Fintech is entering a new era. Once known for breaking old banking rules, it is now competing on something deeper: trust, seamless experience, and personal impact.

From digital banks that redefine everyday payments to apps that turn investing or lending into a few simple taps, the fintech space in 2026 is evolving faster than ever. But with hundreds of platforms promising innovation, the real question is which ones truly stand out.

We have analyzed performance, user trust, and technology adoption to shortlist the 12 best fintech apps in 2026 – platforms that are not just popular but are pushing the boundaries of what digital finance can do.

Whether you want to save smarter, trade effortlessly, or explore crypto safely, these are the apps worth your attention this year.

Top 12 fintech apps in 2026

The information in this table has been compiled through our thorough research on each app’s website and reliable review sites. The types of apps, key functionalities, pricing, user ratings, and installation numbers will help you determine which fintech app best suits your needs.

| App | Type | Pricing | Main market | User ratings (avg.) |

|---|---|---|---|---|

| Revolut | Neobank/ Multi-currency Account | Free basic plan; Premium $9.99/mo, Metal $16.99/mo | Europe, UK, expanding to US & APAC | 4.8/5 |

| Chime | Digital Banking / Personal Finance | No monthly fees; optional overdraft up to $200 | United States | 4.8/5 |

| PayPal | Payments & Business Transactions | Free for personal use; ~2.9% per business transaction | Global | 4.7/5 |

| Wise | Global Money Transfers | ~0.6% per transaction on average | Global | 4.8/5 |

| Robinhood | Stock & ETF Trading | Free trades; Gold plan $5/mo | United States | 4.3/5 |

| eToro | Social Trading & Crypto Investing | Free stock trading; spreads apply on crypto | Europe, UK, US | 4.6/5 |

| Coinbase | Crypto Exchange & Wallet | Free to join; trading fees 0.5–2% | United States, Global | 4.7/5 |

| Binance | Crypto Exchange | Free registration; trading fee 0.1% | Global (Asia–EU focus) | 4.6/5 |

| Klarna | Buy Now Pay Later (BNPL) | Free app; interest-free installments | Europe, US | 4.8/5 |

| Mint | Budgeting & Expense Tracking | Free; ad-supported | United States | 4.6/5 |

| Lemonade | AI-driven Insurance | Premiums vary by plan and region | United States, expanding to EU | 4.8/5 |

| GrabFin | Financial Super App (Payments & Insurance) | Free app; service-based fees | Southeast Asia | 4.7/5 |

1. Revolut

Revolut has evolved from a travel card into one of the most comprehensive neobanks in the world. Serving over 40 million customers across Europe, the UK, and the US, it allows users to manage spending, savings, investments, and even crypto – all from a single app. In 2026, Revolut continues to expand its financial ecosystem with features like commission-free stock trading, crypto staking, and personalized financial analytics, making it one of the top choices for users seeking full control over their money.

Core strengths

- All-in-one financial hub: Combines banking, investing, saving, and budgeting in one app.

- Global usability: Multi-currency accounts with interbank exchange rates for over 30 currencies.

- Real-time insights: Smart analytics and instant spending notifications help users track expenses effectively.

- Investment-friendly: Commission-free stock trading and crypto access for retail users.

- Strong security ecosystem: Built-in card freezing, biometric login, and anti-fraud protection.

Who should use it

- Digital nomads and frequent travelers managing multiple currencies.

- Individuals looking for an integrated financial solution covering everyday banking and investing.

- Startups and freelancers receiving international payments without heavy fees.

Watch out

- Some advanced features (like insurance and premium cards) are locked behind paid plans.

- Customer support response times can vary by region.

2. Chime

Chime stands out as one of the most popular digital banks in the United States, reshaping how people handle everyday banking. With a mission to make financial services more transparent and accessible, Chime offers fee-free checking and savings accounts, early direct deposits, and automatic savings tools. In 2026, it continues to gain traction among millennials and Gen Z users who prefer simple, mobile-first banking experiences without the complexity of traditional banks.

Core strengths

- Zero hidden fees: No monthly maintenance, overdraft, or minimum balance requirements.

- Early paycheck access: Get paid up to two days early with direct deposit.

- Smart savings features: Round-up and automatic transfers make saving effortless.

- Strong user experience: Clean, intuitive app interface with real-time transaction alerts.

- Financial protection: FDIC-insured accounts and robust fraud prevention systems.

Who should use it

- Individuals frustrated with traditional bank fees.

- Young professionals and gig workers wanting faster access to income.

- Anyone seeking a simple, mobile-only banking solution.

