Launching a neobank from scratch can take over a year, not to mention millions in development and compliance costs. For fintech founders and digital banks racing to market, that’s too long and too expensive.

That’s why they are turning to white-label neobank solutions. These pre-built, compliant platforms can be customized and launched in a fraction of the time. And the market proves it. The white-label neobanking sector is projected to grow at a CAGR of 10.6% through 2028.

Now comes the hard part – choosing the right white-label neobank solutions. In this guide, we’ve compared the top vendors, built a buyer’s checklist to evaluate your options, and broke down the real costs, all for you to choose the confidently.

White-label neobanks explained in 30 seconds

Before we compare platforms, here’s what you’re actually buying.

A white-label neobank is a ready-made digital banking platform that lets you launch your own branded neobank fast, without coding a core banking system from zero.

Here’s how it works: the provider delivers a core banking infrastructure, API integrations, compliance modules (KYC/AML, data security), and a ready-to-customize frontend. You simply plug in your business model, adjust the UX, and go live under your brand name.

The result is a faster launch, lower upfront costs, and a fully compliant platform built to scale with your growth, all without the heavy lifting of traditional bank tech development.

So, why is everyone talking about it?

Because in a market where speed-to-market defines success, white-label neobanking offers a shortcut:

- Faster launch – Go live in weeks, not months

- Lower cost – Avoid heavy development and licensing fees

- Compliance-ready – Built to meet fintech regulations from day one

That’s why startups, challenger banks, and even traditional institutions are turning to white-label providers to power their digital banking journey.

Now, let’s go straight to the top 6 white-label neobank vendors and compare them in features, launch time, and pricing range.

Vendor comparison: 6 leading white-label neobank providers (2026 update)

| Vendor | Deployment model | Time-to-launch | Pricing range* | Key features |

|---|---|---|---|---|

| Synodus | Custom + White-Label Hybrid | 6–10 weeks (avg.) | Flexible (based on scope) | End-to-end neobank development, UI/UX, API integration, KYC/AML compliance, launch & support |

| Swan | BaaS / API embedding | ~1–2 months | Mid | Regulated EU licence, card issuing, IBANs |

| SDK.finance | Source-code licence & SaaS | ~2–3 months | Mid-High | Core banking engine, API first (2,700 TPS), PCI DSS level 1 |

| Velmie | SaaS / API-first | ~2–3 months | Mid | Modular wallet & neobank, multi-currency, crypto rails |

| Crassula | SaaS (no-code) | ~2–6 months | Low-Mid | Wallet + FX + crypto |

| Mambu | Composable SaaS | ~4–9 months | Mid-High | Cloud-native modular banking |

*Pricing ranges are indicative only. Real costs depend on scope and compliance region.

1. Synodus

With years of experience in finance and banking, and successful neobank and fintech projects delivered, Synodus helps financial institutions, fintech startups, and challenger banks launch digital banks faster, without sacrificing flexibility or compliance.

While most white-label neobank platforms don’t allow deep changes to the core logic or backend architecture because they run on a multi-tenant SaaS system, where many clients share the same infrastructure, Synodus takes a different approach.

We offer a Custom + White-Label Hybrid model that gives you a fully customizable neobank platform built on top of a ready-made fintech stack. You can launch your neobank much faster than building from scratch, while keeping the freedom to scale and innovate as you grow.

The solution covers full stack: core banking, card issuing, KYC/AML, payments orchestration, lending, and risk management, with built-in compliance to PCI DSS, GDPR, ISO 27001, and support for multi-currency and regional regulations (EU, APAC, and North America).

We also provide end-to-end delivery model, from tech advisory, platform design, to integration and post-launch support, so you’ll gain a fully owned, future-proof neobank that aligns with your business roadmap.

This approach has delivered real impact for our clients:

- A crypto-enabled neobank successfully launched in North America.

- 150% increase in user engagement powered by our white-label solutions.

- 3 million active users reached for an e-wallet startup using Synodus technology.

2. Swan

Swan is a European-focused Banking-as-a-Service (BaaS) and white-label provider that enables non-bank brands to embed financial services, from IBAN accounts and cards to payments and compliance, under their own brand.

With full EU licensing and ready-to-use infrastructure, Swan allows companies to go live in as little as 1-2 months, ideal for businesses that want to add banking features without becoming a regulated bank.

The trade-off is limited backend customization compared to source-code or hybrid solutions.

This solution works best for brands or fintechs in the EU that want to launch embedded banking or neobank products fast with minimal regulatory friction.

