DeFi is stabilizing after a volatile cycle, with TVL approximately $130B. Founders today are building products around core primitives such as lending, DEX/AMM, liquid staking, RWAs, perpetuals, and cross-chain applications.

As more capital moves on-chain, the complexity of launching a DeFi product increases. Founders face challenges such as smart contract vulnerabilities, audit bottlenecks, liquidity bootstrapping, regulatory uncertainty, infrastructure costs, and the difficulty of acquiring users in a competitive market.

This context makes choosing the right DeFi development company more critical than ever, not just for delivery speed, but for long-term security, compliance, and scalability.

In this post, we will guide you through the key criteria of a good vendor and highlight some of the leading DeFi development companies you can evaluate for your upcoming project.

What to look for in a good DeFi development company

Even if two vendors look similar on paper, the real difference shows when you evaluate them across these criteria:

1. Technical competency & security mindset

What to look for:

- Proven experience with Solidity, Rust, smart contract frameworks, EVM-compatible chains, Layer 2 solutions (Optimism, Arbitrum).

- A clear smart contract security checklist including formal verification, fuzzing, static analysis, peer review, penetration testing.

- Previous work with audits (Certik, OpenZeppelin, PeckShield, Trail of Bits).

- Knowledge of cross-chain bridge security, oracle integration risks, and gas optimization.

Red flag example: A vendor says “we build secure smart contracts” but cannot show past audits or explain common vulnerabilities like re-entrancy or oracle manipulation.

2. Actual experience with DeFi projects

What to look for:

- Real DeFi case studies: lending, staking, AMM, DEXs, synthetic assets, yield aggregators, token issuance, wallets, oracles.

- Performance metrics: TVL, active users, audited contracts, on-chain transaction volumes.

- Multi-chain deployment experience: Ethereum, Solana, Polygon, EVM-compatible L2s, bridges.

Good example: A vendor can show:”We built a lending protocol for X startup, reached 25,000 users, and achieved 0 critical vulnerabilities post-audit.”

Weak example: A vendor only built NFT marketplaces or Web2 apps, not DeFi.

3. Their product thinking, not just coding

What to check:

- Do they challenge your ideas or just say “yes”?

- Can they help refine tokenomics, yield strategy, staking mechanics, liquidity pools, or compliance workflows?

Good example: “They advised us to switch from over-collateralized loans to isolated lending pools, improved liquidity by 32%.”

4. Speed, process & communication

Startups die because of slow execution, not tech.

What to check:

- Their development process: sprint length, weekly demos, CI/CD pipelines, QA cycles for smart contracts, audit timelines.

- Their communication: Slack, Notion, Jira.

Good example: Weekly demos where you see real progress every 7 days.

Red flag: Vendors who say “we’ll update you at the end of the month.”

5. Compliance & risk awareness

What to look for:

- Knowledge of on-chain vs off-chain KYC/AML integration, KYT, licensing models, risk frameworks.

- Experience building compliant DeFi products in multiple regions.

Example question to test them: “How would you mitigate cross-chain bridge risks in our protocol?”

→ A real vendor gives a structured mitigation plan, not vague statements.

6. Transparent pricing & ownership

What to look for:

- Clear cost breakdown: smart contract → backend → audits → maintenance.

- Full code ownership.

- No hidden fees for deployment or integrations.

Red flag: Vendor refuses to give source code access or tries to own part of your smart contract infrastructure.

With these evaluation points in mind, here’s a curated list of top DeFi development companies you can consider for your next project.

Top 10+ Defi development companies

Based on our research on Clutch, and Goodfirms we have compiled a comparison table of the top 10 DeFi companies that are leading the way in providing innovative solutions and services to businesses globally.

| DeFi development companies | Price range | Clutch reviews | Team size | Years of experience |

