Neobanks are redefining how people interact with money.

With fast onboarding, lower fees, and AI-driven personalization, these digital-only banks are outpacing traditional institutions. The global neobanking market is projected to reach over USD 200 billion in 2025, growing at more than 45% CAGR.

However, building a compliant and scalable neobank app requires deep fintech expertise – from regulatory compliance (PSD2, PCI DSS) to secure architecture and cloud integration. That’s why choosing the right neobank app development company is crucial.

In this guide highlights the top companies in 2026 and helps you decide which partner best fits your neobank vision.

Key takeaways

- Neobank app development companies build end-to-end digital banking platforms, not just finance apps.

- They combine fintech expertise, regulatory knowledge, and modern tech stacks to deliver secure, scalable, and compliant neobanking solutions.

- Their goal is to help startups and banks launch digital-first banking experiences faster and smarter.

10 Leading neobank app development companies

Get a quick glimpse of how the top players stack up with this comparison table—then we’ll break down each company’s strengths in detail:

| Firm | Location | Team size | Rate/hour | Rating |

|---|---|---|---|---|

| Synodus | Vietnam, Singapore | >250 | < $25 | 5/5 |

| Itexus | Poland | >300 | $25 – $49 | 4.9/5 |

| Appinventiv | USA | >1600 | $25 – $49 | 4.7/5 |

| Innowise | Poland | >1000 | $50 – $99 | 4.8/5 |

| DashDevs | Ukraine | >50 | $50 – $99 | 4.8/5 |

| Netguru | Poland | >500 | $50 – $99 | 4.8/5 |

| Cleveroad | USA | >250 | $25 – $49 | 4.7/5 |

| CoreBlue | UK | <50 | $100 – $149 | 5/5 |

| SDK.finance | Lithuania | <50 | N/A | N/A |

| Maticz | India | <250 | $25 – $49 | 4.8/5 |

1. Synodus

Synodus stands out as one of the most capable neobank app development companies in the Asia-Pacific region. Headquartered in Vietnam and operating since 2018, the company has completed 100+ digital projects, with over 30 focused on fintech and neobank platform. Their edge lies in fast MVP delivery (3-5 months) and long-term client partnerships, often lasting 2-3 years, thanks to consistent performance and technical reliability.

Clients include major regional banks such as MB Bank, Techcombank, Vietcombank, as well as global firms like KPMG and BOC Aviation. Synodus delivers ISO 27001-compliant, mobile-first solutions optimized for real-time payments, KYC/AML automation, and API-first banking infrastructure.

Synodus empowers neobank projects with capabilities like:

- Mobile & web app development for neobanks

- Real-time data pipelines and transaction systems

- Third-party API & legacy system integration

- Low-code modules to accelerate rollout

- ETL automation and financial data dashboards

- UX/UI design built for compliance-heavy environments

Their track record that speaks volumes:

- In just 5 months, Synodus built and launched a digital wallet for an APAC startup. The platform now supports over 1 million users, with 99.99% uptime, real-time QR payments, and eKYC onboarding – all maintained under peak traffic conditions.

- For a leading Southeast Asian bank, Techcombank, Synodus engineered a custom data automation system. The result: 80% faster data processing, 95% accuracy, and reporting cycles reduced from 72 hours to just 4.

Clients value Synodus for its ability to deliver fast, secure, and compliant fintech solutions without compromising clarity or structure. They consistently highlight three things:

- Clear communication throughout all project phases

- Well-organized technical documentation that eases onboarding and handover

- Reliable delivery timelines, even for complex, regulation-bound systems

In short, fintech startups or banks in APAC and global seeking fast, scalable, and compliant neobank app development without overhauling their existing core systems.

2. Itexus

Founded in 2013, Itexus is a Fintech-first software development company with proven expertise in digital banking, payments, crypto, lending, and insurance platforms. The firm positions itself as a trusted neobank app development partner, delivering scalable and compliance-ready solutions across North America, Europe, and the Gulf region.

