A wallet’s isn’t just a storage tool. It’s a digital asset custody solution that safeguards private keys, verifies ownership, and connects users to blockchain ecosystems. From simple mobile apps to advanced multi-chain infrastructures supporting DeFi and NFTs, the possibilities are wide, and so are the challenges.

The real question is: how do you build a wallet that balances security, usability, cost, and scalability? This guide walks you through the essentials, giving you a clear path to turn your wallet idea into a working product.

Why should you invest in crypto wallet development?

The crypto wallet industry has grown far beyond its early niche. By 2024, the global crypto wallet market was already valued at $12.6 billion and is projected to continue expanding strongly, reaching nearly $19 billion in 2025 and much higher by the end of the decade ((Grand View Research, TBRC).

User adoption is also accelerating. In 2019, only around 200 million people worldwide used crypto wallets. Fast forward to 2025, and that number has reach 820 million active wallets, reflecting an average annual growth rate of more than 11% (Coinlaw).

For businesses, this shift signals massive opportunities. Investing in crypto wallet development enables you to:

- Drive new revenue streams: from transaction fees, premium services, in-app swaps, or embedded ads.

- Strengthen your brand identity: by offering a secure, user-friendly financial tool that boosts customer loyalty.

- Stay ahead of competitors and future-proof your business in a market that’s becoming a core part of digital finance.

For example, MetaMask, a leading non-custodial wallet, generated over $200 million in revenue in 2021 from its swap feature alone, and newer players are tapping similar models with staking, cross-chain bridges, and DeFi integrations.

With wallet usage set to surpass one billion users before 2030, the case is clear: building a crypto wallet today positions your business to capture tomorrow’s blockchain economy.

Get to know crypto wallets: The ultimate crypto wallet guide for cryptocurrency startups

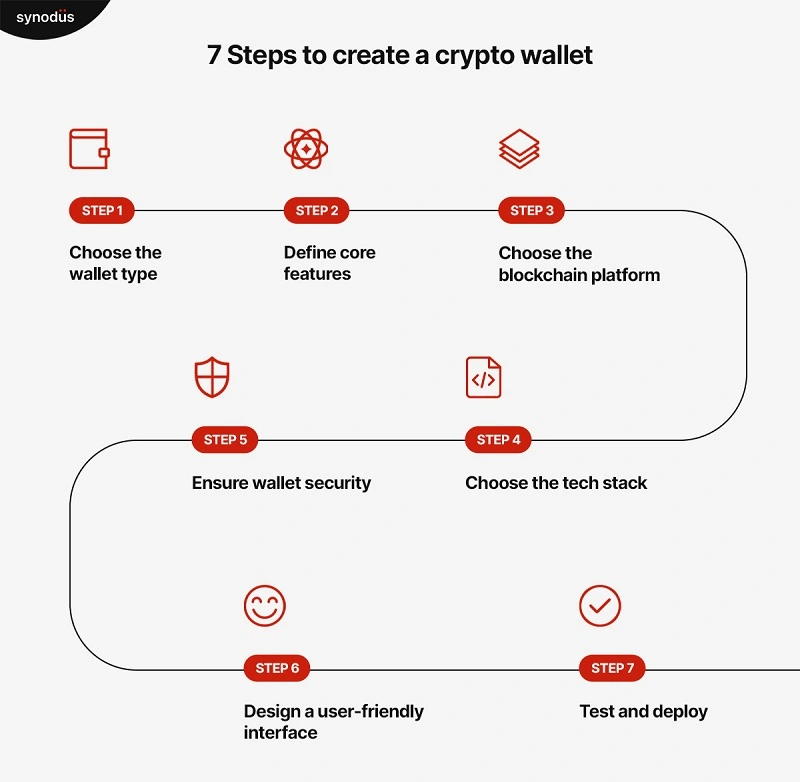

7 basic steps to create a crypto wallet

Step 1: Choose the right type of crypto wallet

Before you start building, you need to understand the types of wallets available, because this choice will dictate your tech stack, security approach, and user experience. Here’s a breakdown:

Hot vs. Cold wallets

- Hot wallets (Online & Connected): they are convenient for sending, receiving, and trading crypto quickly but more vulnerable to hacks (e.g., MetaMask, Trust Wallet).

- Cold Wallets (Offline & Secure): Best for long-term storage with high security, but less convenient for daily use and app integrations. (e.g., Ledger, Trezor).

Custodial vs. Non-Custodial wallets

- Custodial wallets: Private keys are managed by a third party (e.g., exchange wallets).

- Non-Custodial wallets: Users have full control over private keys (e.g., self-hosted wallets).

