In this guide, we will break down what a crypto wallet is, how it works, its key features, and the different types available. We’ll also explore security essentials and whether it’s smarter to build your own wallet from scratch or leverage third-party solutions.

Ready to lay a strong foundation for your crypto wallet journey? Let’s get started!

Key takeaways:

- A Crypto wallet offers crypto startups opportunities to build user trust, expand ecosystems, and create new revenue streams.

- There are 3 main types of crypto wallets including hot wallets, cold wallets, and hybrid wallets – each designed to meet specific needs and security requirements.

- Security is a critical aspect of crypto wallet development, as it directly influences user trust and a startup’s ability to thrive in a competitive market.

What is a crypto wallet?

A crypto wallet is an application or device that secures the passkeys (public and private keys) required to access and manage digital assets. Much like a traditional wallet that holds cash, a crypto wallet secures your cryptocurrency by storing the keys needed to perform transactions.

The meaning of a crypto wallet lies in its role as a secure gateway to the blockchain. Early on, managing cryptocurrency required manually handling complex keys, but today’s wallets simplify this, making it easier for anyone to send and receive cryptocurrency. An example of this is the first Bitcoin wallet created by Satoshi Nakamoto, where he sent 10 bitcoins to Hal Finney, marking the first cryptocurrency transaction.

The purpose of a crypto wallet is to give users control over their digital assets without relying on third parties. Unlike traditional bank accounts, cryptocurrencies are decentralized, meaning there is no central authority to help recover lost assets. Thus, a cryptocurrency wallet is essential for securely storing digital assets. With it, users can safely hold, send, and receive cryptocurrency, knowing that only they access their funds through their private key. That’s why users should use crypto wallets to manage their digital assets.

How does crypto wallet work?

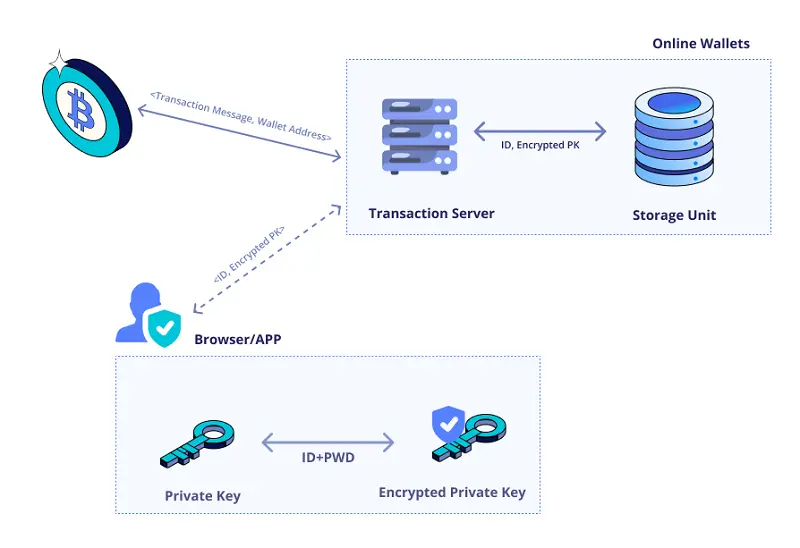

To understand how a crypto wallet functions, it’s helpful to think of it in terms of securing and managing cryptographic keys. A crypto wallet generates and securely stores a pair of keys: one public and one private. The public key is like a bank account number—it’s what you share with others to receive cryptocurrency. The private key, however, acts like the password to your bank account, allowing access and control over your funds. Keeping this key confidential is essential, as losing it means losing access to your digital assets with no way to recover them.

When you start a transaction, you typically enter the recipient’s wallet address (their public key), specify the amount, and then use your private key to sign and authorize the transaction. This signature verifies ownership and provides security, ensuring only the wallet holder can access or transfer the funds.

Modern crypto wallets have made this process more user-friendly. Rather than manually entering long cryptographic keys, many wallets now integrate features like QR codes. This allows users to send and receive cryptocurrency without manually entering long, complex keys. This simplifies the transaction process, making it as easy as scanning a code, choosing an amount, and confirming with your private key.

5 main crypto wallet features

An effective crypto wallet does more than just holding the keys to the digital assets—it offers features that make managing digital assets easy and secure. Here’s what to look for:

Control over private keys

A crypto wallet gives you direct control over your private keys, meaning you’re the only one who can access your assets. This independence from third-party services is a big plus for privacy and autonomy.

Multi-currency compatibility

Many wallets let you manage various cryptocurrencies in one place, so if you hold multiple types of digital assets, you don’t need a separate wallet for each one. It keeps everything organized and within reach.

Enhanced security layers

Wallets typically offer options like password protection, biometric login, and two-factor authentication. These features add extra protection, keeping your assets safe from unauthorized access.

Backup and recovery options

If something happens to your device, having a backup can save you from losing access to your funds. Many wallets provide a recovery phrase (seed phrase) that you can use to restore your wallet if needed. Just make sure to store it somewhere safe and offline.

User-friendly experience

Modern wallets make transactions straightforward with features like QR code scanning, so sending or receiving crypto feels as easy as scanning a code and confirming.

These features make a crypto wallet a must-have for anyone looking to manage digital assets efficiently and with peace of mind.

3 common types of cryptocurrency wallet

Crypto wallets come in different types, each offering its own mix of convenience and security. Here’s a quick look at the 3 main types:

Hot wallets

Hot wallets are online, making them a great choice for people who need frequent access to their funds. This type includes web-based, mobile, and desktop wallets. They’re always connected to the internet, which is convenient but can make them more vulnerable to cyber threats. A hot wallet keeps things quick and accessible.