Watch out

- Limited in-person support or physical branches.

- Cash deposit options are available only through select retailers with small fees.

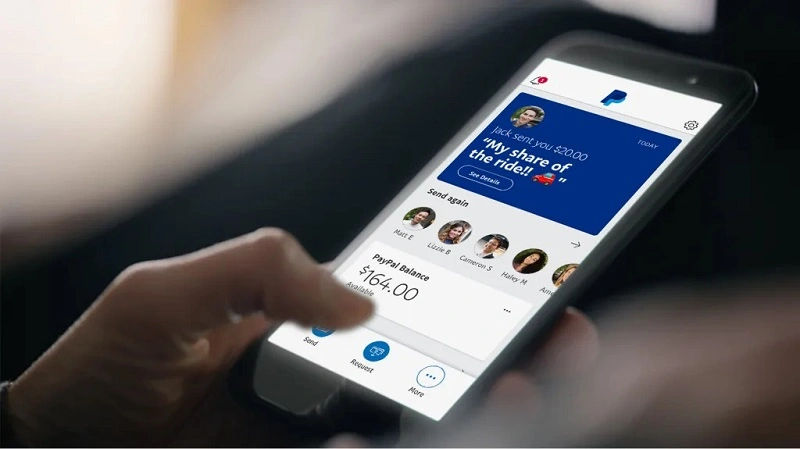

3. PayPal

PayPal remains a cornerstone of global digital payments, empowering individuals, freelancers, and businesses to move money seamlessly across borders. With over 430 million active accounts in more than 200 markets, it continues to play a pivotal role in enabling online commerce and cross-border transactions. In 2026, PayPal stays competitive by embracing crypto payments, BNPL (Buy Now, Pay Later), and expanding partnerships with major eCommerce platforms, ensuring it stays relevant in an increasingly diversified fintech ecosystem.

Core strengths

- Trusted payment infrastructure: One of the most widely recognized and accepted digital payment platforms worldwide.

- Seamless integration: Works effortlessly with major eCommerce systems like Shopify, WooCommerce, and BigCommerce.

- Robust fraud protection: Advanced risk management, encryption, and real-time monitoring safeguard both buyers and sellers.

- Cross-border flexibility: Supports transactions in multiple currencies, simplifying global operations.

Who should use it

- Online businesses looking for a quick and secure way to accept payments globally.

- Freelancers and service providers dealing with international clients.

- SMEs seeking a reliable payment processor without complex setup or maintenance.

Watch out

- Higher fees for international transfers compared to some newer fintech players.

- Account holds or payment delays may occur for new or high-risk sellers.

4. Wise

Wise has redefined the way individuals and businesses handle international money transfers by offering transparent, real exchange rates and ultra-low fees. What started as a peer-to-peer currency exchange has evolved into a global financial platform with features like multi-currency accounts, borderless debit cards, and business solutions for cross-border payments. In 2026, Wise remains a top choice for those seeking clarity, fairness, and cost-efficiency in global transactions.

Core strengths

- True mid-market exchange rate: No hidden markups – users pay exactly what they see.

- Multi-currency account: Hold and manage 40+ currencies from one place.

- Fast, low-cost transfers: Often cheaper and quicker than traditional banks.

- Business-ready tools: Integrations for payroll, invoicing, and global vendor payments.

Who should use it

- Freelancers or remote workers getting paid from overseas clients.

- Expats, travelers, or digital nomads managing money in multiple currencies.

- Businesses with international teams or global suppliers.

Watch out

- No support for cash deposits or credit products.

- Transfer times may vary depending on local banking systems.

5. Robinhood

Robinhood has long stood out as the pioneer of commission-free trading, reshaping how individuals engage with the stock market. The app’s simple design and zero-fee model have opened doors for millions of first-time investors to buy and sell stocks, ETFs, options, and even cryptocurrencies with just a few taps.

As the fintech landscape evolves in 2026, Robinhood is positioning itself as a comprehensive wealth-building platform rather than just a trading app. With new additions such as retirement accounts, crypto wallets, and automated investing options, it continues to bridge the gap between accessibility and long-term financial planning.

Core strengths

- Zero-commission trading: Users can trade across multiple asset types without paying transaction fees.

- Beginner-friendly interface: Clean, intuitive, and engaging – ideal for those new to investing.

- Fractional shares: Allows users to invest with minimal capital and diversify easily.

- Expanding financial ecosystem: Integrates cash management, crypto services, and recurring investments into one app.

Who should use it

- New investors seeking a straightforward and low-cost way to start trading.

- Individuals wanting a unified platform for both investing and basic financial management.

