A sneak peek into the fintech market

Over the last few years, adopting Fintech solutions, including online payment, digital banking, and many others, has skyrocketed among consumers and businesses to more than 64% globally. In leading regions such as China, the US, and India, the number of adoptions can go between 80% to 90%, accounting for a vast majority of the population.

Why do people love fintech so much? It’s convenient and fast. Consumers no longer want to deal with lengthy financial paperwork and customer service interaction.

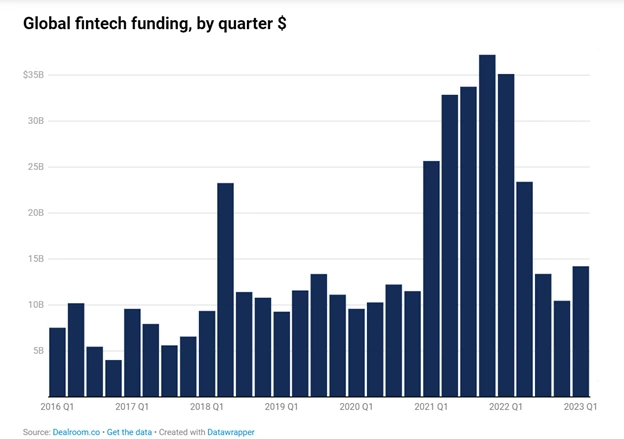

This trend pushed the birth of many fintech startups, with around 26,000 active companies worldwide. But many said fintech has passed its prime, mainly due to the decrease of investment between 2021 and 2022. Investors are more skeptical about new business ideas. There’s no longer a piece for anybody, but only for good ones.

In 2026, the fintech market will go through many turbulences, especially with the current recession.

As a fintech startup, what should you do in this crazy time:

- Find a good product market fit.

- Validate your business ideas instead of rushing into the funding round.

- Focus on building your product: development, UX/UI, and testing. You may want to slow down on Marketing spending.

As a financial business, it’s a good time to go for a customer-centric digital transformation strategy to maintain their engagement and retention.

Top fintech trends that will define the industry in 2026

1. Embedded finance

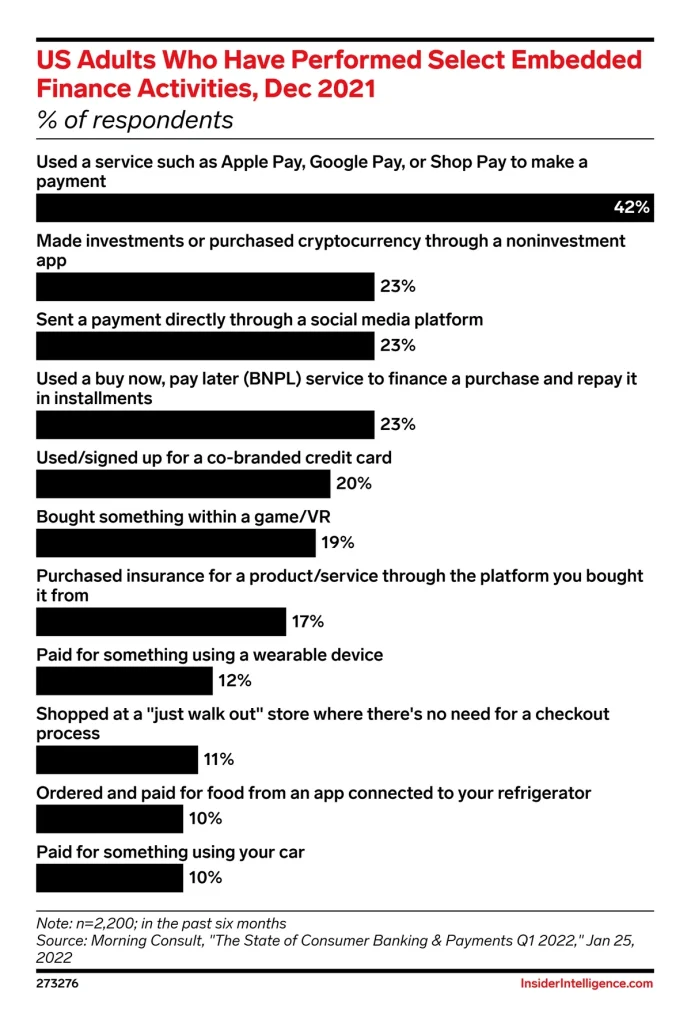

Embedded finance is financial services being integrated into non-financial websites and apps. It allows consumers to access credit and make transactions immediately instead of going to the bank or using online banking. Moreover, the embedded payments help shorten the checkout time by auto-filling all the necessary information, making shopping efficient yet secure.

