The global e-wallet app market is booming, projected to grow at a remarkable 28.3% CAGR from 2023 to 2030. For fintech founders and startups, this represents a huge opportunity to tap into a rapidly expanding digital payments ecosystem. But turning that opportunity into a successful product is far from simple.

Even the most ambitious teams face the same hurdles: tight deadlines, limited budgets, complex payment integrations, and evolving compliance requirements. Projects can drag on, MVPs may go over budget, and users quickly lose trust when performance or user experience falls short.

The difference between success and struggle often comes down to who builds your app. The right development partner brings more than just code, they bring fintech expertise, compliance know-how, and product insight that help turn your idea into a secure, scalable, and growth-ready e-wallet app.

To help you make the right choice, we’ve curated a list of the top 12 e-wallet app development companies to watch in 2026 – trusted innovators helping fintechs launch smarter, safer, and faster in an ever-evolving market.

Top 12 E-wallet app development companies

Here are the top 12 outstanding companies in E-wallet app development that we did research about and compiled into a quick comparison like this. Let’s take a look!

| Company | Location | Team size | Pricing per hour | Rating |

|---|---|---|---|---|

| Synodus | Vietnam, Singapore | 250+ | <$25 | 5/5 |

| RipenApps | India, USA, Canada, Australia, UK, UAE | 150+ | $25 – $49 | 4.7/5 |

| Codiant Software | USA; Indore, India | 350+ | <$25 | 5/5 |

| MindInventory | India, USA, Netherlands | 150+ | $25 – $49 | 4.6/5 |

| Itexus | United States, Poland | 130+ | $25 – $49 | 4.9/5 |

| Appinventiv | India, USA, UK, Australia | 1500+ | $25 – $49 | 4.7/5 |

| Apptunix | India, UAE, USA, UK | 300+ | $25 – $49 | 4.2/5 |

| Intellectsoft | USA, UK, Ukraine | 200+ | $50 – $99 | 4.9/5 |

| Consagous Technologies | India, USA | 500+ | $25 – $49 | 4.5/5 |

| OpenXcell | India, USA | 500+ | <$25 | 4.8/5 |

| Innowise | USA, UAE, UK, Germany, Switzerland, Austria, Italy, Sweden, Poland | 2000+ | $50 – $99 | 4.9/5 |

| RND Point | USA, UAE, India | 250+ | $50 – $99 | 5/5 |

1. Synodus

With more than 6 years of experience in fintech and blockchain, Synodus has become a trusted partner for building secure, scalable, and compliance-ready e-wallet apps. Unlike many vendors that focus solely on development, Synodus brings a strategic approach by combining technical excellence with real-world market insights.

As a startup-friendly company, Synodus goes beyond implementation. Their team works closely with clients to define the right product roadmap, balancing compliance requirements (KYC, AML, etc.) with user expectations and regional payment trends. This ensures your e-wallet app not only functions well but fits your business model and target market.

On the technology side, Synodus leverages modern stacks and advanced tools like blockchain, AI/ML, and big data, while prioritizing speed, security, and cost-efficiency. 90% of projects follow a fixed-cost model, helping clients avoid scope creep and billing surprises. Proposals are typically delivered within 10 days, allowing teams to move fast from idea to execution.

E-wallet capabilities include:

- Digital payments and P2P transfers

- Custodial & non-custodial wallet integration

- Compliance-ready KYC/AML features

- RegTech & transaction monitoring

- Loyalty, cashback, and rewards features

- Cross-border remittance

- AI chatbots for customer support

With 80+ successful projects delivered across 10+ industries and a 77% long-term client engagement rate, Synodus has built a reputation for long-term value, not just quick wins.