- Users interested in building long-term wealth without high barriers to entry.

Watch out

- Lacks advanced analytics and research tools for professional traders.

- History of trading halts and platform outages may deter high-frequency investors.

6. eToro

eToro has grown from a niche trading platform into one of the most dynamic social investing ecosystems worldwide. Its signature feature, CopyTrading, allows users to automatically mirror the portfolios of successful traders – blending learning with real investing. The platform supports stocks, ETFs, crypto, and commodities, making it a one-stop hub for both beginners and seasoned investors.

Looking ahead, eToro is strengthening its position by expanding crypto offerings, improving transparency, and enhancing investor education. Rather than just a trading tool, eToro continues to evolve into a community-driven financial network that empowers users to invest smarter together.

Core strengths

- CopyTrading & social investing: Easily follow and replicate trades from top-performing investors.

- Diverse asset range: Trade everything from stocks to crypto in one app.

- Active community: Connect with millions of users to share insights and strategies.

- Clean, intuitive interface: Ideal for both beginners and experienced traders.

Who should use it

- New investors eager to learn from experienced traders.

- Users seeking exposure to both traditional and digital assets.

- Traders who value transparency and community engagement.

Watch out

- Spreads can be higher than on specialized trading platforms.

- Some assets and features are restricted by region.

7. Coinbase

Coinbase is one of the most recognized and beginner-friendly cryptocurrency exchanges in the world. It simplifies the process of buying, selling, and managing crypto assets, offering a clean interface and strong regulatory compliance. Trusted by over 100 million users, Coinbase has become the go-to platform for those entering the crypto space for the first time.

Today, Coinbase continues to strengthen its ecosystem by adding staking options, advanced trading tools, and self-custody wallets, ensuring users have both convenience and control over their assets.

Core strengths

- User-friendly experience: Intuitive interface ideal for beginners exploring crypto.

- Security-first design: Cold storage, multi-signature wallets, and insurance coverage for digital assets.

- Wide range of assets: Supports hundreds of coins and tokens.

- Educational rewards: Learn-to-earn modules help users understand blockchain while earning crypto.

Who should use it

- New crypto investors looking for a safe and straightforward entry point.

- Traders who prioritize compliance and reliability.

- Businesses accepting crypto payments through Coinbase Commerce.

Watch out

- Transaction fees are relatively high compared to decentralized exchanges.

- Limited access to advanced trading features in some regions.

8. Binance

Binance stands as the world’s largest cryptocurrency exchange by trading volume, offering an extensive ecosystem that spans trading, staking, lending, and NFTs. It attracts both retail and professional traders with its low fees, deep liquidity, and wide selection of digital assets. Despite facing stricter global regulations, Binance continues to expand its offerings and strengthen compliance frameworks to maintain user trust and accessibility.

Core strengths

- Massive crypto selection: Supports hundreds of cryptocurrencies and trading pairs.

- Low transaction fees: Among the most competitive in the market.

- Comprehensive ecosystem: Includes Binance Earn, NFT marketplace, and Binance Pay.

- Advanced trading tools: Features spot, futures, margin, and P2P options for experienced users.

Who should use it

- Active traders seeking low fees and high liquidity.

- Users looking for a platform with both trading and passive earning options.

- Crypto enthusiasts who want exposure to new tokens and DeFi products.

Watch out

- Regulatory restrictions may limit certain services in specific countries.

- The platform’s complexity can be overwhelming for beginners.

9. Klarna

Klarna is a leading Buy Now, Pay Later (BNPL) platform that reshaped how consumers shop and pay online. Operating in over 45 countries with more than 150 million users, Klarna partners with major retailers to let customers split purchases into flexible installments without traditional credit checks. Its seamless checkout experience and personalized shopping recommendations have turned it into a major player in both fintech and e-commerce.

In recent years, Klarna has been expanding beyond BNPL, offering savings accounts, loyalty programs, and AI-driven budgeting tools, positioning itself as a broader digital finance platform rather than just a payment option.

Core strengths

- Flexible payment options: Pay in 3 or 4 installments, or defer payment for up to 30 days.

- Strong retail partnerships: Integrated with thousands of online stores worldwide.

- User-focused experience: Personalized deals, real-time spending insights, and easy returns.

- Transparent terms: No hidden fees when payments are made on time.

Who should use it

- Shoppers who want to manage expenses without using credit cards.

- Online retailers aiming to increase conversions and reduce cart abandonment.

- Young consumers seeking flexible, interest-free payment options.

Watch out

- Missed payments may lead to late fees or impact credit scores in certain regions.