This fintech trend is mostly driven by the customer’s desire for convenience. The search volume of embedded finance has accelerated by more than 600% from 2019 to early 2023. So far, embedded finance has reached $54.3 billion and is expected to grow to more than $248 billion by 2032.

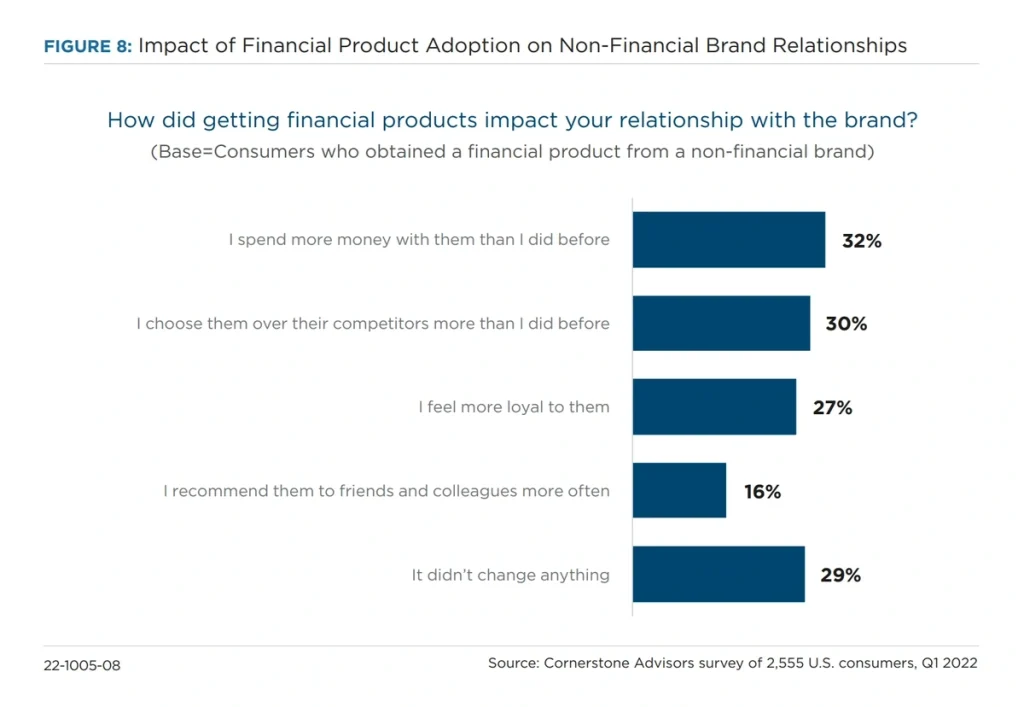

Bond, a fintech company, reports that one-third of consumers using embedded financial services of a brand are likely to spend more money. Also, they tend to stick with their familiar brand over other competitors.

2. BaaS & open finance transformation

In 2026, fintech is shifting from standalone neobanks to modular banking powered by Banking‑as‑a‑Service (BaaS) and open finance. According to Mordor Intelligence, the global BaaS market is expected to grow from USD 24.58 billion in 2025 to USD 60.35 billion by 2030, with a CAGR of 19.68%. Meanwhile, the open finance platform market, where banks and fintechs share data via APIs was valued at USD 25.91 billion in 2025 and is projected to reach USD 46.91 billion by 2030, growing at a CAGR of 15.20%.

For fintechs, this transformation means they can embed banking capabilities (accounts, payments, lending) into their products without building full banking infrastructure. It also enables secure data sharing, more personalized products, and faster innovation.

Open finance and BaaS together reduce costs, accelerate go-to-market, and let non-bank companies offer financial services seamlessly while leveraging regulatory momentum around data portability and API standards.

3. Sustainable & green fintech

Yep, you are not hearing it wrong. Financial go green?