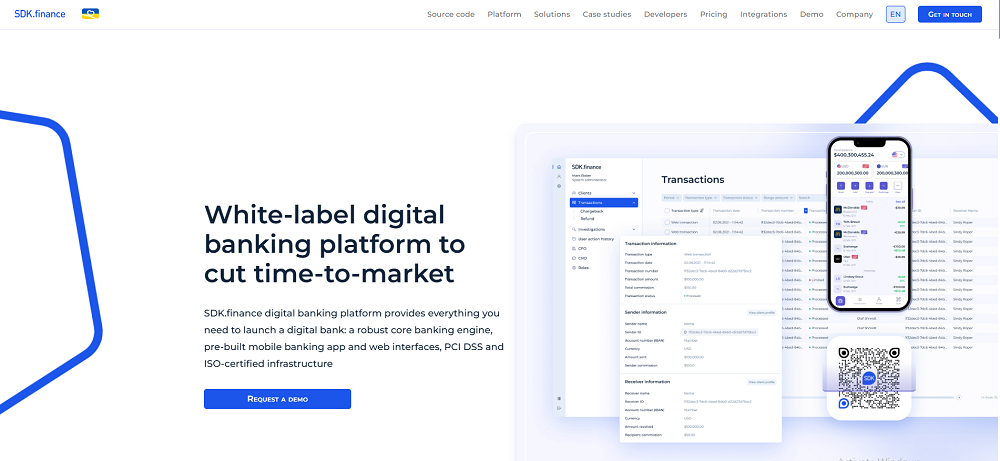

3. SDK.finance

SDK.finance stands out as one of the most flexible white-label neobank platforms, offering both source-code licensing and SaaS delivery. It gives fintech companies a balance between speed and control.

Built with a high-performance core (processing over 2,700 transactions per second) and PCI DSS Level 1 compliance – the highest global standard for payment data security, SDK.finance ensures your neobank can handle enterprise-grade transaction volumes without compromising safety. This means you can launch an MVP within 2-3 months while maintaining security and scalability. However, setup costs and technical resources can be higher than pure SaaS alternatives.

This makes it a strong fit for well-funded fintech firms or challenger banks that want to balance a fast launch with long-term control over their technology stack.

4. Velmie

Velmie is a modular, API-first platform designed for building multi-currency neobanks and digital wallets, including crypto integrations.

It combines speed (2-3 months to launch) with strong customization options, making it a great fit for startups that need to move fast but don’t want to sacrifice flexibility. With pre-built modules for KYC, FX, payments, cards, and compliance, Velmie helps reduce time-to-market while allowing product differentiation.

Velmie works great for Challenger banks or fintech startups that want to move fast but still need room to customize and grow on their own terms.

5. Crassula

Crassula is built for speed. This ultra-fast SaaS white-label platform lets you launch digital wallets, FX, and crypto banking products in as little as 2-6 weeks.

It comes with ready integrations for KYC/AML, payment gateways, currency exchange, and card issuing, so you can skip months of technical setup and focus on getting your product in front of users. However, since it’s a pure SaaS model, backend access and deep customization are limited, which might restrict long-term scalability.

That said, if your priority is launching fast with minimal technical overhead and you’d rather focus on customer experience than building infrastructure, Crassula is a solid choice, especially for small fintechs or startups in Europe looking to test the market quickly.

6. Mambu

Mambu is a composable core banking platform, trusted by banks and large financial institutions to modernize their infrastructure.

It provides modular components for deposits, lending, payments, and cards, all delivered via API. This enables organizations to build tailored digital banking experiences on top. While powerful and enterprise-grade, Mambu’s implementation typically takes 4-9 months and comes with a high cost, so it is less suitable for early-stage startups.

This platform suits banks or established fintechs looking to scale globally or modernize legacy core banking systems with strong reliability and compliance.

For a broader market view, check our detailed guide on top neobank app development companies and see how each vendor stands out in cost, scalability, and integration support.

Buyer’s checklist to pick the right white-label neobank solution

The comparison above gives you options. But which one is right for your business? That depends on your specific requirements, timeline, and constraints.

Before you schedule demos or sign contracts, get clear answers on:

- How fast can you go live?

- How customizable is the platform, both frontend and backend?

- Is it built for the regulatory markets I’m entering?

- What’s the real cost after one year?

- Do they act as a vendor or a long-term tech partner

- Who have they worked with before?

1. Time-to-Market

Ask: “How fast can you go live?“

- For startups or fintech challengers, a vendor that enables launch within 2-4 months is ideal.

- Check for ready-to-use modules (accounts, cards, KYC) and API documentation.

- Avoid vendors that need months of heavy configuration unless you plan for a long-term enterprise rollout.

Benchmark: SDK.finance, Velmie, and Synodus typically enable go-live under 4 months.

2. Customization & scalability

Ask: “How customizable is the platform, both frontend and backend?“

- Can you add or replace modules (FX, lending, crypto, loyalty)?

- Do they support API extensions or open architecture?

- Is there an option to transition from SaaS to self-hosted later?

A hybrid model (like Synodus) can be a good choice. It starts fast but don’t lock you into a rigid SaaS setup.

3. Compliance & security

Ask: “Is it built for the regulatory markets I’m entering?“

- Ensure the platform supports PCI DSS, GDPR, PSD2, and local banking regulations.