|---|---|---|---|---|

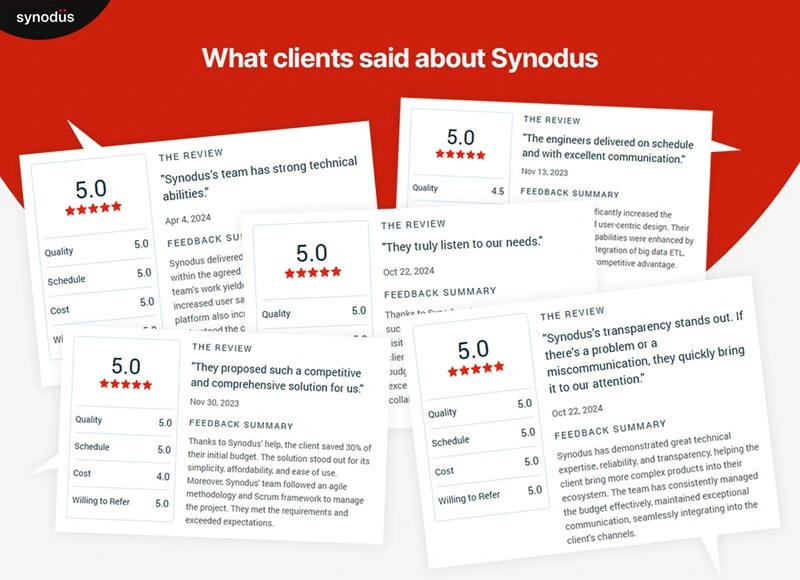

| Synodus | $16 – $30 /hr | 5.0/5 | 250 – 999 | 5+ |

| WeAlwin Technologies | $25 – $49/ hr | N/A | 50 – 249 | 6+ |

| OpenXcell | < $25/ hr | 4.8/5 | 250 – 999 | 15+ |

| SDLC Corp | $25 – $49/ hr | 5.0/5 | 250 – 999 | 8 |

| ScienceSoft | $50 – $99/ hr | 4.8/5 | 250 – 999 | 30+ |

| Solulab | $25 – $49/ hr | 4.9/5 | 50 – 249 | 10+ |

| Interexy | $25 – $49/hr | N/A | 250 – 999 | 7+ |

| Labrys | $50 – $99/hr | 5.0/5 | 10 – 49 | 7+ |

| Accubits | $25 – $49/hr | 4.4/5 | 250 – 999 | 12+ |

| Antier Solutions | $25 – $49/hr | 5.0/5 | 250 – 999 | 19+ |

| Unicsoft | $50 – $99/hr | 4.9/5 | 50 – 249 | 19+ |

| Osiz Technologies | $50 – $99/hr | 4.7/5 | 250 – 999 | 15+ |

1. Synodus

Synodus is a defi development vendor specializing in blockchain and DeFi applications. We help startups launch secure, scalable, and market-ready DeFi products. We also work as a strategic tech partner that helps founders reduce risks, refine product direction, and accelerate time-to-market.

When you work with us, you gain:

Clear product direction

We help you validate and refine your concept, ensure compliance, and shape a product roadmap that’s feasible, investor-friendly, and built for long-term growth.

End-to-end DeFi engineering

Our team handles smart contracts, backend, frontend, audits, and integrations. You get a fully functional DeFi product with strong security, optimal gas usage, and scalable architecture.

Predictable delivery and faster time-to-market

Our process reduces rework and technical risk. You know exactly what will be delivered, when, and at what cost—so you can launch on schedule and stay ahead of competitors.

With 400+ projects delivered across 25 countries, Synodus brings deep expertise in DEXs, staking platforms, lending protocols, asset tokenization, and enterprise-grade blockchain systems.

Case study highlight

A fintech founder partnered with Synodus to launch DeFi for You, a P2P lending platform that allows users to pawn physical items as tokenized on-chain collateral.

How we helped:

- Shaped the product vision and lending model

- Designed the tokenomics for sustainable long-term value

- Built the entire platform: smart contracts, infrastructure, UX, and backen

Business outcomes achieved:

- 861,416,467 of total token supply

- 226,818,268 DFY tokens were sold before listing on exchanges (IDO and pre-sale)

- 28,700 wallet holders of DFY tokens

- 139,381,732 DFY tokens are burned in quarterly burns

- 120,000 transactions made with DFY

2. OpenXcell

Established in 2009 and headquartered in India, OpenXcell is a reliable DeFi development company that provides robust and efficient DeFi solutions that cater to the unique requirements of businesses in the digital finance landscape.

What sets them apart?

- OpenXcell provides a strong infrastructure and ensures cultural compatibility with clients.

- With a proven record of successful blockchain projects, they have earned the trust of over 700 satisfied clients.

Case study highlight

eProcure is a blockchain-integrated platform that automates the entire procurement process. However, creating a secure blockchain network, having a development team with domain expertise, and having a reliable staff were among the difficulties encountered when creating eProcure.

To address these issues, OpenXcell developed an eCommerce procurement platform that was coupled with blockchain technology and featured smart contract administration, eAuction, automated eProcurement, and real-time analytics.