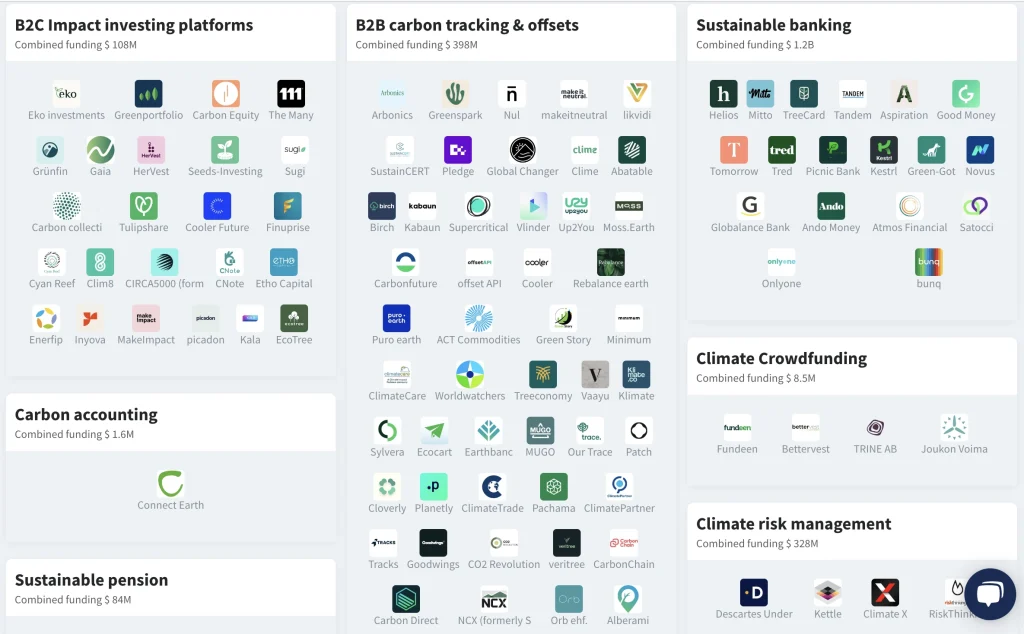

Corporations search for more environmentally sustainable solutions as the concern about climate change and preserving the environment reemerges. Fintech is quick to grasp the opportunity and is already developing an eco-friendlier version. They are known as “green fintech” and are expected to be among the leading fintech trends.

This technology may sound strange, but we have some examples to have a grasp of it:

Joro is a green fintech designed for customers who are heedful of their financial sustainability. The app will calculate the consumer’s carbon footprint based on purchasing data.

Stripe, one of the giant unicorns, recently started investing in sustainability with Stripe Climate. The app allows businesses to allocate their revenue to carbon removal initiatives.

Mastercard has also globally released its Carbon Calculator. The tool will give customers insights into their carbon footprints while offering solutions so that they can contribute to reforestation through smart spending decisions.

Although only 8% of fintech founders categorize themselves as “sustainable fintech,” investors are increasing their investment. In the first half of 2024, climate fintech startups in Europe and the U.S. raised USD 2.1 billion. BusinessGreen says this is almost the same as the amount raised the previous year, showing that investment in climate fintech remains strong despite tough economic conditions. On the other hand, green fintech start-ups are sprawling globally, and many can be found in Switzerland, Spain, Singapore, and Sweden.

4. Buy now pay later will increase despite the concerns

As its name implies, Buy Now Pay Later (BNPL) allows customers to pay a certain amount in advance and pay the remaining balance later.

This emerging fintech trend is often interest-free, thus appealing to many customers and eliminating complicated approval standards. With BNPL, businesses can have more sales and attract more customers.

