Step 1. Conduct market research & define your target audience

Before choosing how to build your crypto exchange, you first need to conduct market research to understand the industry landscape and identify your target users

You can start with looking at industry trends—what’s changing, what’s in demand, and how regulations might affect your business. Use tools like Google Trends to track interest over time, and follow discussions on forums like Reddit or Twitter to gauge user sentiment. Pay attention to new technologies or trading models gaining traction.

Next, conduct a competitive analysis by examining existing exchanges. Identify the top players in your target market and analyze key aspects such as trading fees, supported cryptocurrencies, security measures, user experience, liquidity, and customer support. Explore platforms like CoinMarketCap and CoinGecko for objective data, and check user reviews on Trustpilot or social media to spot strengths and weaknesses.

Then, segment your target audience carefully. Are they experienced traders, casual investors, or complete beginners? Different groups have different needs—some want advanced trading tools, while others just need an easy-to-use platform. Also, consider things like their age, location, and trading habits. The better you understand them, the easier it will be to design a platform that fits their needs and keeps them coming back.

Step 2. Make sure your crypto exchange is legal

We all know that to run a successful crypto exchange, you must follow the laws and get the right licenses.

Since each country has its own rules, it’s important to research and understand what applies to your business. To navigate these regulations smoothly, working with legal experts can help ensure your exchange meets key requirements like KYC (Know Your Customer) and AML (Anti-Money Laundering).

Depending on your jurisdiction, you may need specific licenses such as a Money Transmitter License (MTL) in the US, or authorization from financial regulators like the FCA in the UK. Obtaining these licenses can take time and require detailed paperwork, so planning ahead is essential.

Remember, legal compliance is an ongoing process involving regular reporting and audits. Failing to meet these requirements can lead to severe penalties or even the shutdown of your platform.

However, getting everything in order from the start will help you build a legal, secure, and trustworthy exchange that gains user confidence and long-term success.

Step 3. Choose the right approach – white label vs custom solutions

After conducting market research and ensuring legal compliance, the next step is to choose the right approach to build your crypto exchange. You typically have two options: white-label solutions or custom development. Each has its pros and cons, depending on your goals, crypto exchange development cost, and technical needs

White-label solutions – Fast & budget friendly

A white-label solution is a ready-made platform that lets you launch your exchange quickly. It comes with essential features like a trading engine, user dashboard, and admin panel, so you don’t have to build everything from scratch.

This option is ideal if you want to enter the market fast, validate your idea, or target a niche segment with limited budget. However, customization is limited, and you’ll depend on the provider for updates, new features, and even ongoing compliance adjustments.

Custom solutions – Full control & Scalability

A custom solution means building your exchange from the ground up, tailored to your unique business goals. It gives you full control over user experience, features, tech stack, scalability, and security infrastructure. This route is best suited for businesses aiming for long-term growth, high-volume trading, or integration with advanced technologies like DeFi protocols or AI-based trading.

However, it requires more time, money, and technical expertise. You’ll need a dedicated development team and a clear product roadmap.

So, which one should you choose?

- Go for white-label if you’re a startup looking for a quick and affordable launch with standard features and minimal technical risk..

- Choose custom development if you need full control, scalability, and have the budget to invest in a fully tailored platform.

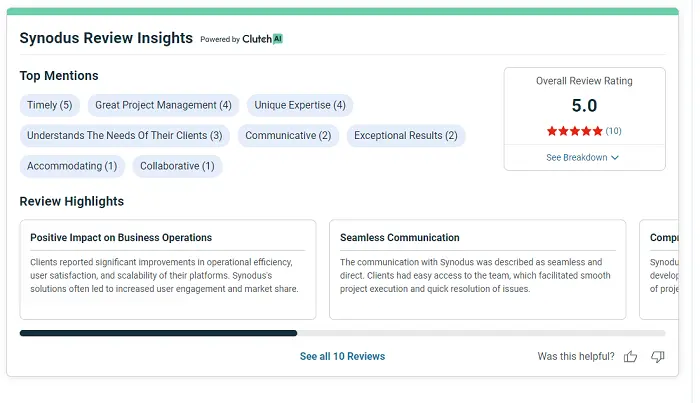

Whether you choose white-label or custom development, your choice of vendor is just as important as the solution itself. A skilled and reliable partner can make the process smoother, faster, and more secure.

Here’s what to look for:

- Proven experience with crypto or fintech platforms.