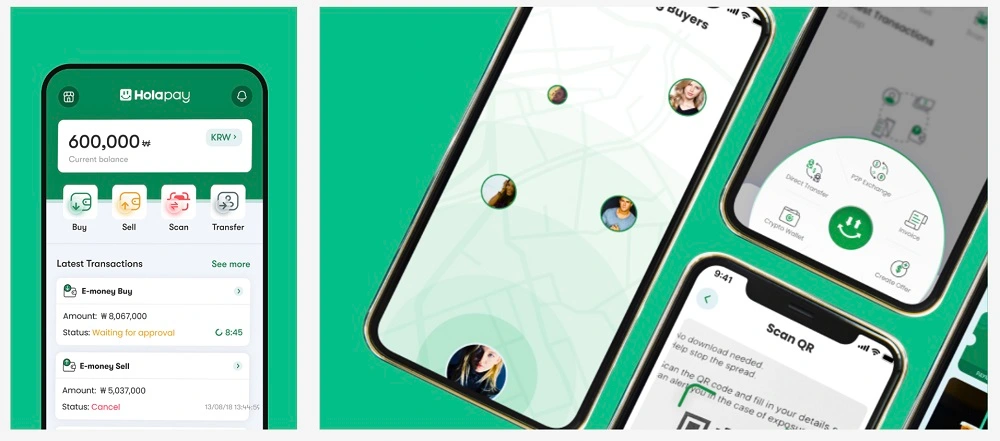

Case study: An e-wallet startup venture

Synodus partnered with Holapay from the early stage to build a secure and feature-rich e-wallet app tailored for emerging markets. The solution combined multi-layer security, peer-to-peer transfers, and both custodial and non-custodial options for the wallet. Additionally, Synodus integrated KYC and AML verification modules to ensure regulatory compliance from day one.

Delivered within four months, the app quickly reached 3 million users, thanks to its seamless UX, performance stability, and strong backend architecture. This success established the startup as a competitive player in the fintech and blockchain market, demonstrating rapid adoption and scalability.

Today, Synodus collaborates with clients across Asia, Europe, and North America to build custom e-wallet apps that prioritize scalability, security, and regulatory compliance.

Need a trusted partner for your e-wallet project?

2. RipenApps

RipenApps is a digital product development company with proven expertise in building scalable, secure e-wallet apps for startups, enterprises, and fintech innovators.

Since 2017, the team has successfully delivered 500+ mobile apps, generating more than 7 million users and $380M+ in revenue. In the digital finance space, they’ve helped launch e-wallet apps that meet high standards for usability, scalability, and compliance, supporting millions of users globally.

This e-wallet app development company is known for 95% on-time delivery and excellent value for money. Businesses working with RipenApps often report up to a 90% increase in revenue post-launch. Their proficient fintech experts promise to save 60% of your development costs while building a sustainable product.

To project clients’ sensitive data, every project is developed under NDA, with a strong focus on privacy and regulatory alignment.

E-wallet capabilities include:

- Peer-to-peer and peer-to-merchant transfers

- QR code and NFC-based payments

- Advanced security with biometric authentication and data encryption

- AI-based KYC onboarding and AML integration

- Integration with banking APIs and payment gateways

Case study: Al Muzaini: The ultimate digital remittance solution

In just 7 months, RipenApps developed Al Muzaini, a seamless, secure, and efficient money transfer app with features commonly found in e-wallets, such as real-time payment processing, AI-powered KYC verification system, and a multi-language system. The app is available on Android & iOS, reach over 100,000 downloads and 50,000+ active users, ranking as the #1 FinTech App in Kuwait.

3. Codiant Software

Codiant Software, headquartered in the USA, aims to empower enterprises with cutting-edge digital capabilities by harnessing agile development teams and next-generation AI solutions. In the realm of e-wallet app development, Codiant combines global innovation with regional insights to craft mobile and web wallet solutions that are highly secure, scalable, and tailored to market-specific needs.

Founded in 2010, Codiant has successfully delivered over 1,200 projects, spanning AI-driven platforms, digital payments, and enterprise software. They offer clients a 7-day trial to experience their services before making the final decision.

Codiant build customized digital wallets that support morden payment flows, including multi-currency and cross-border transactions. Their solutions also comply with PCI standard and utilize tokenization to ensure top-tier security.

E-wallet capabilities include:

- Peer-to-peer and QR-based money transfers

- Wallet balance management and instant bill payments

- Multi-currency and NFC-based transactions

- Integration with e-commerce and payment gateways

- Real-time transaction alerts and detailed analytics dashboards

- Encrypted architecture with tokenization and PCI DSS compliance

Case study: Monay – A digital wallet solution for merchants and financial institutions

For Monay, the development team of Codiant Software had to build the app from the ground level. Money allows users to make instant digital payments to other retailers or businesses via Monay Wallet balance, credit, and debit cards. This application provides a solution for peer-to-peer money transfer, multiple payment mode options, and multiple payment transfer methods. Besides, it also includes advanced security features to protect the customers’ data privacy.

