With the global rise of fintech and digital payment adoption, understanding these cost factors upfront helps startups and enterprises avoid overspending and build scalable products.

This guide gives you a full breakdown of E-wallet app development cost, including average pricing by region, key cost drivers, and real-world examples, so you can budget confidently and choose the right development approach.

How much does E-wallet cost? (Overview)

E-wallet app development costs can differ a lot, starting at $10,000 for a simple MVP and going beyond $250,000 for advanced versions. Check the table below for more specifics:

| App type | Key features | Estimated cost | Development time |

|---|---|---|---|

| MVP (Minimum Viable Product) | – User registration & authentication – Basic wallet functionality (Add/Withdraw Funds) – Peer-to-peer (P2P) transfers – Transaction history – Basic security measures (e.g., PIN, password) | $10,000 – $30,000 | 2 – 4 weeks |

| Basic app | – All MVP features – Bill payments & mobile recharges – Bank account integration – Push notifications – Enhanced security (e.g., Two-factor authentication) | $25,000 – $50,000 | 2- 4 months |

| Medium app | – All basic app features – Multi-currency support – Budgeting tools & expense tracking – QR code payments – Loyalty programs & cashback offers – Advanced security (e.g., Biometric authentication) | $50,000 – $100,000 | 6 – 9 months |

| Complex app | – All medium app features – Cryptocurrency integration AI-powered financial insights – Investment & savings modules – Regulatory compliance – Features (e.g., KYC, AML) – 24/7 customer support chatbot – Admin dashboard with analytics | $100,000 – $250,000+ | 9–12+ months |

Key factors influencing E-wallet app development cost

Next, we’ll explore each component in depth to understand how it impacts the overall e-wallet mobile app development cost.

Features

The e-wallet mobile app development cost largely depends on the features included. Apps with standard functionalities such as user registration, balance viewing, and P2P transfers are typically more budget-friendly.

However, adding advanced fintech app security features (like biometric login, real-time fraud detection, offline payments, or support for multiple wallets and currencies) can drive up the cost. These enhancements require robust backend systems, tighter security protocols, and thorough testing.

Moreover, integrating even one high-end feature can extend development time and demand specialized skills, which contributes to higher initial investment and ongoing maintenance expenses.

Choosing the right features to match your business goal and budget is crucial. We’ve outlined the average development costs for popular e-wallet app features as below:

| Feature | What to have | Estimated cost |

|---|---|---|

| User authentication & management | – User registration & login – User authentication | $5,000 – $12,000 |

| Core wallet features | – Wallet management – Peer-to-peer transfers – Transaction history | $15,000 – $35,000 |

| Payment methods | – Payment integration – Bill splitting – QR code payments – NFC payments | $15,000 – $30,000 |

| Security features (basic) | – User authentication security – Data encryption – Session management | $15,000 – $20,000 |

| Admin & notifications | – Admin dashboard, – Notifications | $10,000 – $15,000 |

| Advanced features | – Virtual cards, – Cryptocurrency support, – Advanced analytics | At least $15,000 |

Type of E-wallet

The type of e-wallet you choose has a direct impact on development cost, as each requires different features, integrations, and security measures. Here’s a quick overview:

- Closed wallet: Operates within a single ecosystem, minimal integrations, and the simplest to develop. Costs are generally low.

- Semi-closed wallet: Usable for merchants and users but without direct bank connections. Requires more integrations and moderate development effort.

- Open wallet: Connects directly to banks for full payment capabilities. Higher technical complexity and stricter compliance make costs higher.

- Crypto wallet: Supports blockchain-based transactions, wallets, and smart contract integrations. High security and regulatory requirements drive the cost to the top.

Here’s a quick glance to see how each e-wallet type affects integration complexity and development cost:

| Type of E-wallet | Integration complexity | Cost impact |

|---|---|---|

| Closed wallet | Low | Low |

| Semi-closed wallet | Medium | Medium |

| Open wallet | High | High |

| Crypto wallet | Very high | Very high |

Third-party integrations

When building an e-wallet app, integrating third-party services like payment gateways, KYC/AML services, or banking APIs, requires additional development work. Developers need to set up workflows, manage varying data formats, and ensure that each integration meets strict security and compliance standards. This requirement can extend the development timeline by several weeks and significantly increase initial costs.