- Strong understanding of security protocols and compliance standards.

- Clear communication and post-launch support.

- Positive client reviews on sites like Clutch and GoodFirms.

Take time to evaluate multiple vendors, review case studies, and ask about their approach to handling scaling, security, and feature updates. This help you avoid unnecessary risks and hidden costs down the road.

- Suggested for you: 10 must-know crypto exchange development companies for 2025 success

Step 4. Define key features and choose the right tech stack

To make your crypto exchange smooth, secure and user-friendly, you need to define the right key features and choose a strong technology foundation to support them. At this stage, you should have a clear vision of what your platform will look like – form both a user and technical perpective.

We’ve already broken down the essential features of a crypto exchange in this detailed guide on key features. So here, we’ll focus on how those features connect to the technology choices you need to make.

One the features are clear, it’s time to select the right technologies to build and scale your platform:

- Backend development: Languages like Node.js, Java, Python, or even Go are popular for handling real-time transactions and ensuring system reliability.

- Frontend framework: Use React or Angular to create smooth, responsive user interfaces.

- Database systems:

- PostgreSQL or MySQL for structured, secure financial records.

- MongoDB or Redis for faster access and scalability.

- APIs & microservices: For modularity and better system maintenance, integrate REST or GraphQL APIs to connect different services (KYC provider, liquidity aggregator, wallet service, etc.)

- Infrastructure: Cloud providers like AWS or Google Cloud help you scale and manage uptime efficiently.

A strong tech stack ensures your platform can handle large trading volumes, protect user data, and adapt as your business grows.

Step 5. Build your crypto exchange & keep it secure

To turn your idea into a working crypto exchange, it’s time to start development. This involves both technical implementation and strong security practices from day one.

Build the core of your exchange

At this stage, your development team will:

- Set up the trading engine: This is the heart of your exchange that matches buy/sell orders with low latency and high accuracy.

- Create the user interface (UI/UX): Your platform should be easy to use on both web and mobile, with an intuitive layout for trading, deposits, and withdrawals.

- Integrate crypto wallets: Support hot and cold wallets for safe fund storage and seamless transactions.

- Add KYC/AML modules: Enable user verification flows in line with compliance requirements.

- Build an admin dashboard: This allows you to monitor trades, manage users, track suspicious activities, and more.

Keeping your exchange safe & protect your user data

Your crypto exchange is like a digital vault, and security is what keeps hackers out. Here’s how to protect your exchange and user data:

- Use cold wallets for storing most user funds, keeping them offline from potential hackers.

- Enable two-factor authentication (2FA) and strong password policies to secure user accounts.

- Protect against cyberattacks like DDoS and brute-force with proper server-side protections.

- Encrypt all sensitive data – including user info and transaction history, using industry-standard encryption.

- Conduct regular security audits and penetration testing to find and fix vulnerabilities early.

- Educate users with in-app tips and notifications on how to avoid phishing scams and use extra security features.

Launching a crypto exchange without solid security can lead to breaches, loss of user trust, and legal problems. So security should be treated as a core part of development, not an afterthought.

Step 6. Launch and promote your crypto exchange

This is the final step—getting your exchange live and attracting users. But simply launching isn’t enough. You need a strong marketing and growth strategy to bring in traders and build trust. Here are key areas to focus on:

- Test everything before going live: Ensure your exchange runs smoothly by conducting final security checks, stress testing, and fixing any last-minute bugs. A flawless user experience from day one will help retain users.

- Create a strong market entry strategy: Decide how you’ll attract your first users. Will you offer incentives like lower trading fees or bonuses? Will you partner with influencers or crypto communities? A well-planned launch will give your exchange a competitive edge.

- Build brand awareness: Promote your exchange through social media, content marketing, and PR. Share educational content about crypto trading, highlight security features, and engage with the community to establish credibility.

- Optimize for SEO & paid ads: Improve search rankings with an SEO-optimized website and invest in paid ads to attract early adopters. Google Ads, crypto forums, and social media promotions can drive initial traffic.

- Provide exceptional customer support: Offer 24/7 support via live chat, email, or Telegram. A responsive support team will help build user confidence and increase retention.

- Monitor & improve: Gather user feedback, track performance, and continuously optimize the platform. Regular updates and improvements will keep your exchange competitive and secure.