Single-Chain vs. Multi-Chain wallets

- Single-Chain: Supports only one blockchain, simpler to build and secure, but limited if users want cross-chain assets. (e.g., Bitcoin Core Wallet).

- Multi-Chain: Compatible with multiple blockchains (e.g., Trust Wallet, Exodus).

Consider your target audience and goals: beginners may prefer hot, custodial, single-chain wallets for ease of use, while advanced users may expect non-custodial, cold, or multi-chain wallets for maximum security and flexibility. Always weigh regulatory compliance when choosing custodial wallets.

Once you know this, immediately check compiance. If you plan to operate in the US, EU, or Singapore, you’ll need to align with KYC/AML regulations, licensing, and data privacy laws like GDPR. Skipping this step means you could build a wallet… only to find out you can’t legally launch it.

Step 2: UX/UI design with security in mind

This is where your product comes alive for users. The goal? A wallet that feels simple, even for someone new to crypto, but is secretly armored with security.

Key principles:

- Design for clarity: No clutter, no confusing flows. If users get lost, they leave.

- Security by design: Every UI element should reinforce safety: clear seed phrase backup steps, biometric logins, two-factor authentication.

- Anti-phishing design: Many hacks don’t break your code – they trick your users. Your interface should prevent that.

Remember: a wallet that looks pretty but isn’t secure will fail the moment it gains traction.

Step 3: Choosing blockchain & tech stack

This is where many startups make irreversible mistakes. Your choices here define how scalable, secure, and future-proof your wallet is.

- Pick your chain(s): Ethereum, BNB Chain, Solana, Polygon – or go multi-chain from day one.

- Decide token standards: ERC-20 (fungible), ERC-721 (NFTs), ERC-1155 (multi-asset).

- Set your infrastructure: run your own nodes for control, or leverage providers like Infura, Alchemy, QuickNode for speed.

- Plan your key management: Hardware Security Modules (HSM) or advanced MPC (multi-party computation) for enterprise-grade security.

My advice? Don’t overcomplicate. Start focused, then expand once you have real users.

Step 4: Development & Integration

This is the execution phase. Your developers start building modules that will become the backbone of your wallet.

What you need to include from the start:

- Wallet creation & recovery: Make it easy, but never compromise seed phrase safety.

- Transaction management: Accurate gas fee calculation, seamless send/receive.

- Security layers: Strong encryption, anti-fraud checks, malware defenses.

Optional (depending on your vision):

- DEX integration for swaps.

- NFT marketplace connections.

- DeFi protocols for staking or lending.

Rule of thumb: Your MVP doesn’t need everything, but what it has must work flawessly.

Step 5: Testing, security audit & legal review

At this stage, resist the urge to rush launch. Testing is where your wallet earns credibility.

- Start with functional testing: unit + integration. Does signing a transaction always work? Does recovery fail gracefully if a user enters the wrong seed phrase?

- Then do penetration testing: simulate phishing, brute force, or network-level attacks. If your wallet survives this, it’s ready for the wild.

- Don’t skip a third-party audit. Firms like CertiK, SlowMist, or Quantstamp give you a seal of approval that investors and users take seriously.

- Close with a compliance review: KYC/AML, GDPR/CCPA, and local licensing. Security without compliance is half a solution.

Wallets that skip audits don’t survive. Wallets that embrace them earn trust.

Step 6: Deployment & launch

This is where your wallet goes from code to real users and real money. Launching isn’t just publishing an app – it’s making sure people can use it safely and trust it from day one.

- For mobile: App Store and Google Play releases.

- For desktop: Chrome extension or standalone web app.

- Monitoring: set up anomaly detection and performance tracking from day one.

- User education: simple guides teaching users how to back up their seed phrase, avoid phishing, and use multi-factor authentication.

Step 7: Post-launch growth & continuous security

Releasing your wallet is only the beginning. The real challenge is scaling securely, adapting to user feedback, and staying ahead of both competitors and compliance changes.

Here’s how you should approach scaling:

- Regular updates: Patch vulnerabilities, improve performance.

- Customer support: Be ready when users lose access, get phished, or just get confused.

- New features: Expand into staking, multi-chain support, fiat on/off ramps, or even embedded finance.

Treat your wallet as a living product. The day you stop updating, you start losing trust.

Things to notice when building a crypto wallet

Building a crypto wallet is not just about following basic steps, there are more factors that can impact its success and effectiveness. Let’s take a closer look at these key considerations to build a robust crypto wallet.

1. Use open-source libraries for faster development

You can save a lot of time and effort if using open-source libraries for crypto wallet setup. These libraries are extensively tested and free to use. Examples include:

- BitcoinJ SDK: A Java library that supports multiple languages like Python, Ruby, and Java. Great for Bitcoin wallets.