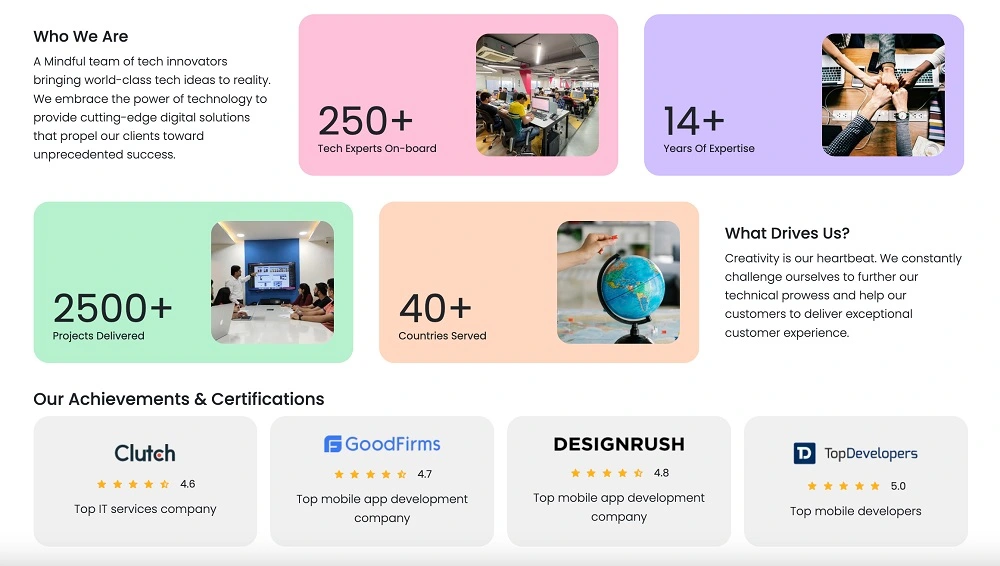

4. MindInventory

As a leading digital transformation company, MindInventory helps businesses of all sizes build secure, scalable, and regulation-compliant e-wallet apps. With a strong focus on cutting-edge fintech solutions, the team ensures measurable growth through technology, backed by a 100% refund policy that guarantees client satisfaction.

Founded in 2011, MindInventory has served over 1,600 clients from 40+ countries, including Fortune 500 companies. With a mission to redefine the future of finance, they offer full-cycle wallet development that complies with PCI DSS and DGPR standards, enabling seamless digital payment and high-level data security.

E-wallet capabilities include:

- Peer-to-peer transfers and QR/NFC-based payments

- Card and bank integration with 3D-secure authentication

- Wallet passbook with advanced filtering and transaction history

- Automated bill payments and recharges (utilities, travel, insurance)

- Real-time notifications and transaction monitoring

- Support for multi-currency and cross-border transfers

5. Itexus

Itexus aims to help start-up businesses, midsize companies, and enterprises in creating secure, scalable and regulation compliant e-wallet solutions across web and mobile software. Founded in 2013, it has 300+ Fintech projects delivered for 250+ clients in 23 countries. They can start development within 1-2 weeks of signing the contract and have your MVP live in 3-4 months.

Having deep expertise in digital wallet development, Itexus brings advanced features and robust security to every project. They have repeatedly demonstrated their ability to develop:

- QR-code payment, peer-to-peer transfers, and cryptocurrency integration

- Wallet top-up, balance tracking, withdrawals, and money transfers (to cards or other users)

- Card management and virtual card issuance

- Bill payments, recharges, and payment links

- Transaction history, expense analytics, and reporting dashboards.

Itexus regularly delivers wallets for real-world use cases such as bank-to-bank, migrant remittance apps, mobile e-wallets with ATM integration. Their commitment to security, compliance, and scalable architecture makes them a reliable partner for ambitious e-wallet initiatives.

Case study: Coinstar – Digital wallet and app ecosystem

Coinstar, a $2.2B global fintech company, chose Itexus to help them build an application because of this company’s capabilities in security, scalability, and long-term maintainability. The app enables users to buy and sell cryptocurrencies, link bank accounts, and manage balances, and handle daily transactions via smartphones. Within four months, the MVP was launched followed by 6,500+ users onboarded in just two months.

6. Appinventiv

Appinventiv, established in 2014, is an industry leader in building digital products, from mobile apps like E-wallet apps to AI-powered software. With a team of over 1,500 mobility engineers and a portfolio including more than 3,000 startups and Fortune 500 companies, Appinventiv consistently delivers high-security, high-performance solutions across the US, Europe, and MENA regions.