What distinguishes Itexus is its focus on security and regulatory alignment, offering PCI-DSS-compliant products and incorporating best-in-class standards such as ISO 27000, TLS 1.2 encryption, and Azure Key Vault integration.

Its neobank development capabilities include:

- Banking-specific UI/UX design

- Architecture and cyber security consulting

- API integrations and legacy modernization

- Full CI/CD setup and DevOps operations

- PCI-aligned secure development practices.

This firm has delivered standout projects in the neobanking space. For instance:

- Migrant neobank app that delivered in 13 months, this app supports P2P transfers, early wage access, virtual/physical card issuance, and microloans with no fees. Integrated with Mbanq for banking services and Alloy for KYC, it is projected to serve over 30 million users.

- Another success story involves an AI-driven wealth management platform developed for a top-20 global asset manager. After deployment, it halved advisor prep time and helped double post-launch sales, all within just eight months.

Clients consistently praise Itexus for its clear communication, agile mindset, and strong project execution. Though some reviews mention slight delays in early scoping stages, the overall experience is described as highly professional.

Ideal for: fintech startups and global financial institutions seeking secure, enterprise-grade neobank app development with strong compliance and DevOps foundations.

3. Appinventiv

Appinventiv was founded in 2015 and quickly scaled to a team of over 1,600 professionals across multiple regions. The company has delivered over 3,000 digital products across 35+ industries, with a strong focus on financial services. It has earned recognition from Deloitte’s Tech Fast 50 and is an AWS Advanced Tier Partner. For the NeoBank niche, Appinventiv has always built with a firm commitment to security and regulatory compliance, including PCI DSS, GDPR, and PSD2 standards.

Key services of Appinventiv that are related to Neobank development include:

- Custom banking and EMV app development

- Lending and risk management software

- Payment gateway integration

- Banking CRM systems

- Investment portfolio management solutions

This company has led several impressive neobank-related initiatives, such as:

- For a major international bank, Appinventiv built an AI-enhanced banking platform that automated ATM forecasting, customer service bots, and churn prediction. The result? A 35% reduction in manual effort and a 20% increase in customer retention.

- Another notable project involved building a mobile financial literacy app aimed at Gen Z users. Originally based on the Edfundo concept, the app gained traction as a smart money tool for children, helping its clients raise $500K in pre-seed funding.

Appinventiv’s clients appreciate their responsiveness, willingness to adjust to scope changes, and round-the-clock support. However, a few reviews highlight communication delays on complex projects.

Appinventiv is ideal for both startups and global enterprises looking to digitize financial services, launch neobank MVPs, or modernize legacy banking infrastructure with a partner that balances speed, compliance, and innovation.

4. Innowise group

Innowise Group is a prominent neobank app development company. Up to date, the company has completed more than 1,300 projects, many of which focus on digital banking. A standout feature of Innowise is Innobank – its customizable white-label banking platform. This solution allows neobanks to launch quickly while ensuring compliance with key standards like GDPR and ISO 27001.

Neobank development expertise includes:

- Fintech consulting and business analysis

- Web and mobile app design with modern UI/UX

- Integration of APIs and replacement of outdated core banking systems

- AI-powered fraud detection tools

- Cloud infrastructure setup, DevOps, and CI/CD pipelines

This company has a proven ability to deliver impactful results:

- In one project, they revamped the QA process of a digital bank, cutting bugs by 80% and tripling issue resolution speed.

- In another case, their AI fraud detection system reached 99.3% accuracy, performing 2.4× faster than the client’s legacy tool, minimizing false positives and improving user trust.

Clients frequently commend Innowise for its deep technical expertise, proactive communication, and solution-oriented approach. Some note minor coordination challenges across time zones, but overall, the company’s execution and reliability earn high marks.

Today, Innowise works with clients of all sizes – from startups building MVPs under $50K to enterprises investing over $600K in advanced neobank platforms.