Beyond development, the integrations come with ongoing fees. For example, KYC providers often charge $1–$3 per verification, while payment gateways typically take a 2–3% cut per transaction. As your user base grows, these costs can rise quickly.

Plus, integrations requires regular maintenance, updates, and monitoring to stay aligned with API changes or regulatory updates. The more you add, the more time and money it takes to keep things running smoothly.

These are some of the most common third-party services integrated into e-wallet apps, along with their average pricing:

| Integration type | Description | Estimated cost |

|---|---|---|

| Payment Gateways | Integrating services like Stripe, PayPal, or Square for processing transactions. | $5,000 – $20,000+ |

| Banking APIs | Connecting with banks to enable features like balance checks and fund transfers. | $10,000 – $30,000+ |

| KYC/AML Services | Implementing Know Your Customer and Anti-Money Laundering checks through services like Jumio or Onfido. | $5,000 – $15,000+ |

| Push Notification Services | Using platforms like Firebase Cloud Messaging or Twilio to send real-time alerts to users. | $2,000 – $5,000+ |

| Analytics Tools | Incorporating tools like Google Analytics or Mixpanel for user behavior tracking and insights. | $3,000 – $8,000+ |

UI/UX design requirements

UI/UX design has a significant impact on e-wallet app development cost. If you go with a simple, read-made design style, it may take only 80 to 120 hours. However, when a more customized design is required, featuring branded visuals, interactive flows, and polished transitions, the workload can increase to 200 to 300 hours.

Sensitive screens like PIN entry, biometric login, and transaction confirmation often require 40 to 60 extra hours due to the need for enhanced security and regulatory compliance.

A well-structured design process also involves 2 to 3 rounds of user testing and iteration. Each round takes 5 to 7 working days, contributing to higher cost.

Furthermore, if the app is designed separately for iOS and Android without a shared design system, design time may nearly double.

Moreover, involving multiple specialists, such as a UX researcher, UI designer, and motion designer, can add $1,000–$5,000 to the project, depending on the level you need:

| Role | Junior | Mid-level | Senior |

|---|---|---|---|

| UX Designer | $25 – $50 | $50 – $75 | $75 – $100+ |

| UI Designer | $20 – $40 | $40 – $60 | $60 – $90+ |

| UX Researcher | $44 – $53 | $53 – $62 | $62 – $72+ |

Platform selection

Platform selection directly affects development time, team structure, and long-term maintenance.

If you choose native development for iOS and Android, you’ll need to maintain two separate codebases. This usually involves two different teams, which doubles both workload and cost. However, it offers the best performance, strong security, and full access to native features like Apple Pay, biometric login, and NFC.

In contrast, cross-platform frameworks like Flutter or React Native use a single codebase for both platforms. This can reduce development time and cost by 30–40%. It’s ideal for MVPs or apps with basic features. Nonetheless it may not perform well with complex native integrations or high-security tasks, common requirements in e-wallet apps.

Web apps are even more cost-effective, often 50–70% cheaper than native development. They are faster to build, but lack key mobile features like push notifications, offline access, and native payments. Therefore, they are best suited for admin dashboards or limited-use interfaces, not full e-wallet functionality.

See the table below for specific figures:

| Platform | Estimated cost |

|---|---|

| Native iOS/Android | $70,000 – $90,000 |

| Cross-platform | $40,000 – $60,000 |

| Web app | $30,000 – $45,000 |

Development team

When planning your e-wallet app development budget, the location of your development team is the single most impactful factor on the overall cost. The same app can cost 3 to 4 times more depending on whether it’s built in the US or Southeast Asia.

- US, UK, and Western Europe: Development in these regions comes with the highest labor rates and strict compliance standards, often driving costs to 3-4x higher than elsewhere. Building advanced fintech apps here can easily exceed $150,000 – $300,000.

- Eastern Europe, India, and Southeast Asia: These regions offer highly skilled fintech developers at a fraction of the cost. Company can save up to 70% of totla expenses while still ensuring security, scalability, and quality delivery – making them ideal for startups and growing fintechs partnering with an experienced E-wallet app development company.