Build a successful crypto exchange platform with Synodus

As you can see, launching a thriving crypto exchange is not only about code but also about creating a financial ecosystem that can withstand market volatility, regulatory scrutiny, and fierce competition. Here, Synodus builds robust platforms to withstand market challenges and regulatory hurdles. Partnering with Synodus is a strategic imperative for anyone looking to break into the competitive landscape of how to create a crypto exchange platform.

Notably, we offer innovative white label solutions that enable you to launch a robust cryptocurrency exchange quickly and cost-effectively. Our customizable platforms not only reflect your unique brand identity but also set you apart in a crowded market. With advanced security measures in place, you can operate confidently while safeguarding user funds in today’s volatile landscape. Better yet, our solutions are designed to scale seamlessly with your business, ensuring you stay ahead of growing demand and regulatory standards.

Why Synodus is your crypto catalyst

- Cost-effective: Synodus operates a development team in Vietnam, which enables us to offer competitive pricing. Our hourly rates range from $16 to $30, significantly lower than the average rates for cryptocurrency exchange development in the market, which range from $25 to $150 (based on our research on reputable B2B review sites like Clutch). Choosing Synodus could save you up to approximately 73.71% on development costs per hour compared to the average market price.

- Ability to deliver quickly: We will contact you within 24 hours to discuss your goals, needs, and constraints. A senior business analyst and technical lead will then analyze your requirements and craft a customized roadmap. Within just 5 working days, you’ll receive a detailed proposal with a technical assessment, and project onboarding will begin within 14 days.

- Blockchain mastery: Our team of over 250 dedicated professionals not only follows trends but also sets them. With cutting-edge blockchain expertise, we build secure and impenetrable exchanges.

- Tailored architecture: One-size-fits-all approaches need to be revised. We build custom exchanges tailored to your needs, helping you stand out in a competitive market.

- UX that converts: In crypto, complexity kills adoption. Our intuitive interfaces turn novices into power users, which maximizes engagement and liquidity.

- Compliance without compromise: We make it easy to stay on the right side of the law. We go above and beyond legal requirements, earning the trust of your customers and government regulators.

- Evolve or perish: Launch day is just the beginning. Our relentless support ensures your platform evolves faster than the market so that you can stay ahead of the curve.

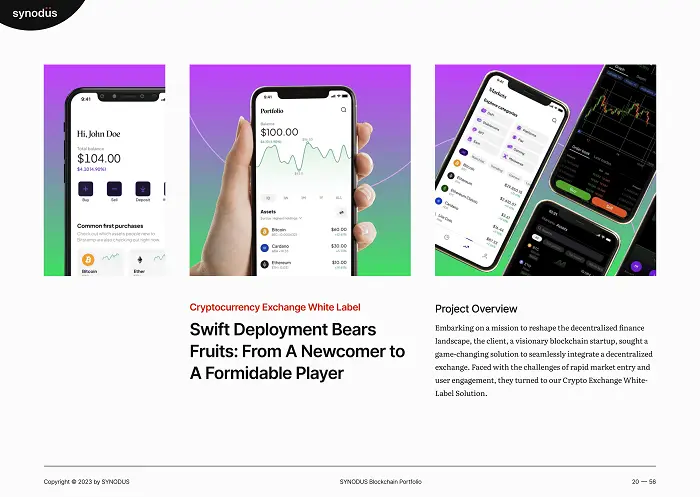

Case study: From newcomer to industry leader

A forward-thinking blockchain startup teamed up with Synodus to add a decentralized exchange to their platform. By using Synodus’ white label solution, they achieved impressive results:

- 150% boost in user engagement due to flourishing trading operations.

- Seamless integration and accelerated time-to-market.

- Compliance adherence and regulatory confidence.

This partnership changed the client’s position in the decentralized finance space, elevating them from a follower to a strong competitor in the industry.

Check out our portfolio to see how our development services have helped clients achieve faster time-to-market, increased efficiency, and greater customer satisfaction.

Conclusion

How to build a crypto exchange platform can be challenging, but with the right approach, it becomes manageable. The above guide outlines 6 key steps to help you launch your platform successfully.

Start by choosing between a white-label solution for a quicker launch or a custom build for more control. Conduct thorough market research to understand trends and identify your target audience. Ensure compliance with legal regulations and select essential features that enhance user experience – finally, partner with a reliable development company to bring your vision to life. With the right approach, you can turn your cryptocurrency exchange into a thriving business.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.