5. DashDevs

DashDevs has established itself as a leading neobank app development company, known for its industry-specific expertise and ability to deliver customized fintech solutions. With a strong presence across global markets, the firm has earned the trust of major clients such as RakBank and PwC.

A major differentiator is FintechCore, DashDevs’ proprietary white-label banking platform. This solution enables clients to launch neobank apps in under three months, ensuring compliance and flexibility while minimizing time-to-market.

DashDevs also offers a wide range of services tailored to neobank development. These include:

- Open banking APIs and third-party integrations

- Support for issuing both virtual and physical cards

- AML and fraud detection systems

- Cross-border payment and currency exchange tools

- KYC/KYB verification solutions

- Full-scale payment orchestration platforms

DashDevs has completed several standout projects in the neobank space.

- For MuchBetter e-wallet, they delivered a feature-packed app in just four months with a $120K budget and a small team. The app now runs in 180+ countries, connects with over 300 merchants, and boasts 99.9% uptime.

- In another case, they helped build the UK-based Chip Savings App. It was finished in only three months and uses AI to automate saving decisions. Today, the app has around 500,000 users, each saving an average of £250.

Clients praise DashDevs for its sharp design, fast delivery, and strong technical skills. However, some have suggested more proactive communication across time zones.

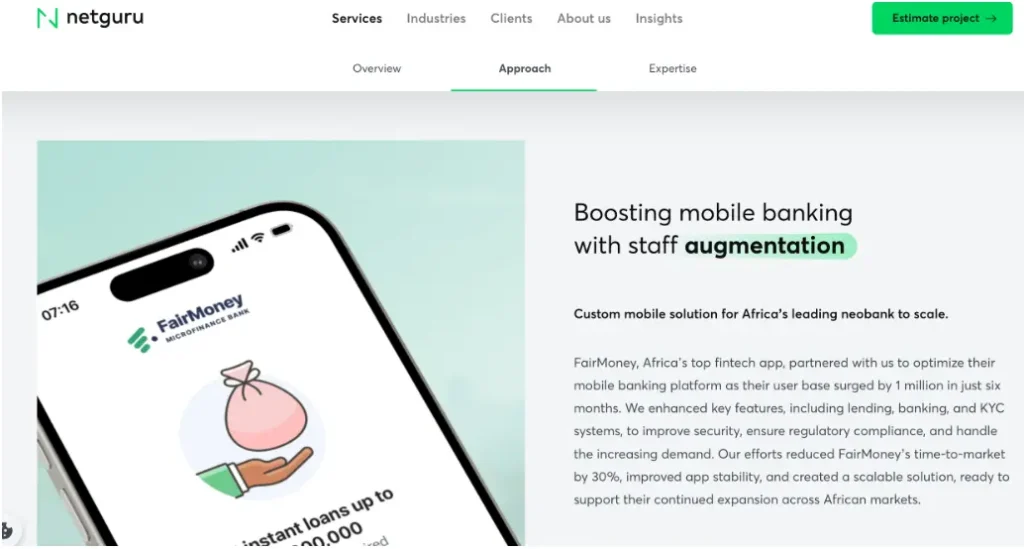

6. Netguru

Netguru, founded in 2008, is a recognized neobank app development company, consistently ranked in the Deloitte Fast 50 and FT1000 for Europe’s fastest-growing firms. The team specializes in fintech, with strong expertise in mobile banking, digital wallets, payment systems, and secure, compliant architectures. Their solutions follow GDPR, PSD2, and PCI-DSS standards, and support KYC and AML features when required.

For neobank clients, Netguru offers a full stack of services:

- Fast MVP design and rollout

- End-to-end app development

- Modern UI/UX with user-first thinking

- Help with upgrading or replacing legacy platforms

- Built-in fraud detection tools

- Staff augmentation

Some of their best-known neobank projects include:

- For the Candis invoice app, Netguru built a mobile MVP in just 16 weeks. As a result, invoice approval times dropped from days to under two hours. The app now serves around 2,400 users and processes 1,200 invoices per month.