You can check the table below for a clearer comparison:

| Region | Basic e-wallet app | Advanced e-wallet app |

|---|---|---|

| US/UK/Western Europe | $60K – $120K | $150K – $300K |

| Eastern Europe/India/SEA | $20K – $50K | $70K – $150K |

Key takeaways:

- Regional cost differences are the largest driver of your development budget

- Outsourcing to cost-efficient regions can save 50-70% without sacrificing quality

- Focus on where your team is located before fine-tuning team size or experience level

Other hidden costs

Beyond core development, several hidden costs can significantly increase your total e-wallet app development cost. Here’s what you should plan for:

- Infrastructure & scalability: As your user base grows, your backend must handle higher loads reliably. You’ll need to invest in cloud hosting, database services, server maintenance, and disaster recovery. These are recurring costs that can range from a few thousand to over $10,000 per month, depending on traffic and system complexity.

- App store deployment fees: To launch your app, you’ll pay $99 per year for Apple and a $25 one-time fee for Google Play. Beyond that, you may need to budget for App Store Optimization (ASO), visual assets, and time spent navigating app review or resubmission processes, especially when policies change.

- Legal & compliance costs: E-wallet apps must comply with financial and data regulations such as KYC, AML, PCI DSS, and GDPR. This often involves legal consultation, integrating verification systems, and passing formal audits. Depending on your target markets, these costs can add $10,000 to $50,000 or more to your budget.

- Ongoing maintenance & support: After launch, regular updates, bug fixes, performance monitoring, and customer support are necessary. These ongoing services typically cost 15–20% of your initial development budget annually and require a dedicated support team.

- Marketing & user acquisition: Building the app is only step one, you also need to attract users. A strong launch and ongoing marketing strategy can take up 20–30% of your total project budget. Depending on your channels, Customer Acquisition Cost (CAC) usually ranges from $10 to $50 per user in the fintech space.

Examples of E-wallet development cost

To show how the above factors affect costs, here are three real-world examples: PayPal, Apple Pay, and Venmo. Each reflects a different level of functionality and infrastructure.

PayPal

Estimated cost: $150,000 – $300,000+

Key features:

- Multi-currency support

- Peer-to-peer (P2P) transfers

- Bank account and card linking

- NFC payments

- Biometric authentication

- AI-based fraud detection

- Premium UI/UX design

Development timeline: Approximately 12–18 months

PayPal is one of the most expensive digital wallet to develop because of its global scale and technical complexity . It works in over 200 countries, supports 25+ currencies, and handles real-time currency conversion, which requires a powerful and scalable backend.

It also integrates with hundreds of banks and payment networks like Visa and Mastercard, each with its own security and technical requirements. On top of that, PayPal must comply with global regulations like PCI DSS, GDPR, AML, and KYC, and uses AI to detect fraud in real time.

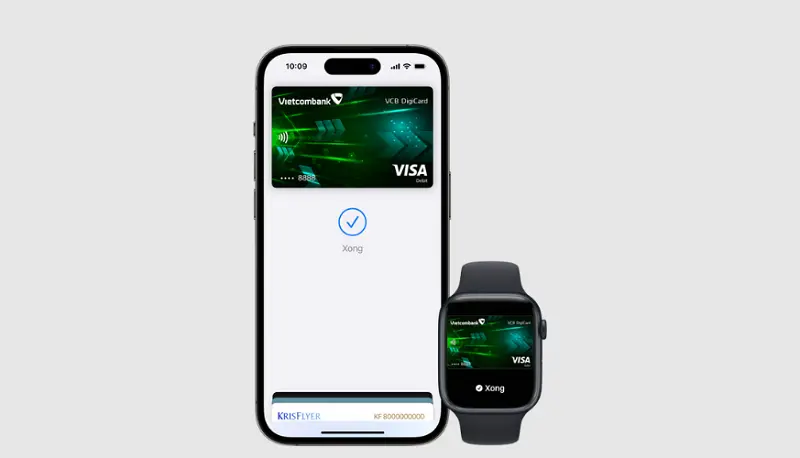

Apple Pay

Estimated cost: $50,000 – $300,000

Key features:

- NFC-based contactless payments

- Device-specific security (e.g., Secure Enclave)

- Biometric authentication (Face ID, Touch ID)

- Integration with Apple Wallet

- Tokenization for secure transactions

Development timeline: Approximately 9–12 months

Apple Pay is costly to develop as it focuses heavily on security, hardware integration, and smooth performance. It uses tokenization and encryption, while payments are confirmed with Face ID or Touch ID for extra protection.