- Limited utility outside partner merchants.

10. Mint

Mint is one of the most popular personal finance and budgeting apps in the United States. It aggregates bank accounts, credit cards, bills, and investments in one place, giving users a clear overview of their financial health. By automatically tracking spending, categorizing expenses, and offering insights, Mint helps users make informed financial decisions without manual effort.

Over time, Mint has added features like goal tracking, credit score monitoring, and bill reminders, making it a comprehensive tool for everyday money management.

Core strengths

- Automatic expense tracking: Consolidates multiple accounts to provide a real-time financial snapshot.

- Budgeting and goal setting: Helps users plan and stick to spending goals.

- Credit score monitoring: Offers free insights into credit health.

- User-friendly design: Simplifies complex financial data for easy understanding.

Who should use it

- Individuals seeking a complete overview of their personal finances.

- Users wanting to monitor spending, savings, and bills in one place.

- Anyone looking for free tools to improve financial habits and planning.

Watch out

- Ad-supported, which may affect user experience.

- Some features may not support all bank accounts or investment platforms.

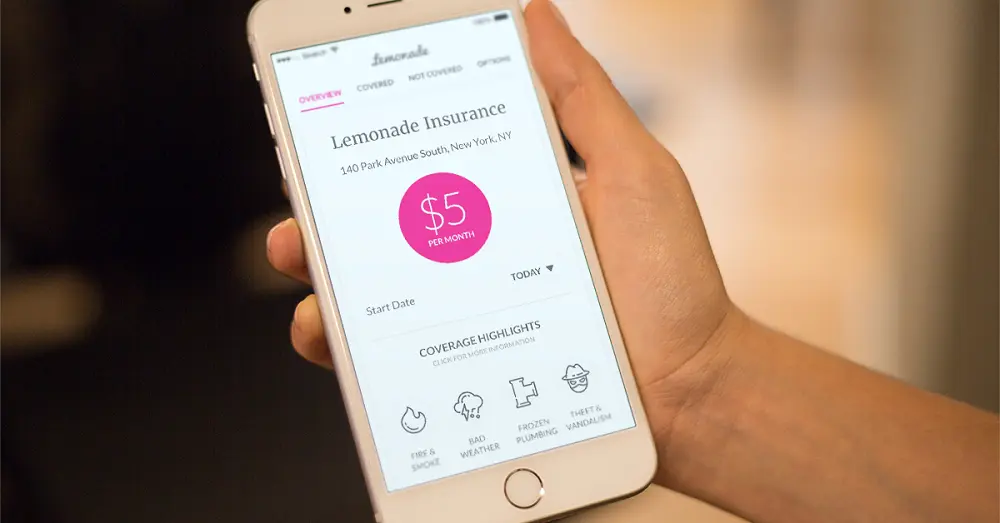

11. Lemonade

Lemonade is an AI-driven insurance platform that simplifies the process of obtaining renters, homeowners, and pet insurance. Using artificial intelligence and behavioral economics, Lemonade provides fast quotes, instant claims processing, and transparent pricing. Its innovative approach has made it one of the most popular insurtech apps in the United States, particularly among tech-savvy millennials and Gen Z users.

Lemonade continues to innovate by expanding coverage options and integrating smart automation, aiming to make insurance more accessible, affordable, and user-friendly.

Core strengths

- Instant quotes and claims: AI-powered tools allow users to get coverage and process claims quickly.

- Transparent pricing: Flat fees and clear terms help users understand exactly what they pay for.

- User-focused experience: Simple app design, fast onboarding, and responsive customer support.

- Social impact: Unclaimed premiums are donated to causes chosen by users, promoting community engagement.

Who should use it

- Young renters and homeowners seeking fast, affordable insurance.

- Individuals who prefer fully digital experiences over traditional insurance processes.

- Users looking for transparent, socially responsible insurance providers.

Watch out

- Coverage options are limited compared to traditional insurers.

- AI-based decisions may not cover complex claims in all scenarios.

12. GrabFin

GrabFin is a financial super app primarily serving Southeast Asia, integrating payments, lending, insurance, and investment services into a single platform. Leveraging the Grab ecosystem, it enables users to manage everyday financial needs alongside ride-hailing, food delivery, and other services, creating a seamless lifestyle and finance experience.

Looking ahead, GrabFin aims to expand its offerings with smarter credit solutions, micro-investment options, and enhanced financial literacy tools, reinforcing its position as a one-stop digital finance platform in the region.

Core strengths

- All-in-one financial hub: Combines payments, lending, insurance, and investment services.