- Another project, European Card, led to a secure mobile payments app. Users can send money with just a phone number. Within months, it reached over 50,000 downloads on Google Play and earned an impressive NPS score of 9.

Clients often praise Netguru’s technical strength, smooth collaboration, and flexibility. The only downside? Their rates tend to be higher than some local alternatives.

From agile startups like Solarisbank to global names like IKEA, UBS, and Volkswagen, Netguru has shown it can deliver for both newcomers and industry giants.

7. Cleveroad

Cleveroad has been delivering neobanking app development company since 2011. The company handles 25 to 40 projects annually, with fintech as one of its primary sectors. Their experience in digital banking is both wide and hands-on. Cleveroad helps banks and fintech firms launch online banking platforms, mobile wallets, trading apps, and digital onboarding tools. These systems usually integrate smoothly with existing core banking setups. That means clients can go digital without tearing down legacy systems.

For neobank app development, Cleveroad provides a full range of services:

- Clean and intuitive UI/UX design made for banking apps

- Full-cycle web and mobile app development

- Integration with APIs and third-party services

- Support for modernizing old systems

- Built-in tools for fraud detection and compliance

Here’s a real example from their work: Cleveroad recently worked with a Swiss investment bank. The goal was to improve its digital onboarding flow. The team built a full solution with automated KYC and digital account opening. Thanks to this, the bank saw fewer user drop-offs and better compliance.

Clients often describe Cleveroad as reliable and detail-oriented. Many praise their thorough testing, clear communication, and smooth project handling. Some did mention minor time zone challenges. But these were usually managed well and didn’t affect results.

Cleveroad is a great match for fintech startups building MVPs on budgets from $10,000. It also partners with established banks on long-term digital transformation projects.

8. CoreBlue

CoreBlue is a London-based neobank app development company founded in 2015. Although relatively smaller in scale, the company has already completed over 50 custom software projects. Many of these are in the fintech and banking space. Their client list includes well-known names like PayPoint and the Bank of Kigali.

CoreBlue is also serious about security and quality. The company holds ISO 27001 and ISO 9001 certifications. This helps build trust and shows their commitment to high standards.

They offer a full range of services for building neobank platforms, such as:

- Custom software development for financial services

- Native and cross-platform mobile apps

- Cloud systems and backend architecture

- Secure infrastructure setup and ongoing maintenance

What makes CoreBlue stand out is their clear communication and flexible process. Clients often mention how well the team uses tools like Slack and Zoom to stay on track. Their agile workflow makes it easy to adapt to changes. At the same time, their focus on quality ensures reliable results at every step.

CoreBlue is a great fit for fintech startups and fast-growing companies. They work best with teams looking for a hands-on, collaborative partner to bring their digital banking ideas to life.

9. SDK.finance

SDK.finance has been around since 2013. The company is known for building solid fintech infrastructure made specifically for digital banking and neobank platforms. They hold PCI DSS Level 1 certification, which is the highest standard for payment security. They’re also working toward SOC 2 compliance to strengthen trust even further.

One of SDK.finance biggest strengths is the scalable core banking engine. It can handle over 2,700 transactions per second. That adds up to more than 12.6 billion transactions per year. This makes SDK.finance a strong choice for high-volume fintech products and fast-growing neobanks.

SDK.finance’s neobank services cover everything clients need to launch and scale, including:

- White-label banking platforms

- Scalable core systems

- Full mobile and web app development

- UI/UX design focused on financial users

- Integration with third-party APIs

- Built-in AML and fraud detection

They’ve already delivered several successful neobank projects. For example:

- SDK.finance helped MPAY switch from a physical kiosk model to a fully digital wallet platform. By using SDK’s ledger layer and source code, MPAY launched faster and added features like multi-currency support. This improved both user satisfaction and adoption.

- Another major win was with Geidea, a large payment provider in the MENA region. Geidea used SDK’s system to process over 4 million transactions daily across 700,000 POS terminals. This improved real-time tracking and helped Geidea maintain its 75% market share in Saudi Arabia.