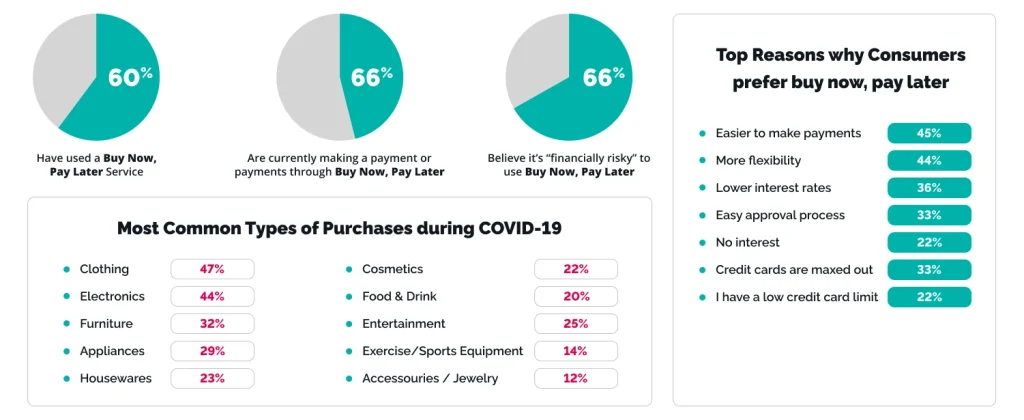

A report by TechMagic has pointed out that 60% of customers surveyed have used BNPL services. During the pandemic, this trend of fintech has helped struggling households complete their purchases of clothing, electronics, and many other essential items. Most eCommerce sites now include BNPL as one of their main payment methods or work on BNPL’s implementation.

Despite BNPL’s merits, there are several concerns that most people underrate or neglect. Customers either overspend their accounts or don’t understand their situation. A survey from The Ascent points out that 17% of BNPL customers are likely to be late on their payments, and 18% are likely to do that. Another survey from Accrue Savings showed that 28% of Gen Z and 22% of Millennials often overspend, and 44% of consumers who have used BNPL have already missed a payment.

This has created a niche market for Save Now, Buy Later (SNBL) – a fintech model that recently caught the attention of investors in late 2021 till now.

This model is nothing new compared to traditional savings in banks. But for a long time, banks haven’t found a way to monetize it.

SNBL works directly with services or product providers, allowing the customers to put aside monthly savings to receive discounts or good interest rates from the providers. This model is promised to help sellers deal with abandoned carts and drive more conversions. Meanwhile, SNBL will receive a percentage from every purchase. Multiply is the first SNBL platform with 250K+ active users in 2 years since funding.

5. Using regtech for accuracy and efficiency

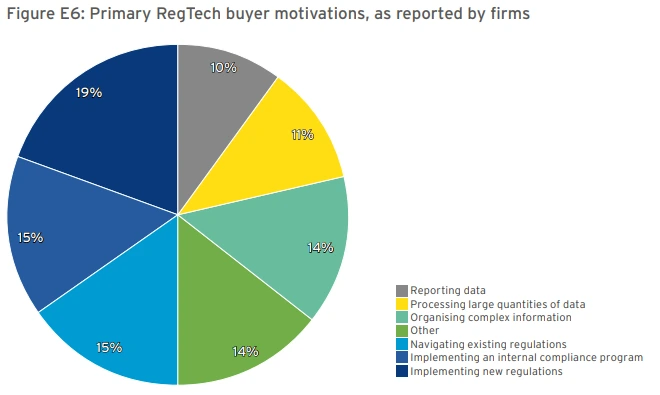

Regulation technology, or regtech, is a valuable tool for financial institutions to manage complex databases while abiding by the law. Regtech utilizes cloud technology, machine learning, and big data analytics to detect and prevent risks. It connects and facilitates communication between organizations and regulatory agencies.

Thanks to regtech, you can use data without disruption, compliance is monitored, and financial crimes can be traced. There are positive signs and predictions that the regtech industry will thrive. Junipe Research predicts a 200% growth between 2022 and 2026.

6. AI‑driven intelligent automation / LLM workflow automation

By 2026, fintech automation is shifting from rule-based RPA and template-driven low-code platforms to AI-driven intelligent automation powered by LLMs, autonomous agents, foundation models, and workflow orchestration. Industry reports show the Intelligent Process Automation (IPA) market reached $14.55B in 2024 and is projected to scale to $44.74B by 2030, driven by AI-native operations and LLM-first architectures.

What changes is not just speed, it’s capability.