- Integration with Grab ecosystem: Users can link daily services with financial tools.

- User-friendly interface: Simple navigation and real-time transaction updates.

- Accessibility: Designed for a wide range of users, including first-time digital finance adopters.

Who should use it

- Individuals in Southeast Asia seeking a comprehensive digital finance solution.

- Users looking to manage payments, savings, and credit from one app.

- Consumers who prefer integrating lifestyle and financial services in a single platform.

Watch out

- Features may vary depending on country regulations.

- Advanced investment options are still limited compared to specialized platforms.

Now that you’ve gained a detailed understanding of six great fintech apps for your business, let’s move on to some helpful tips for choosing the perfect fintech app tailored to your specific financial needs.

How to choose the perfect fintech app for your financial needs

Choosing the perfect fintech app for your financial needs requires considering several factors to ensure that the app you select aligns with your financial goals, security requirements, and usability preferences. To make the decision easier, consider the following factors:

- Identify your primary financial goal: Clarify what you need from a fintech app. Are you looking for budgeting help, investment advice, savings options, or a combination of services? Knowing your goals can help you narrow down your options to apps designed to meet those specific needs.

- Evaluate ease of use: A user-friendly interface and seamless onboarding are crucial, especially if you’re new to digital finance. Apps like Chime or Mint excel at simplicity, while eToro or Binance provide more advanced tools.

- Consider fees and pricing structure: Some apps are free, some charge subscription fees, and others take a small cut per transaction. Make sure you understand the costs before committing.

- Security and trustworthiness: Check for encryption, multi-factor authentication, and regulatory compliance. Well-established apps like PayPal, Coinbase, and Revolut prioritize user protection.

- Geographic availability: Not all features are available worldwide. Ensure the app supports your country and currency needs.

- Integration with your lifestyle: Some apps, like GrabFin or Revolut, integrate multiple services (payments, investments, insurance) in one place, while others specialize in a single function. Choose what aligns with your habits and priorities.

- Customer support and community: Access to responsive support or an active user community can save time and reduce frustration when issues arise.

Partner with Synodus for seamless fintech app integration

Integrating fintech apps can be complex, with risks of failed transactions, workflow mismatches, and security gaps. Synodus helps businesses overcome these challenges with expert integration and custom app development.

Our integration services:

- Payment gateways: Secure, fast, and error-free transactions.

- Banking APIs: Real-time processing and compliance.

- Digital wallets: Streamlined payment options for users.

- Investment platforms: Smooth portfolio and trading integration.

- Fraud prevention systems: Protect data and transactions with advanced security.

In addition to integrating the existing fintech app into your system, which makes your transactions faster and easier, having a custom fintech app designed for your business brings even greater benefits.

A tailored app ensures that all features match how your business works, giving you more control over user experience, security, and growth. It also helps you adapt quickly to market changes. At Synodus, we can develop a custom fintech app that fits your business perfectly.

Our custom fintech app development services include:

- Features match your workflow for maximum efficiency.

- Enhanced control over user experience, security, and scalability.

- Quick adaptation to market changes and new business needs.

Every app we develop is tailored to your requirements, using advanced technology and strong security measures to deliver reliable performance.

Here’s what you get when you choose us as your fintech app development partner:

- Save your time with features designed to fit your business workflow.

- Save your money by reducing long-term costs. Our tailored solution cuts out unnecessary features, streamlining your operations.

- Save your effort with an app that eliminates the need for workarounds, making your business operations smoother.

- Boost growth with a scalable solution that adapts to your business needs and helps you stay ahead of the competition.

FAQs

Look for features like security, ease of use, low fees, fast transactions, and services that match your financial needs. Apps that can work with other financial tools are also helpful.

Fintech apps are usually faster, cheaper, and more flexible than traditional banks. However, banks offer more stability and extra services like loans and insurance, with government-backed protection.

Fintech apps ensure security through a variety of measures, including encryption, secure login processes, two-factor authentication, fraud detection systems, regular security updates, and compliance with industry regulations such as PCI

Summary

Without doubt, the top 6 best Fintech apps fintech apps we’ve highlighted are great for helping your business manage payments, boost cash flow, and simplify transactions. These apps are designed to meet the needs of small businesses and entrepreneurs, offering everything from quick payments to enhanced security.

We hope that the list and the tips mentioned earlier will help you choose the most suitable apps based on your specific needs.

However, if you are looking for something more tailored, a custom-built fintech app could be a much better fit. With an app made just for your business, you can streamline operations, save time and money, and scale your business more effectively. Let us help your business grow faster, smoother, and smarter. Chat with us now!

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.