Focused on the digital wallet space, Appinventiv excels at creating features like multi-account management, dynamic KYC, payment gateway integration, and cross-platform compatibility. Their developers leverage AI, ML, blockchain, and emerging tech to build wallets with on-demand scalability, robust security, and exceptional user experiences.

E-wallet capabilities include:

- Peer-to-peer payments and QR/NFC contactless transactions

- Account top-up, balance management, and virtual card issuance

- Bill payments, service recharges, and payment link support

- Transaction history with analytic dashboards and real-time notifications

- Multi-currency functionality and secure wallet-to-bank transfers

- Loyalty rewards, discounts, and chatbot/customer support integration

Case study: Asian Bank – Crypto-enabled digital wallet

Appinventiv partnered with a leading Asian bank to develop a digital wallet that enables users to store and spend cryptocurrencies via linked debit cards. The app supports real-time crypto transactions, in-store payments, and a smooth user experience. It reached 250,000+ downloads and processed over 50,000 transactions shortly after launch.

7. Apptunix

Apptunix, established in 2013, empowers startups and enterprises to build secure, scalable, and feature-rich digital wallet apps. With over 2,500 clients across 25+ countries and 2,000+ launched digital solutions, their team applies cutting-edge technologies, such as AI, ML big data analytics, RPA, and cybersecurity to develop tailored fintech applications.

They offer end-to-end e-wallet app development, from ideation to deployment, integrating modern features like chatbot support, voice recognition, data analytics, and secure authentication systems.

E-wallet capabilities include:

- Peer-to-peer and merchant transfers via QR/NFC-enabled transactions

- Account top-up, wallet balance monitoring, and virtual card issuance

- Bill payments and service recharges with payment link support

- Transaction history with analytics dashboard and real-time notifications

- Biometric and multi-factor authentication, data encryption, and compliance-level security

Case study: comfyPay – Retail digital wallet

Appinventiv created ComfyPay, a retail-focused e‑wallet app enabling QR-based peer-to-peer transfers, instant bill payments, and virtual loyalty cards. The solution integrates chatbot assistance, voice interaction, and real-time notifications. Shortly after launch, ComfyPay recorded 100,000+ downloads and 40,000 monthly active users, demonstrating Appinventiv’s strength in building user-centric wallet apps.

8. Intellectsoft

Intellectsoft is an E-wallet app development company with over 17 years of market experience in digital transformation. The company help enterprises adopt emerging technologies, enhance internal operations, and deliver better customer experiences. Known for successfully launching both MVPs and full-scale fintech products, Intellectsoft brings reliability and innovation to financial software.

E-wallet capabilities include:

- P2P payment and digital money transfers

- In-app currency management

- Blockchain-based wallet development

- Real-time transaction synchronization

- PCI DSS and GDPR compliance

- Intuitive, gesture-based mobile user interface

- Biometric authentication (fingerprint, face ID)

Case study – Blockchain Wallet App:

Intellectsoft built a secure mobile wallet that allows users to send and receive Bitcoin and Ethereum through intuitive gestures. The app ensured anonymous, real-time transactions, offering a seamless user experience while maintaining enterprise-grade security. It also included multi-signature support, biometric authentication, and backup recovery options to enhance user control and safety. The wallet was developed for both iOS and Android platforms with a scalable architecture, allowing easy integration of additional cryptocurrencies in the future.

9. Consagous Technologies

Consagous Technologies, founded in 2008, is global Web & Mobile App development company with a track record in fintech. With 700+ successful projects, 689+ happy clients, and 25+ industry awards, they deliver solutions 20% faster without compromising on quality.

Focused on digital wallet services, Consagous builds secure, and compliant e-wallet applications designed for seamless financial transactions.

E-wallet capabilities include:

- QR code and NFC-based payments

- Debit and credit card integration

- Wallet top-up via mobile number or bank

- Real-time transaction monitoring

- Role-based access control

- Multi-currency and multi-language support

Case study: BongaPay – a transformative financial conduit platform

BongaPay’s mission is to democratize financial services, providing seamless integration of transactive functionalities tailored to empower daily economic engagements in underserved regions. This platform has integrated mobile wallet functionality, allowing users to link their bank debit cards via their registered phone numbers, enabling easy peer-to-peer (P2P) transactions. It is also accompanied by a messaging feature with payment notifications for more clarity between transaction parties.