LLM agents can automate high-judgment workflows previously impossible for RPA, including:

- KYC/AML compliance (risk scoring, adverse media checks, policy reasoning)

- Document understanding (contracts, financial statements, bank data extraction)

- Customer support automation with multi-turn reasoning

- End-to-end onboarding & case management across core banking systems

- Regulatory reporting and transaction monitoring using AI-reasoning chains

This enables 50–70% faster processing, reductions in operating cost, and near-real-time scalability—especially for neobanks, lenders, and payments platforms.

However, this new stack also requires AI governance, including model risk management (MRM), audit trails, explainability, data lineage, and human-in-the-loop controls. Without them, LLM agents can introduce compliance gaps that regulators increasingly monitor—especially under EU AI Act, MAS FEAT, and US OCC AI guidelines.

7. AI-driven fraud, deepfake attacks & real-time AML

Financial criminals are now using AI to scale attacks faster than ever. Deepfake videos to bypass KYC, synthetic identities to open accounts, and automated bots to test stolen credentials in seconds.

According to Business Wire, deepfake attacks strike every five minutes, making 244% surge in digital document forgeries in 2024.

Because of this, fintech companies need fraud tools that work in real time and learn from behavior, not just static rules. In 2026, the industry is shifting to AI fraud detection, behavioural biometrics, and real-time AML engines that stop suspicious actions as they happen.

8. Advanced digital identity & biometric authentication (face, voice, behavioural)

Voiceprint alone is no longer reliable, as deepfake audio can easily fool single-channel biometric checks. That’s why fintechs are adopting multi-modal biometrics, combining face recognition, voice, liveness detection, and behavioral patterns like typing rhythm, mouse movements, and device usage. This layered approach not only strengthens security but also speeds up onboarding without disrupting the user experience.

The market reflects this shift: according to Mordor Intelligence, the global Biometric & Passwordless Authentication market is expected to grow from USD 26.55 billion in 2025 to USD 57.71 billion by 2030, with behavioral biometrics expanding at a CAGR of ~17.8%.

When moving to multi-layer verification, fintechs make it much harder for fraudsters to impersonate users. In practice, studies show that combining multi-modal biometrics with AI can reduce account takeover fraud by up to 72%, demonstrating a highly effective way to protect customers while keeping onboarding smooth.

9. Also Consider: On-demand pay as one of your features

On-demand pay or earned wage access is a type of payment that allows workers to request part of their paycheck before the next pay period.

On-demand has helped employees deal with unexpected expenses and relieved some financial stress. A survey on working individuals in the US and UK showed that 35% of people were in financially stressful situations and could not pay expenses between pay periods.

The same survey also points out that about 20% of people are willing to use the on-demand pay option if it is available. ADP’s statistics report that 80% of workers are ready to take a job that provides on-demand pay over one that does not offer it, making it a notable fintech future trend.

You don’t need a whole app to start with On-demand pay. Instead, developing it as one of the features, especially for banks that focus on individual and businesses clients.

10. GenAI & agentic AI for decisioning and predictive finance

AI in fintech has moved far beyond basic machine-learning models. In 2026, companies are using GenAI and Agentic AI to automate tasks end-to-end: compiling customer documents, running credit analysis, generating recommendations, and even handling customer support.

A 2025 EY‑Parthenon survey shows 77% of banks have launched or tested GenAI, while 31% are using fully agentic models. Analysts at KPMG estimate that GenAI could generate $200–$340 billion in annual value for global banking. IBM also note that what began as tactical pilot projects in 2024 is now becoming central to strategic operations, with many banks actively deploying agentic AI.

For fintechs, this shift means faster customer onboarding, automated underwriting, smarter support, and lower operating costs, but also critical challenges around governance, bias, and explainability.

11. Tokenization & digital Assets (RWA, CBDC, Stablecoin)

Fintech is moving beyond traditional DeFi toward tokenizing real-world assets (RWA), adopting CBDCs, and using stablecoins for digital finance. The RWA tokenization market has grown from USD 5 billion in 2022 to USD 24 billion by mid-2025 (~380% increase), while fiat-backed stablecoins reached USD 224.9 billion in April 2025.

Tokenization allows fintechs to turn illiquid assets like bonds, real estate, and private credit into tradeable blockchain tokens, enabling 24/7 trading, lower costs, and faster settlement. Institutional interest is rising, as banks and funds see tokenized assets as a way to improve capital efficiency and manage risk. Combined with stablecoins, RWA tokenization powers new on-chain products, such as lending, collateral, and treasury solutions.

