store & Play Store submissions

- Real-time monitoring integration (e.g., Datadog, Sentry, Firebase)

- Rollback and recovery strategy setup

Team involved: DevOps, QA, Developers, Project Manager

Timeline: 1–2 weeks

Estimated cost: 5–10% of total budget

Note: Following launch, you should also allocate time for customer support, optimization of performance, as well as the review of analytics to improve retention and monetization.

How to reduce BNPL app development cost

Now that you know where most of your BNPL budget goes – from developers and integrations to compliance, the next question is how to spend it smarter. Based on our experience building fintech and BNPL platforms for startups and enterprises, here are practical ways to lower costs without sacrificing quality or speed.

Build a functional MVP, not a full ecosystem

A complete BNPL platform (merchant dashboard, credit engine, analytics, user app) can easily exceed $150,000 – $300,000 if built all at once.

Most startups don’t need that on day one. Instead, build a core MVP that includes:

- Checkout flow with installment options

- Basic repayment management

- Merchant onboarding

- Integration with one payment gateway

This version usually costs 40-60% less and gets you to market faster to test demand, pitch investors, or attract merchants.

Use proven fintech APIs instead of building everything from scratch

Integrating APIs for payment processing (Stripe, Adyen), KYC/AML (Sumsub, Veriff), and credit checks (Experian, TransUnion) can save both time and long-term maintenance costs.

While these APIs add usage fees ($0.10–$1 per request), they’re cheaper than hiring in-house specialists or building proprietary modules that must be updated constantly for compliance.

Tip: Choose providers that offer sandbox environments and pre-built SDKs, they can shorten integration time by 25-30%

Outsource development but balance cost and expertise

Hiring a local fintech dev team in the US or Western Europe costs $120–$180/hour, while offshore teams in Vietnam or Eastern Europe charge $35–$60/hour for equivalent skill sets.

That’s a potential 50–70% saving, but it only works if you choose a partner who understands fintech compliance (PCI DSS, PSD2) and has clear delivery frameworks (Agile sprints, transparent milestones).

Tip: Avoid the cheapest options. A team with fintech experience might charge slightly more but reduce your timeline and rework cost significantly.

- Suggested for you: How to plan and build a successful fintech app step-by-step

Examples of BNPL app development cost

Afterpay

Target market: Retail

Estimated development cost: $100,000 – $150,000

Key features:

- “Pay in 4” model (interest-free, bi-weekly payments)

- Instant approval decision engine

- Real-time checkout integration

- Lightweight user dashboard

- Merchant onboarding tools

Afterpay is a straightforward BNPL model that focuses on speed and convenience. The app is designed to provide an easy and fast shopping experience, especially for younger consumers and impulse shopping. With fixed short-term payment plans and no full credit checks, Afterpay reduces risk and doesn’t require a complex financial system.

Even without long-term interest, the app requires integrating payment gateways, connecting with merchant systems, and ensuring strong security to prevent fraud. As the app scales, it also needs stable cloud infrastructure and the ability to handle real-time transactions. Therefore, Afterpay’s costs are mainly driven by system integration and the need for fast response times.

Klarna

Target market: Broad e-commerce, including electronics, fashion, and home goods

Estimated development cost: $150,000 – $250,000

Key features:

- Multiple payment options: Pay Later, Pay Now, Financing

- Deep merchant integrations across verticals

- Personalized shopping feed with product discovery

- Embedded credit engine

- Loyalty & rewards system

- User insights and behavioral analytics

Klarna is often called the “BNPL super app” because it goes beyond basic deferred payments to include e-commerce and marketing features. This significantly increases development costs compared to standard BNPL apps.

Instead of just payment logic, Klarna requires a complex backend to handle various transaction types, from interest-free payments to long-term financing. Additionally, supporting multi-region functionality and merchant dashboards further drives up costs.

Building a Klarna-like app requires more than just fintech developers. You need data specialist, UX designers , and experienced DevOps engineers to scale globally. These hidden layers are why Klarna’s development cost is often 70% higher than simpler BNPL apps.

Affirm

Target market: High-ticket goods and services (e.g., electronics, travel, healthcare)

Estimated development cost: $200,000 – $300,000+

Key features:

- Long-term financing plans (up to 36 months).

- Full credit checks & soft pulls (Experian, Equifax).

- Interest-bearing loans with dynamic APR.

- Real-time loan underwriting engine.

- Complex repayment calculators.

- Dispute resolution workflows.

- Regulatory compliance: KYC, AML, Truth in Lending.

Affirm operates more like a micro-lender than a basic BNPL app, offering loans with interest rates and custom terms. This means its backend must handle credit checks, loan processing, and risk assessments – all of which add to development costs.

Compliance is also a major factor, requiring systems for financial disclosures, fraud detection, and KYC/AML processes, especially in regulated markets like the U.S. and EU.

Moreover, Affirm targets higher-value purchases, so the user interface needs to clearly present loan terms, payment schedules, and customer support options, making the design more complex and costly.

Bonus: Expected ROI and Payback of a BNPL app

A well-planned BNPL platform can typically break even within 12-24 months after launch. Revenue mainly comes from merchant commissions (2-6%), service fees, and partnership incentives.

Startups that launch with a lean MVP and scale merchant adoption strategically often recover their initial $150K-$250K investment in under two years, especially when transaction volume passes the $500K-$1M/month mark.

To understand how BNPL platforms generate revenue, explore how BNPLs make money

Wrapping up

In sum, building a BNPL app like Afterpay, Klarna, or Affirm in 2026 can cost anywhere from $10,000 for a basic MVP to over $400,000 for a fully featured enterprise solution. The final cost depends on various factors, including the app’s complexity, user experience design, third-party integrations, regulatory compliance, and the development team’s location.

Whether you’re aiming for a simple BNPL offering or a sophisticated credit assessment platform, success starts with a well-defined roadmap and a realistic budget.

We hope this article provides valuable insights to support your planning and decision-making.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.