- Confirm KYC/AML vendor compatibility and whether compliance tools are included or extra.

- Evaluate data control: Who owns user data, you or the provider?

Bonus: Choose a vendor with strong documentation and audit support because it saves huge headaches later.

4. Total cost of ownership (TCO)

Ask: “What’s the real cost after one year?“

- Compare not only license + SaaS fees but also customization, API usage, and compliance costs.

- Ask for tiered pricing models and scaling rules, some vendors charge extra for every new user or card issued.

- Consider future migration costs if you plan to expand or add new currencies.

Smart move: Negotiate multi-year pricing early. Many vendors give discounts for 12 to 24 months of commitments.

5. Support & Partnership

Ask: “Do they act as a vendor or a long-term tech partner?“

- Check for dedicated project managers, post-launch support, and roadmap collaboration.

- A good vendor should guide you through regulatory setup, testing, and market launch, not just deliver software.

- Review case studies or customer testimonials for proof of success.

Red flag: If support is ticket-only and response times are slow, think twice.

6. Reputation & Proven Experience

Ask: “Who have they worked with before?“

- Look for live use cases or client success stories, especially in similar regions or verticals (e.g., EU fintech, SME banking).

- Verify platform uptime, performance benchmarks, and security certifications.

- Check review sites like G2, Finextra, or LinkedIn case studies for independent credibility.

Some tips for you: Don’t just count the number of clients, check how long they’ve stayed. Long-term partnerships often reveal more about product reliability than flashy logos.

Big names don’t always mean best fit. A smaller vendor with niche fintech experience can sometimes provide faster support and better alignment with your growth stage.

Cost breakdown for launching a white-label neobank

You’ve got your evaluation criteria. But here’s the question that matters most: what will this actually cost?

Before you commit to a platform, it’s important to understand what drives the total cost. While white-label neobanks are far cheaper than building from scratch, they still involve four major cost components. Plus a few hidden ones founders often overlook.

Setup license & onboarding: $50,000 – $150,000

Most vendors charge an upfront setup or license fee that covers:

- Platform configuration

- Initial compliance setup (KYC, AML, PCI DSS)

- Core banking modules and access credentials

This one-time cost gets your digital bank “up and running” within the vendor’s infrastructure.

Monthly SaaS / platform subscription: $5,000 – $20,000

Ongoing monthly fees vary by scale, usually based on number of users, API calls, or transaction volume. This covers:

- Hosting and infrastructure

- Security updates and uptime SLAs

- Customer support and software maintenance

Choose a vendor that scales pricing gradually as your user base grows.

Customization & integration: $30,000 – $80,000 (depending on scope)

If you want to stand out, add unique UX flows, loyalty systems, or crypto features, customization is a need. Costs here depend on how much you extend the base platform:

- UI/UX customization

- Third-party API integrations (FX, cards, lending, etc.)

- Custom feature development

For hybrid vendors like Synodus, this is where your flexibility and ownership pay off.

Compliance & audit fees: $10,000 – $30,000 annually

Even white-label neobanks must meet regulatory standards from AML reporting to data audits. Expect recurring costs for:

- AML/KYC provider subscriptions

- Legal reviews

- Security and compliance audits

Some vendors include these in their platform fee, others don’t, so always check the fine print.

Hidden & indirect costs to keep in mind

Many founders underestimate the smaller costs that can quietly add up:

- KYC provider charges: Usually per verification (e.g., $1-$2/user)

- API usage overages: Once your user volume grows

- Maintenance & version upgrades

- Payment network or card-issuer fees

A tip for you to not be surprised by the hidden cost: always Plan an extra 15–25% of your total budget for these operational expenses.

- Read more: Top 11 Neobanks for businesses in 2026

Wrapping up

In the end, launching a digital bank is no longer a multi-year, multi-million-dollar mission, but choosing the right white-label partner still makes all the difference.

Start by being clear on your goals and growth stage. Ask about compliance, data control, migration paths, and post-launch support, because those are the real success factors once your neobank goes live.

And remember: the best white-label solution is not just the fastest, it’s the one that helps you grow sustainably, stay compliant, and truly own your product.

FAQs

A white-label neobank functions similarly to a regular neobank, but differs in the form of development. While neobanks are developed from scratch by a company, white-label neobanks are pre-built platforms that other businesses can license and brand as their own. Consequently, white-label neobanks can be deployed faster.

Yes, white-label neobanks must meet regulatory requirements of where they operate. However, the compliance is built-in with the application. Providers handle the legal complexities as they develop the banking platform, alleviating the regulatory responsibility from their partners.

It depends on the licensing model. SaaS-based solutions allow UI and branding tweaks, while source-code licensing gives you full backend control to customize workflows, integrations, and compliance logic.

Choose vendors with flexible pricing tiers and gradual scaling. Start with an MVP version, focus on core modules first (KYC, payments, ledger), and add advanced features later. This phased approach helps reduce upfront spending while validating market demand.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.