As a result, eProcure was successfully implemented with more than 300 customers. The technology offered an intuitive user interface along with a safer and more straightforward buying process.

3. Minddeft Technologies

Minddeft Technologies is a well-known name in the DeFi development sector, offering a wide range of solutions for various DeFi applications. Their expertise includes building decentralized exchanges, liquidity protocols, and yield optimization platforms. Thanks to prioritizing user experience and security, Minddeft Technologies utilizes blockchain technology to offer trustworthy and easy-to-use DeFi solutions.

What sets them apart?

- They go beyond typical customer support by offering personalized, hands-on guidance throughout the entire project lifecycle—from ideation to deployment.

- Minddeft has been featured in various news outlets, highlighting their significant impact in the blockchain industry.

Case study highlight

With the traditional financial system being centralized, it often leads to inefficiencies and delays. The need for a more advanced and streamlined approach to address these challenges is evident. Minddeft Technologies identified this gap and decided to leverage their expertise in DeFi to provide a solution.

The results are remarkable. The DeFi platform created by Minddeft Technologies has led to a significant change in the financial infrastructure. It has introduced several benefits in terms of risk, trust, and opportunities. Not only has it offered improved options compared to traditional financial methods, but it has also introduced innovative financial ideas such as synthetic assets.

4. SDLC Corp

SDLC Corp is poised to maintain its position as a top DeFi company in 2026, boasting a talented team of blockchain experts who leverage agile methodologies to ensure efficient and timely project delivery. This company offers a wide range of applications for its DeFi development services, such as DeFi exchange, asset management, compliance, and KYT, crowdfunding, and synthetic assets.

What sets them apart?

- They have expertise in Odoo development and customization services which help create software that simplifies and automates complex workflows.

- Their agile process ensures quicker project delivery, helping businesses enter the market faster.

Case study highlight

The development of a food delivery app presents several significant UX challenges, such as intricate onboarding procedures, the need for consistency across various platforms, the avoidance of overwhelming choices during checkout, the maintenance of transparency in payment procedures and more.

SDLC Corp addressed these challenges with key UX metrics, including streamlined user onboarding, consistent experience across different platforms, user-friendly design, efficient error handling, and comprehensive user training resources. These metrics play a crucial role in ensuring a seamless and gratifying user experience, ultimately leading to the application’s overall success.

5. ScienceSoft

ScienceSoft, a company headquartered in the United States, specializes in offering IT consulting and software development services. Thanks to harnessing knowledge and skills in blockchain technologies, ScienceSoft has succeeded in building DeFi platforms that are both secure and scalable, catering to a wide range of industries.

What sets them apart?

- Over 3,600 success stories, including projects for Walmart, eBay, NASA JPL, PerkinElmer, Baxter, IBM, Leo Burnett.

- ScienceSoft has been recognized as one of the top 10% European Software Development Companies by Aciety for the second year in a row.

Case study highlight

ScienceSoft created a customer portal for Secure-DeFi, a fintech startup specializing in cutting-edge cryptocurrency solutions. With ScienceSoft’s proficiency, the Customer obtained:

- A fully operational customer portal, developed in just 4 months utilizing ScienceSoft’s proven Agile methodologies.

- The ability to enhance portal usage and maintain a strong user base thanks to the user-friendly UX and visually attractive UI.

- Seamless scalability to accommodate extensive content and increase user engagement.

6. Solulab

Solulab is one of the leading blockchain development companies, boasting a vast user base of over 50 million active users for their applications and an impressive customer success rate of 97% that rivals others in the industry. Solulab has established partnerships with Fortune 500 companies as well as fast-growing startups, such as Walt Disney, Goldman Sachs, Mercedes Benz, the University of Cambridge, Georgia Tech, and many others.

What sets them apart?

- Led by former management leaders from Goldman Sachs and Citrix, SoluLab brings a wealth of industry knowledge and strategic insight to each project.

- Using agile methods, SoluLab ensures flexible, on-time delivery tailored to client needs.

Case study highlight

NFTY aimed to create a reputation layer for NFT transactions, requiring utility tokens, a reliable infrastructure, and networks to ensure quality and trust in NFT trading.

SoluLab’s expert team successfully developed the protocols and built the reputation layer to address these needs. They launched the NFTY token, allowing users to maximize benefits while keeping all transactions transparent and secure. Additionally, the NFTY protocol rewards supporters who identify and promote genuine talent, making it useful in both digital and physical spaces.