The system also depends on special hardware like the Secure Enclave, which makes development and testing more complex. To reach this level of safety and user experience, developers must spend a lot of time building and fine-tuning the system.

It also needs to follow strict financial rules and work quickly across different devices. All of this adds to the time and cost of development.

Venmo

Estimated cost: $75,000 – $175,000

Key features:

- Social feed for transactions

- P2P payments

- Bank account and card linking

- Transaction history

- Push notifications

- Optional cryptocurrency support

Development timeline: Approximately 6–9 months

Venmo costs more to build than a basic e-wallet app because it combines money transfers with social features. This e-wallet has a real-time social feed where users can see, like, and comment on each other’s transactions.

Even though it only works in the U.S., it still needs secure systems for linking bank accounts and cards, sending and receiving money instantly, and supporting cryptocurrency. These features require a strong, reliable infrastructure.

Additional features like transaction history, push notifications, emojis, and privacy controls further increase development and ongoing maintenance costs.

E-wallet app development cost breakdown by phase

Another way to plan your e-wallet app development cost is by breaking it down into key phases, as outlined below:

Planning & research

This is the initial strategy phase where you define the app’s purpose, target users, key features, and technical roadmap. It ensures that the project starts on the right track.

Estimated cost: $5,000 – $10,000

Timeframe: 2–4 weeks

Cost drivers:

- Business analysis and documentation

- Market and competitor research

- Technical architecture and feature list creation

- Initial team consultation (PM, developers, architects)

Cost-saving tip: You can reduce costs by doing preliminary market research yourself using free tools (like Google Trends, competitor apps, or Statista’s public data). Keep your feature list lean, define a Minimum Viable Product (MVP) to avoid overbuilding early.

UI/UX design

This stage delivers the look and feel of your app across platforms.

Estimated cost: $10,000 – $20,000

Timeframe: 3–6 weeks

Cost drivers:

- Designer fees (hourly or per screen)

- Prototyping and design tools (Figma, Sketch, Adobe XD)

- Cross-platform layouts (iOS, Android)

- User journey flows and usability testing

Cost-saving tip: It would be better to use pre-made UI kits or design systems (e.g., Google Material, Apple Human Interface) to speed up design work. Limit design to key screens first and expand only if necessary.

Development (Frontend + Backend)

This is the core stage where your app’s features and backend systems are built.

Estimated cost: $30,000 – $100,000+

Timeframe: 3–6 months

Cost drivers:

- Developer salaries or outsourcing fees

- Payment gateway and bank API integrations

- Secure backend (encryption, authentication, data handling)

- Multi-platform development (iOS, Android, web)

- Infrastructure setup (cloud services, databases, DevOps)

Cost-saving tip: You can lower your development budget significantly by working with Synodus, a provider known for offering high-quality solutions at a more affordable cost. Their agile teams specialize in e-wallet development and follow a streamlined, transparent workflow. This allows you to save both time and money while avoiding unnecessary complexity. If you’re looking for a partner that delivers efficiency without the high price tag, Synodus is a practical and budget-friendly choice.

Testing & QA

Here, you can ensure your app works reliably and securely.

Estimated cost: $5,000 – $15,000

Timeframe: 2–4 weeks

Cost drivers:

- Manual and automated test case creation

- Performance and security testing tools

- Cross-device and OS testing

- Bug fixing and retesting cycles

Cost-saving tip: You should automate repetitive test cases early using open-source tools (e.g., Selenium, Appium). Plus, focus testing efforts on high-risk features like payments and login first, before testing every minor detail.

Deployment

In this phase, your app is prepared and submitted to app stores (Apple App Store and Google Play) for users to download.

Estimated cost: $2,000 – $5,000

Timeframe: 1–2 weeks

Cost drivers:

- App store account fees (Apple: $99/year, Google: $25 one-time)

- Preparing store assets (screenshots, privacy policy, descriptions)

- Backend server configuration and domain setup

- Last-mile compliance and approval processes

Cost-saving tip: You can avoid delays (and extra cost) by carefully following Apple and Google’s submission guidelines. Use DevOps automation to simplify future updates and deployments.