- Coinbase SDK: Best for cross-platform wallet development on iOS and Android. It supports popular programming languages.

2. Use APIs for integration

APIs are essential for connecting wallets to blockchain networks and third-party platforms. They simplify interactions, enabling seamless synchronization and efficient functionality. Popular APIs include:

- Coinbase API: Ideal for integrating exchange features.

- Bitcore API: Useful for blockchain exploration and wallet integration.

- SimpleSwap API: Allows cryptocurrency exchanges within the wallet.

3. Ensure scalability with cloud technology

Cloud platforms like AWS, Google Cloud, and Microsoft Azure provide efficient infrastructure. They help businesses scale and manage resources easily.

Blockchain-as-a-Service (BaaS) from these providers simplifies blockchain integration. This ensures your wallet performs smoothly even during high demand.

4. Ensure compatibility and synchronization

Ensure your crypto wallet works on all smartphones, tablets, and desktops. Synchronization between devices is essential for a seamless user experience.

Key strategies include:

- Cross-platform development: Use frameworks like Flutter or React Native to ensure wallets work on iOS, Android, and desktop platforms.

- Real-time synchronization: Use cloud solutions to instantly sync balances, settings, and transaction history across devices.

- Responsive design: Ensure the interface works well on all screen sizes.

5. Legal and regulation

Following regulations builds trust and keeps operations smooth. Key steps include:

- KYC Procedures: Verify identities to meet Know Your Customer requirements.

- AML Policies: Follow Anti-Money Laundering laws to prevent illegal activities.

- GDPR Compliance: Secure user data in line with global privacy laws.

- Tax and Licensing: Stay updated with tax requirements and renew operating licenses as needed.

6. Strengthen security & User experience

- Implement encryption & two-factor authentication (2FA) for user protection.

- Design an intuitive UI/UX to simplify wallet operations and prevent errors.

The development cost of building a crypto wallet

The cost of crypto wallet setup often ranges from $15,000 to $200,000. It depends on the wallet’s complexity, required features, and developer hourly rates. This rate varies by region – $50 to $180 per hour. More complex wallets with advanced features or customization will increase the overall cost.

Estimated costs and duration:

| Wallet type | Estimated cost | Estimated duration |

|---|---|---|

| Simple | $15,000 – $30,000 | 2 months |

| Medium complexity | $30,000 – $75,000 | 3 to 4 months |

| High complexity | $75,000 – $200,000+ | 6 months or more |

Why you should choose Synodus for crypto wallet development?

With years of experience in blockchain and fintech, Synodus is a leading crypto wallet development company trusted by startups and enterprises worldwide.

We understand the challenges of launching a crypto wallet: security risks, high development costs, compliance hurdles, and user adoption struggles. Our team of experts leverages cutting-edge technology, including blockchain, encryption, automation, and AI, to build secure, scalable, and user-friendly wallets.

We offer two development approaches:

- Packaged solutions & White-label services – A cost-effective, fast-to-market option with customization to fit your business needs.

- Custom-built crypto wallets – Designed from the ground up for maximum flexibility, scalability, and security.

A wallet we developed for our client, Hola Pay, achieved 3 million users in just four months. Our expertise ensures your wallet meets the highest standards in security, compliance, and user experience.

Compliance is key in the crypto industry. Our legal and blockchain experts ensure that your wallet meets AML, KYC, GDPR, and financial regulations in your target markets.

We guarantee a crypto wallet with:

- Multi-layer security (encryption, two-factor authentication, cold storage)

- Bitcoin, Ethereum, and multi-crypto support

- NFT & tokenized asset management

- Seamless DeFi integrations

- Web3 compatibility & DApp connectivity

- Mobile-friendly design for iOS & Android

- Custom branding for white-label solutions

Launch your crypto wallet today!

Conclusion

Building a cryptocurrency wallet isn’t just about offering a digital solution—it’s about crafting a secure, user-friendly tool that meets the evolving needs of the crypto community.

Clearly defining your business goals, selecting the right features, and prioritizing security, you can create a wallet that stands out in a competitive market.

However, success also hinges on choosing the right development partner. Selecting an experienced crypto wallet development company ensures that your project is in safe hands, from ideation to launch. With the right team, you can leverage the latest technologies, ensure scalability, and build a wallet that will adapt to the fast-paced nature of the digital currency market.

Are you ready to build a secure, innovative crypto wallet that enhances user experience? With the right planning and the right partner, you can bring your vision to life and capture a share of the growing digital currency market. Let’s make it happen.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.