Many fintech apps don’t fail because of bad ideas, they fail due to compliance gaps, weak security, poor UX, and fragile infrastructure. For startups, even one misstep can lose trust, delay approval, or lead to months of rework.

Before investing another dollar, make sure you understand the real problems behind fintech app development, and how to solve them the right way. That’s exactly what this article will help you uncover.

The major challenges in fintech app development

Below are 11 key challenges in fintech app development you need to address. We’ve grouped them into 3 main categories including Regulatory & security challenges, Technical & infrastructure challenges, and User & market challenges.

Regulatory & security challenges

1. Regulatory compliance

Regulation is the single biggest barrier in fintech app development. Financial apps must comply with KYC/AML, GDPR, PCI DSS, and local banking laws, which differ across regions. This can be especially challenging for apps targeting multiple markets. Non-compliance can result in heavy fines or even business suspension.

How to overcome this challenge:

- Learn about financial regulations (KYC, AML, PCI, DSS, GDPR, etc) to ensure the app follows all legal requirements in different regions

- Use AI and machine learning to automate KYC checks, verify customers, and monitor for suspicious activity, making compliance faster and more accurate.

- Use tools for biometric ID verification, facial recognition, and document scanning to meet KYC rules efficiently.

- Tokenize payment data to protect sensitive info and reduce the risk of data breaches.

2. Security concerns

Fintech apps handle sensitive data like personal info, financial transactions, and payment details, which makes them a target for cyberattacks.

Key risks include data breaches, where weak security exposes customer information, and fraud, such as identity theft or unauthorized access to accounts. Another threat is phishing, where users are tricked into giving away personal data. These risks all highlight the need for strong security to keep users and their data safe.

To secure your app:

- Use strong encryption, like AES-256, to protect sensitive customer data both in storage and during transmission.

- Add multi-factor authentication (MFA) and biometric methods like fingerprint or face recognition to secure user access and prevent unauthorized access or identity theft.

Technical & infrastructure challenges

3. Integration with legacy systems

Many fintech solutions must integrate with traditional banks or government systems that run on outdated infrastructure. Poor integration causes data inconsistency and slows real-time processing.

The solutions include:

- Use APIs to connect fintech apps with traditional banking systems. APIs allow smooth communication between the two without needing a full system overhaul.

- Implement middleware solutions, which act as a bridge, making data exchange easier and fixing compatibility problems.

- Consider moving parts of the legacy infrastructure to cloud-based platforms. This helps simplify integration with modern fintech apps and reduce reliance on outdated technology.

4. Scalability

As fintech apps grow, they need to handle more transactions without slowing down or losing reliability. Building a system that can scale efficiently is key to supporting more users and transactions. Without good scalability, performance issues and downtime can affect the user experience.

Here’s the key step to scale faster:

- Use cloud services like AWS or Azure to handle growing traffic automatically, without needing big upfront infrastructure costs. These platforms adjust server capacity as needed during busy times.

- Build fintech apps with microservices, so each function (like payments or user authentication) runs independently. This way, scaling one part doesn’t affect the others, making the system more efficient and reducing downtime.

5. Data management and analytics

Fintech apps deal with a lot of user data that must be processed, stored, and analyzed effectively. Key challenges include making sure financial transactions are accurate, handling large amounts of data, and gaining insights to personalize the user experience, all while following data privacy laws like GDPR.

Key areas to solve this problem:

- Big data and AI integration: Use AI and machine learning to analyze large datasets, providing personalized financial services and spotting fraudulent transactions in real-time by detecting unusual patterns.

- Secure, compliant storage solutions: Utilize secure cloud storage that meets GDPR and PCI DSS standards, ensuring safe storage and encryption for sensitive data, along with strict access controls.

- Data governance frameworks: Create strong data governance policies to ensure data accuracy, proper handling, and compliance with privacy laws.

6. Payment processing and transactions

Managing cross-border and real-time payments comes with challenges such as processing delays and currency exchange issues. High transaction fees and the need to handle chargebacks and refunds also add to the complexity.

What you should do:

- Use blockchain technology for secure, transparent, and faster cross-border payments, reducing delays and currency exchange fees.