Clients often praise SDK.finance for its flexibility, scalability, and fast deployment. Still, a few reviews mention that customer support could respond more quickly.

SDK.finance is especially popular among startups and mid-sized banks. It’s a smart choice for teams looking to launch digital products without overspending.

10. Maticz

Maticz, founded in 2020, has quickly gained traction in fintech, serving 200+ clients across many countries. The team has built multiple neobank platforms from scratch and actively supports Web3, blockchain, and DeFi projects.

When it comes to neobank app development, Maticz offers a wide range of services, including:

- Custom-built neobank apps

- Open banking API integrations

- Virtual and physical card issuance

- Cross-border payments and currency exchange

- Crypto-friendly banking features

- Compliance-first design with strong data protection

They’ve completed some standout neobank projects with impressive results.

- For a European neobank, Maticz built a cloud-native MVP that onboarded 1 million users in just 6 months. It cut KYC time by 60%, maintained 99.98% uptime, and included features like biometric sign-up and automated DevOps pipelines

- In another project, the team developed a DeFi-based crypto wallet. It now handles over $75 million in monthly transactions. Users can complete KYC in just 2 minutes, use multiple currencies, and verify identity via tools like Jumio and Sumsub.

Clients love the quality of Maticz’s work. They often mention the clean code, polished UI, and how the final product exceeds expectations. Agile workflows and clear communication are also big pluses. On the flip side, a few clients suggest improving QA during MVP stages and offering better admin panel guides or extended post-launch support.

Maticz is a great choice for startups launching neobank apps, crypto-banking platforms, or fintech products that handle global payments.

White label vs custom neobank app development

When planning your neobank, one of the most critical decisions is whether to choose a white-label platform or a custom-built solution. Each approach has distinct advantages, depending on timeline, budget, and long-term goals.

White-label neobank development

White-label neobank solutions, such as ready-to-launch modules from vendors like Synodus, allow companies to deploy quickly, often in 3-5 months, at a starting investment of $50k-$80k.

- Pros: Rapid MVP launch, proven infrastructure, compliance-ready, lower upfront cost.

- Cons: Limited customization; full control depends on vendor roadmap.

Custom neobank development

Custom solutions are built from scratch, tailored to your unique UX, features, and technical requirements. These projects typically take 6–12 months and start around $120K–$200K.

- Pros: Complete control over architecture and UX, unique branding, long-term scalability.

- Cons: Higher cost, longer development cycles, more complex project management.

By understanding the differences in speed, cost, and flexibility, fintech startups and banks can make informed decisions about whether a white-label MVP or a custom neobank build best fits their strategy.

How to choose the right neobank app development partner?

Begin with a quick remote scan. Start with a remote scan focused on what your neobank project actually requires:

- Look for real fintech experience on their website or case studies: onboarding flows, KYC/AML handling, payments, ledgering, or banking API integrations.

- Check for compliance maturity, ensuring they explain ISO 27001, PCI DSS, or AML/KYC processes in practical terms, not just list badges.

- Review delivery transparency: do they provide sample sprint structures, team roles, or timelines from previous projects?

If most of these signals don’t align with your project’s scope, it may not be worth moving forward to a meeting. For vendors who pass, use the first meeting to validate depth. Ask them to show real evidence, not describe: a sprint break down from a similar fintech project, how they manage fraud and AML monitoring, and what a typical working week looks like. For cost, request a module-based estimate tied to your required features and ask how they control overruns.

Finally, shortlist vendors who provide evidence that directly matches your project’s complexity and constraints – not generic claims.

Wrapping up

Choosing the right path for your neobank, whether white label or custom, depends on your timeline, budget, and long term goals. Review the top vendors, weigh the trade offs between speed, customization, and compliance, and match them with what matters most for your business.

The key takeaway: there is no universal best company, only the one that fits your priorities and can help you launch, scale, and innovate confidently in the digital banking space.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.