7. Interexy

Interexy is considered a leading blockchain development company. This company has highly skilled developers who possess extensive experience. Interexy’s comprehensive DeFi solutions encompass all aspects of decentralized app development, including the design, coding, integration, support, and evolution of various DeFi products.

What sets them apart?

- DeFi enables businesses to tokenize their data, ensuring secure storage in a decentralized environment.

- DeFi facilitates efficient, expedited, and utmost secure transactions.

- DeFi empowers companies to customize their payment systems according to their specific needs.

Case study highlight

Interexy helped a fintech startup build an NFT-based ticketing platform using blockchain technology. The platform ensures secure, transparent, and efficient ticket transactions, solving issues like fraud and scalping.

Interexy developed the platform with advanced features, including integration of a blockchain-based NFT marketplace, where tickets are tokenized as NFTs, allowing for secure buying, selling, and transfer of tickets. The use of blockchain ensures transparency, preventing counterfeit tickets and ensuring a seamless user experience.

The startup benefits from a decentralized solution that boosts trust among users, enhances the overall ticketing process, ensures better scalability, which positions it for future growth within the evolving ticketing and entertainment industries.

8. Labrys

Labrys, established in 2017, is the leading Web3 development agency in Australia, specializing in blockchain infrastructure and Web3 technologies. Labrys has a strong focus on decentralized finance (DeFi). Thanks to its knowledge of blockchain, Labrys strives to create reliable and scalable DeFi platforms for various industries. Their DeFi solutions prioritize transparency, removing middlemen, and ensuring secure financial transactions.

What sets them apart?

- Labrys performs comprehensive smart contract audits to detect vulnerabilities and guarantee the security and dependability of your DeFi project’s code.

- Labrys makes sure that your DeFi venture is not solely groundbreaking but also viable, meticulously verified, and extensively examined to ensure a successful launch.

Case study highlight

Labrys collaborated with Fluidity Labs and Superposition to develop Fluidity Money, a DeFi platform that rewards users for actively using their cryptocurrency. By wrapping stablecoins into Fluid Assets and lending out the underlying assets on money markets like Aave, Fluidity generates yield.

Users earn rewards ranging from small amounts to significant dividends when they use Fluid Assets for transactions, swaps, or trading. Since its launch, Fluidity has expanded to multiple blockchains, including Ethereum, Arbitrum, Solana, and Sui, and has seen significant growth in user transactions.

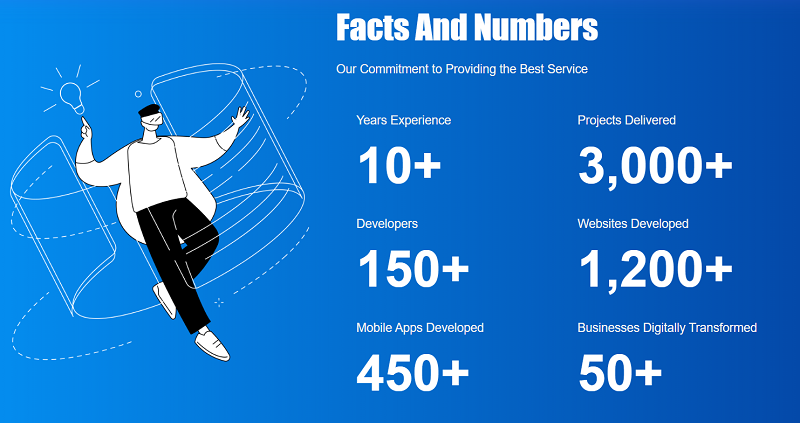

9. Accubits

Accubits stands out as a top blockchain development company in the industry, acknowledged by reputable sources such as The Economic Times, Entrepreneur Media, Red Herring, and various other global reviewers. They have earned the trust of over 200 tech startups, government agencies, and Fortune 500 companies.

What sets them apart?

- They offer white-label blockchain platforms, enabling clients to launch projects swiftly with minimal capital investment.

- They integrate AI technologies into their blockchain solutions for enhanced predictive analytics and automated decision-making

Case study highlight

Reltime AS, a fintech company based in Norway, provides a Web3 financial ecosystem. Their primary objective is to enable individuals worldwide to reclaim authority over their finances. Currently, financial institutions hold all the power, but Reltime aspires to disrupt this prevailing system. The collaboration between Accubits and Reltime involved assisting them in the launch of a Defi flash loan application.