Cold wallets

Cold wallets, on the other hand, stay offline, making them more secure but less convenient for regular use. Cold wallets are much safer from hacking attempts by keeping private keys disconnected from the internet. Hardware wallets (like USB devices) and paper wallets are common options here. If you’re more focused on security than frequent access, a cold wallet is a solid choice for holding assets long-term.

Hybrid wallets

Hybrid wallets combine the features of both hot and cold wallets, offering a balance between security and convenience. These wallets store the majority of users’ assets offline for security, while keeping a smaller portion online for easier access and quick transactions. Hybrid wallets are ideal for users who prioritize security but still require occasional access to their funds without sacrificing too much convenience.

Choosing the right wallet type for a crypto wallet depends on factors such as security requirements, user convenience, transaction frequency, and your target audience.

Hot wallets are ideal for active traders who need quick access, while cold wallets are better suited for long-term holders who prioritize security. Hybrid wallets strike a balance, offering both security and easy access.

Additionally, the platform (web, mobile, or desktop) and integration with other services are important considerations when determining the best wallet type.

Crypto wallet security considerations

For crypto startups, security is a top concern when building a crypto wallet. Since there’s no central authority to recover stolen funds, users are fully responsible for safeguarding their assets. Here are some common risks and tips for staying secure:

Risk of hacking

Hot wallets, since they’re online, are more exposed to hacking attempts. Hackers might try phishing attacks, malware, or other tricks to get into your wallet. To keep things secure, consider using two-factor authentication, setting up a strong password, and avoiding public Wi-Fi when accessing your wallet.

Private key exposure

Your private key is the key to your assets—if someone gets a hold of it, they control your funds. Unlike traditional finance, there’s no safety net for recovering stolen crypto. For larger holdings, using a hardware wallet is a good move since it keeps your private key offline and away from potential attackers.

Phishing scams

Phishing is a popular tactic for scammers trying to trick you into sharing your private key. This can come from fake websites, emails, or messages. Stick to official apps and websites to access your wallet, and be cautious of links you don’t recognize.

Backup and recovery

If you lose access to your wallet, having a backup can save you. Many wallets provide a recovery phrase to restore your wallet. Store this phrase safely, ideally offline and in secure locations, so you’re covered if your device gets lost or damaged.

In crypto, staying safe means being proactive. Pick the right wallet, set up solid security measures, and keep an eye out for potential risks.

Building from scratch or using third party wallets?

When building a crypto-related platform, one of the first big questions is: Do you create a wallet from scratch or use an existing one? Both options have their upsides and challenges, so your choice will depend on your goals, budget, and priorities.

Building a crypto wallet from scratch means you get total control. You can shape every feature, making it ideal for a unique, custom experience. On the other hand, integrating a well-established wallet like MetaMask or Trust Wallet lets you skip a lot of heavy lifting. You tap into a trusted system with features ready to go, saving time and money.

To help you weigh your options, here’s a quick look at how each option compares:

| Factor | Build from Scratch | Use an Existing Wallet |

|---|---|---|

| Customization | Full control over features and design, enabling unique functionalities. | Features are limited to those available via the wallet provider’s API. |

| Development Time | Longer, due to the complexity of building the backend and security functions. | Shorter, with pre-built APIs allowing for rapid integration. |

| Cost | High initial costs for development, plus ongoing maintenance expenses. | Lower costs as maintenance and updates are managed by the wallet provider. |

| Security | Full responsibility for implementing and maintaining security measures. | Security features are built-in and managed by a trusted provider. |

| User Trust | Requires effort to build trust as a new product. | Established wallets like MetaMask already have strong user trust and familiarity. |

| Maintenance & Scaling | Continuous updates and scaling adjustments are required as the user base grows. | Maintenance is handled by the provider, though scalability depends on the provider’s roadmap. |

Final takeaway: Which option fits your needs?

Choosing between building a wallet from scratch and using an existing one is a matter of aligning your choice with your goals, budget, and timeframe.

- If customization, full control, and a unique user experience are central to your product’s value, building from scratch will provide the freedom you need to create a standout wallet. This approach requires a high investment and a longer development cycle, but it enables you to shape every aspect of the user experience and security.

- If speed, cost-effectiveness, and reliability are your top priorities, integrating an existing wallet is a sensible choice. Established wallets like MetaMask offer a secure, trusted option that allows you to launch quickly without the heavy lifting of custom development. However, be prepared to work within the limitations of a pre-built solution.

Turn your crypto wallet ideas into reality with Synodus

At Synodus, we know crypto moves fast, and so do we. Our team ensures your crypto wallet is highly secure, while staying focused on building the features that make your app stand out. Whether you’re looking for a quick setup or need custom tweaks to make an off-the-shelf solution feel like your own, we’ve got you covered.

With Synodus, you don’t just get a plug-and-play wallet—you get a partner who truly understands crypto. From first setup to future scaling, we handle every step to bring your product to life quickly and confidently.

Conclusion

Just as every crypto journey begins with a wallet, so does every startup’s approach to shaping that experience. A well-chosen wallet can either simplify user interactions or turn them into a struggle.

For startups, the goal is simple: create a wallet that’s secure, easy to use, and aligned with your vision. Whatever path you take, make sure it’s one that builds trust and keeps users coming back.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.