- Work with well-known payment processors like PayPal, Stripe, or TransferWise. They provide fraud protection and handle currency conversions, making payments easier and cheaper.

- Set up automated systems to manage chargebacks and refunds, reducing the workload for customer support and improving user satisfaction.

User & market challenges

7. User experience (UX) design

Even if your fintech app is secure and fully compliant, users will abandon it if the experience feels clunky or confusing. In finance, convenience and trust go hand in hand, a poor UX can kill adoption just as quickly as a data breach.

A good fintech UX should make complex financial actions feel effortless. That means:

- Simple onboarding: Streamline KYC and registration with clear steps, eKYC automation, and document scanning. Avoid making users fill endless forms.

- Personalized dashboards: Tailor insights and visuals based on user behavior — e.g., spending summaries, goal tracking, or custom recommendations.

- Intuitive navigation: Design for both power users and first-timers, ensuring quick access to core actions (transfer, pay, invest).

- Inclusive design: Optimize for accessibility and multiple devices — mobile-first, but desktop-friendly.

8. Trust and transparency

For fintech apps to succeed, users must feel confident in sharing their financial data. Common issues include unclear fees and terms, which can lead to dissatisfaction, and negative press from security breaches or regulatory problems that can damage trust.

How to overcome this challenge:

- Be transparent about fees and policies: Clearly explain all fees, terms, and security measures at every step of the user journey. This openness builds trust and reduces frustration.

- Maintain regular communication and provide incident reports: If there’s a security breach or operational issue, promptly inform customers about what happened, how it’s being fixed, and how their data is protected. Consistent communication fosters trust.

- Highlight third-party certifications and audits: Show security certifications like ISO 27001 or SOC 2 compliance to demonstrate that your app meets high security and transparency standards.

9. High competition

The fintech industry is still becoming crowded, with many companies competing for market share. This competition makes it difficult for new fintech apps to attract users and stand out from established players. Many startups struggle to differentiate themselves, leading to price wars, lower profits, and losing customers.

Additionally, larger, more established competitors often have the advantage of brand recognition, resources, and customer loyalty, which can make it challenging for smaller players to gain traction. New entrants must find ways to innovate and provide value to overcome the high barriers to entry.

To differentiate and retain customers:

- Target a niche market: Instead of trying to compete in a large market, find and serve specific groups, like small and medium businesses or areas that don’t get much attention. Offer products that solve their unique problems.

- Stand out through superior user experience and security: Make sure your app is easy to use, offers personalized services, and has strong security. A fintech app that is simple and safe can quickly attract users.

- Form strategic partnerships: Collaborate with other fintech companies, banks, or financial institutions to offer combined services or integrations that provide more value to customers.

10. Customer support and responsiveness

Fintech apps need to offer fast, efficient customer service for financial issues. Key challenges include handling complex questions about transactions or security, providing 24/7 support without high costs, and keeping customers happy with reliable communication.

Here are some ways to strengthen your support experience:

- Use AI-driven chatbots to handle routine inquiries, offering instant support around the clock. Chatbots can manage questions about transactions, security, and account issues, enhancing the user experience.

- Provide customer service across multiple platforms, including in-app, social media, email, and phone support, allowing users to contact you through their preferred channels and reducing response times.

11. Innovation speed vs. risk

Fintech companies often hurry to launch new features to stay competitive, which can lead to bugs, security risks, or non-compliance with regulations. It’s hard to balance fast innovation with proper testing and compliance. Finding a balance between rapid innovation and thorough testing is a common challenge.

To manage this trade-off effectively, you can apply these methods:

- Agile development methodologies: Break down feature releases into smaller, manageable sprints for quicker, well-tested deployments.

- Continuous integration and continuous delivery (CI/CD): Use automated testing and deployment to catch bugs and security issues early, while keeping up a fast pace of innovation.

- Sandbo testing: Test new features in a secure sandbox before launch to ensure they meet security and compliance standards, reducing the risk of failures.

For a full view of how to solve these fintech app challenges, here’s a quick summary of what really works in practice.

- Build with compliance first. Understand regulations (KYC, AML, GDPR) early, not later.

- Invest in secure architecture. Encryption, MFA, and zero-trust frameworks protect both data and brand reputation.