Maintenance & updates

Once your app is live, you need to keep it running smoothly!

Estimated cost: $10,000 – $20,000 per year

Timeframe: Ongoing

Cost drivers:

- Developer time for bug fixes and improvements

- Server and infrastructure costs

- Updating for new OS releases and device types

- Adding features based on user feedback

- Customer service support (email/live chat)

Cost-saving tip: You should monitor your app’s performance using tools like Firebase Crashlytics or Sentry to proactively catch and fix issues. Moreover, schedule updates quarterly instead of reactively fixing small bugs one at a time – this lowers long-term cost.

These phases typically align with how overall fintech app development costs are structured – from discovery to post-launch optimization.

How to optimize your e-wallet app development cost

By now, you already understand what drives your E-wallet app development cost, from features and security to team location and project complexity. But optimizing cost isn’t just about finding the cheapest developers. It’s about making strategic decisions that help you balance budget, quality, and time to market.

Let’s break down the most effective ways to reduce E-wallet development cost while keeping your app scalable, compliant, and future-ready.

1. Choose the right development approach

Your choice between custom development and white-label E-wallet solutions directly impacts cost, flexibility, and delivery time.

- A custom E-wallet app offers full control over design, security, and integrations – ideal for banks or enterprises with long-term visions.

- A white-label or hybrid approach reduces development time by up to 40–60%, letting startups validate their MVP faster and save initial costs.

If you plan to scale later, start with a hybrid model: use a white-label foundation for essential wallet features (onboarding, transfers, transaction tracking) and customize high-value modules like loyalty rewards, biometric authentication, or crypto integration when the user base grows.

2. Leverage regional cost advantages

Development costs vary dramatically by region and so does fintech expertise. Hiring E-wallet developers in the US or Western Europe can cost 3–4 times more than teams in Vietnam, India, or Eastern Europe, while offering comparable (or even better) technical quality.

Outsourcing or offshoring to a reputable fintech software company helps reduce costs related to infrastructure, salaries, and compliance processes.

- Offshore teams (e.g., in Vietnam or India) deliver the strongest cost efficiency.

- Nearshore teams (e.g., in Eastern Europe) offer cultural and timezone alignment.

To maximize results, choose partners who specialize in financial software development, understand KYC/AML compliance, and provide transparent project management frameworks.

3. Prioritize your MVP and roadmap

Not every E-wallet needs advanced AI-powered analytics or in-app investing features at launch. Start with a minimum viable product (MVP) focused on essential modules: digital payments, user onboarding, transaction history, and security layers (e.g., 2FA, biometric login).

Once the MVP is validated, you can add personalized insights, loyalty programs, or cross-border payment features in later phases.

This phased approach helps manage cash flow and aligns development with actual user demand.

4. Optimize team structure and collaboration model

A lean, well-structured development team can save you significant time and money.

- Dedicated development teams are ideal for long-term builds where consistent expertise matters.

- Fixed-price projects work well for short-term or well-defined scopes.

- Agile outsourcing models let you scale up or down flexibly as priorities change.

Ensure your team includes key roles such as Fintech business analyst, UI/UX designer, and QA engineer who understand both user experience and regulatory compliance, reducing back-and-forth later in development.

5. Partner with experienced fintech developers

Ultimately, the most effective way to control E-wallet app development cost is to work with a tech partner who understands fintech – not just code.

Experienced vendors bring ready-to-use frameworks, proven security protocols, and compliance expertise, allowing you to save both time and money.

With over 250 fintech specialists and experience delivering 30+ wallet and payment projects, Synodus helps startups and financial institutions build secure, scalable, and cost-efficient E-wallet apps.

By combining custom development flexibility with regional cost advantages from Vietnam, Synodus delivers world-class quality at optimized costs – from MVP design to full-scale rollout.

Wrapping up

Developing an e-wallet app in 2026 can cost from $15,000 to over $300,000. This cost reflects what you want your app to do, basic transfers, bill payments, crypto support, or advanced security.

To decide your e-wallet app development cost, start by defining your app’s core goal. Are you building a quick MVP to test the market, or a full-featured app ready for scale? Each feature adds time, complexity, and cost.

Don’t aim for everything at once. Start small, with essential functions, then upgrade based on real user needs. This approach keeps your costs controlled, and your product focused.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.