The phase one of the project has been effectively finalized with the creation of the Reltime cryptocurrency (RTC) and the defi lending and borrowing application. RTC cryptocurrency has been officially listed on the Coinmarketcap crypto exchange. Furthermore, the applications have been officially released on both the Google Play Store and the Apple App Store.

10. Antier Solutions

Antier Solutions is one of the best DeFi firm companies that specializes in creating public, private, or hybrid blockchain products and flawless DeFi smart contracts. They offer reliable, robust, and scalable solutions to clients worldwide. With a track record of over 500 successful projects launched globally, Antier has established itself as a premier DeFi token development company.

What sets them apart?

- Antier works with various blockchain frameworks such as Ethereum, Polkadot, and Solana, allowing them to tailor solutions to specific project needs.

- They emphasize robust security measures and compliance with industry standards, ensuring that DeFi platforms are safe and trustworthy.

Case study highlight

Antier Solutions built a decentralized exchange (DEX) for Cardax, a cryptocurrency exchange. Using advanced DeFi protocols and blockchain technology, Antier created a fast, secure platform for peer-to-peer cryptocurrency trading. The exchange allows users to trade easily and safely, with transparent transactions. Antier’s experience in blockchain and DeFi solutions helped ensure the exchange worked smoothly and met high standards, providing Cardax with a reliable platform for its users.

11. Unicsoft

Unicsoft, founded in 2005, specializes in providing DeFi development services. The company prides itself on possessing the necessary technical expertise to build DeFi wallets, tokens, and smart contracts with advanced features. With a track record of successfully delivering over 200 projects, the Unicsoft team also offers project maintenance services. Notably, this DeFi development company emphasizes its ability to reduce time to market (TMM) by conducting thorough testing of various hypotheses.

What sets them apart?

- They provide comprehensive security audits to identify vulnerabilities and ensure the reliability of DeFi projects.

- Unicsoft offers expert consulting to guide clients through every stage of their DeFi projects, ensuring alignment with business goals and industry standard.

Case study highlight

Unicsoft developed an innovative DeFi platform for cross-chain conversions of digital assets. The client approached Unicsoft with the idea of creating a user-friendly wallet that could handle all types of crypto assets.

Unicsoft’s team designed and implemented a solution that allows users to convert digital assets across different blockchains seamlessly. This platform enhances the accessibility and usability of digital assets, contributing to the growth of the DeFi ecosystem.

12. Osiz Technologies

Osiz Technologies is renowned as a prominent blockchain development company dedicated to crafting cutting-edge blockchain solutions that cater to the unique requirements of businesses.

Osiz Technologies provides Defi development services that enable clients to leverage the opportunities presented by decentralized finance (Defi) ecosystems. Thanks to its knowledge and skills, this company creates and implements cutting-edge Defi solutions customized to address individual business requirements.

What sets them apart?

- Osiz offers tailored blockchain forking services, including hard and soft forks, enabling businesses to adapt existing blockchain frameworks to their specific needs.

- Recognized as the best game-fi development company award at the 2022 Money Expo (the biggest trading event in India)

Case study highlight

Osiz Technologies developed a decentralized exchange (DEX) for a client, leveraging their expertise in DeFi development to create a secure and efficient platform for peer-to-peer cryptocurrency trading.

The DEX allows users to trade digital assets without intermediaries, ensuring transparency and reducing transaction costs. Osiz’s comprehensive DeFi solutions enabled the client to launch a robust platform that meets the growing demand for decentralized financial services.

Now that you have detailed information about the 10+ best decentralized finance companies, however, picking the right one can still feel overwhelming with so many options.

To ensure that you make the right choice and avoid common mistakes, we’ve put together five simple tips. These will guide you through the complexities of the DeFi space and help you reach your business goals.

Conclusion

To sum up, selecting the appropriate DeFi development company is of utmost importance for the success of your DeFi project.

Once you compare vendors, prioritize those who can demonstrate real security thinking, transparent communication, and the ability to translate your business model into scalable on-chain architecture.

A strong partner is not the one who promises fast delivery, but the one who can challenge assumptions, mitigate defi risks early, and build for long-term sustainability. If a vendor cannot explain their security model or audit expectations clearly, they are not the right partner for a DeFi product.

More related posts from our Fintech blog you shouldn’t skip:

- Top 10 defi use cases that solve startups’ problems in Finance

- 10 Best Fintech App Development Companies in 2026 [Latest Update]

- Top 15+ Best Fintech Apps You Must Check Out In 2026

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.