At the same time, fintechs must ensure strong custody and governance for high-value tokenized assets, making tokenization both a powerful opportunity and a responsibility for digital finance in 2026.

12. Real-time payments (RTP)

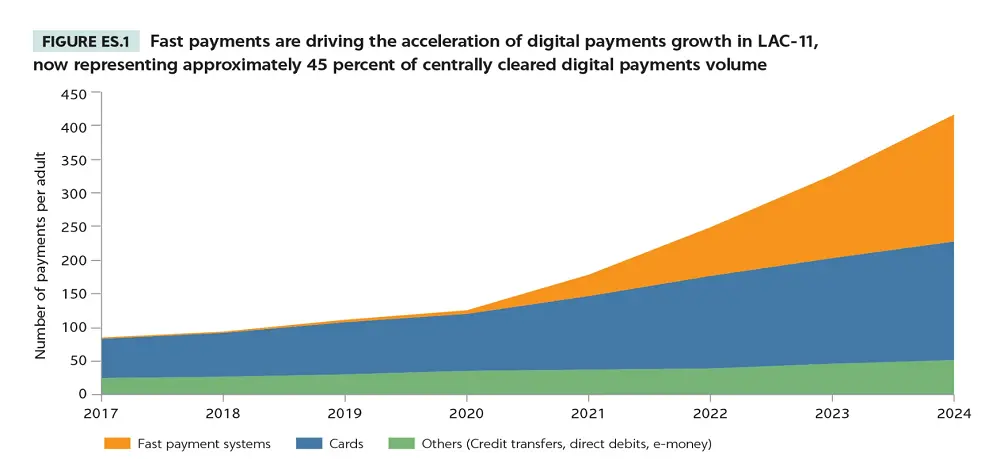

Real-time or instant payments have become mainstream and are scaling rapidly worldwide. Unlike traditional batch transfers that can take hours or days, RTP allows funds to move instantly between accounts, 24/7, 365 days a year. Global fast-payment transactions have surged from ~620 million in 2017 to ~ 79.8 billion in 2024, showing mass adoption across regions.

This shift changes how products are built and monetized. Instant settlement unlocks new use cases (real-time payouts, merchant settlements, A2A transfers) and improves cash flow for both businesses and consumers.

But it also raises the bar for operations: real-time fraud detection, liquidity management, and instant reconciliation become mandatory. As instant rails expand and integrate with tokenized settlement layers, RTP will remain a core infrastructure trend shaping the next generation of payments.

Fintech technologies that might be downtrend

Not all fintech trends stay relevant forever; some are losing their traction or disappearing from the game. There are several fintech trends that are highly expected to become irrelevant soon.

- Covid-19 initiatives: Now the world has overcome Covid-19, and restrictions have been loosened, Covid-19-centric projects are no longer relevant. Most populations are no longer inclined to shop online solely. However, the efficiency and convenience provided by embedded finances will allow fintech products to stay alive.

- Cryptocurrency exchange: Following the bankruptcy of FTX crypto exchange and cryptocurrency cost inflation, the public has lost interest in digital currency. Investors now recognize that any money in pure cryptocurrencies would likely be lost and retreat from the unpredictable market. 2026 is expected to be the year crypto exchanges are reevaluated, and the fintech industry will be reshaped. While the future of crypto is uncertain, this is not the best time to start investing.

- (Un)stable coins: the question about a stable coin’s lifespan is yet to have a finite answer. The interest rates might get hiked, causing the market to cut back on everything except the essential investments, of which stablecoins are not one. If investors lose trust in them, stablecoins may crash. A stablecoin crisis might cause catastrophic consequences for the bond market and other financial businesses.

Wrapping up

From our analysis of the top 12 fintech trends, we hope you get a clearer picture of the potential ups and downs of the market. During this turbulent period, it’s a great time to dive deep into research and find opportunities that potentially arise. Nevertheless, the success of a Fintech product lies in its core value and application performance.

More related posts from our Fintech blog you shouldn’t skip:

- Top 15+ best Fintech apps you must check out in 2026

- Fintech super apps: Exploring features, benefits, and trends

- Fintech app: The ultimate guide for developers

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.