- Use modular systems for scalability. Don’t overbuild; scale by modules as your user base grows.

- Design UX around financial trust cues. Simplicity, transparency, and accessibility drive adoption.

- Test early, test often. User feedback and sandbox testing prevent costly redesigns later.

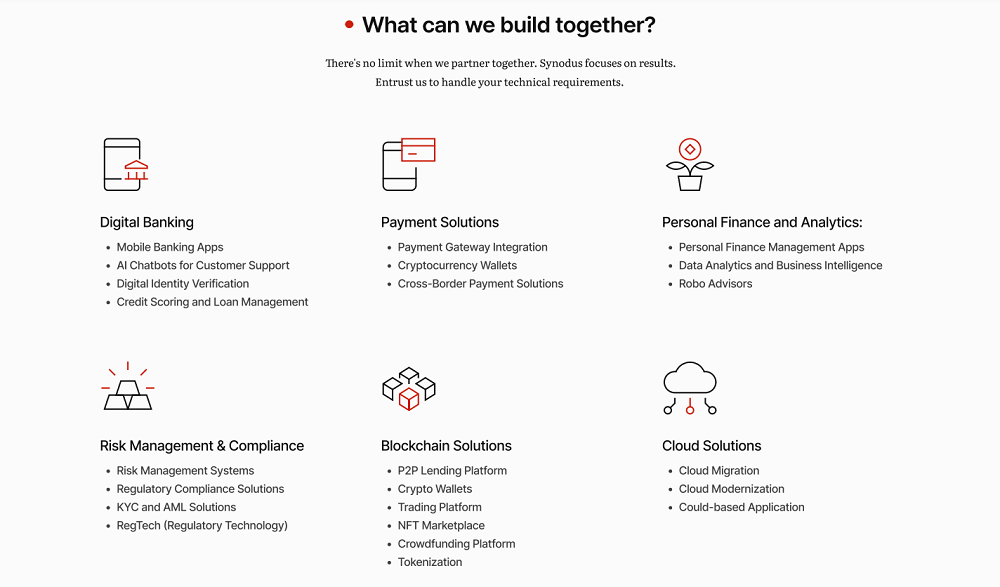

Managing all these aspects from compliance to user trust can be complex. That’s why having the right team by your side is important. At Synodus, we specialize in helping fintech innovators handle these exact challenges which is turning compliance and technical complexity into opportunities for growth.

Develop a risk-free fintech app with Synodus

As a trusted fintech consulting and development partner, Synodus helps fintech founders and enterprises build secure, regulation-ready apps that scale effortlessly, so you can focus on growth instead of risk.

Here’s what you gain when building with Synodus:

- Faster time-to-market: Agile delivery and pre-built fintech modules let you launch in weeks, not months.

- Lower development costs: Our strategic MVP and fixed-cost models help you test ideas efficiently without overbuilding.

- Stronger compliance & security: We ensure KYC, AML, and data protection frameworks from day one, minimizing risk of fines or breaches.

- Higher user trust & retention: With financial-grade UX and transparent design, your customers feel safe and stay loyal.

- Long-term scalability: Modular systems and API-first architecture make it easy to expand or integrate new features as your business grows.

With 30+ successful fintech products built, we have helped global clients overcome major problems in fintech such as complex data, payment, and compliance. Here are two examples where we helped fintech startups tackle real-world challenges, from scaling infrastructure and ensuring compliance to delivering seamless user experiences.

In 2023, we helped an e‑wallet startup scale to 3 million users by redesigning onboarding, integrating P2P and crypto payments, and building a microservices architecture for high performance and real-time transactions.

For a digital banking PaaS targeting SMEs, we implemented a modular, API‑first architecture with fast onboarding, KYC/AML compliance, and mobile/web UX. The project launched on budget, serving initial clients in North America.

Conclusion

In the fintech app development industry, it is undeniable that there are challenges that hinder their seamless operation. From ensuring robust security and user experience to navigating complex regulations and offering diverse financial products, fintech app developers must constantly adapt and innovate to stay ahead.

Addressing and overcoming these 11 key problems in Fintech apps can help businesses create a future where financial services are accessible, secure, and easy to use for everyone.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.