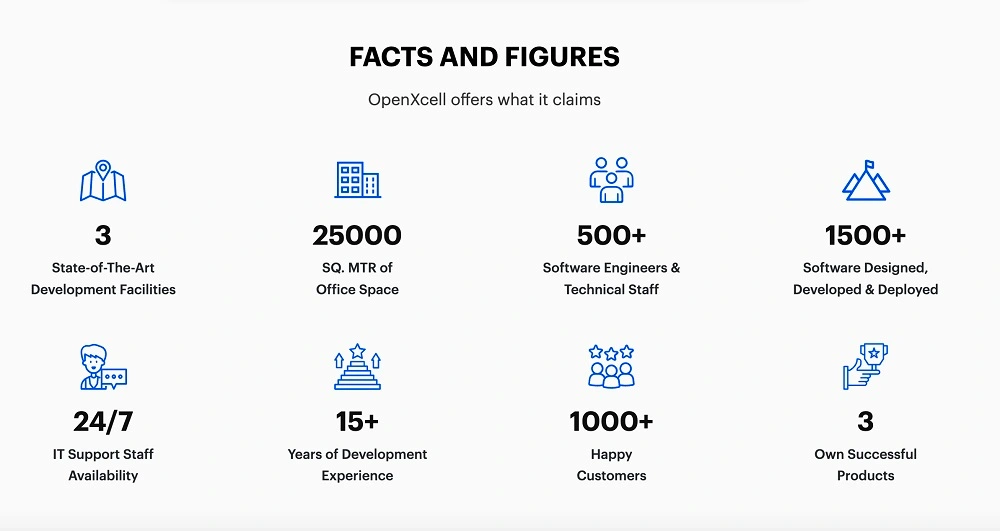

10. OpenXcell

OpenXcell offers AI-powered E-wallet app development services designed to enhance transaction security, streamline payment processes, and deliver engaging user experiences. With a proven track record of 1,000+ clients and 20% faster product delivery, the company ensures high efficiency and responsive 24/7 support.

E-wallet capabilities include:

- AI-based fraud detection and automated payments

- Encrypted transactions with multi-layered security

- Reward system integration

- Intuitive and scalable user experience

- Robust backend infrastructure for high performance

By leveraging cutting-edge AI and secure development practices, OpenXcell builds digital wallet solutions that drive innovation and resilience in the digital finance space.

Case study: Speed – Bitcoin payment integration

OpenXcell partnered with Speed to build a seamless Bitcoin-powered e-wallet platform. The app allowed users to pay using Bitcoin with real-time conversions, reducing transaction time and cost significantly. Key features included dynamic QR code payments, real-time transaction dashboards, and enhanced transparency without relying on third-party intermediaries. The solution helped Speed’s users save up to 65% in transfer fees while enabling instant, borderless payments.

11. Innowise

Innowise is an international full-cycle software development company with a strong focus on fintech innovation, especially in e-wallet app development. With over 17 years of experience and a presence in the USA, UK, EU, and the Middle East, they empower startups and enterprises to build robust, user-friendly digital wallets that meet today’s evolving financial needs.

They deliver custom wallet solutions that combine smooth user experiences, real-time transactions, and ironclad security, helping businesses launch competitive fintech products while staying compliant with financial regulations.

E-wallet capabilities include:

- User authentication & security

- Multi-card & multi-currency management

- Peer-to-peer (P2P) transfers

- Contactless payments

- Real-time transaction tracking

- Admin dashboard & analytics

With a 93% client retention rate and solutions trusted by businesses in over 60 countries, Innowise is ready to bring your e-wallet vision to life securely, swiftly, and at scale.

Case study: Secure ID scanner & digital wallet app

The client asked Innowise to upgrade their digital wallet app to store essential documents like ID cards, credit cards, and membership passes in one secure platform. The team enhanced the app through code optimization, ID and age verification, access control integration, and digitalization of membership cards. The 15-month project achieved 40% faster performance and 65% reduction in storage usage, improving both speed and security.

12. RND Point

RND Point is a Fintech-focused software development company with over 250 experts and 120+ completed projects. With an average time-to-market of just 3 months, RND Point delivers tailored financial solutions, including eWallets and money transfer apps, to banks and startups alike.

E-wallet capabilities include:

- P2P & contactless payments

- Digital savings and lending

- Flexible wallet configuration

- Advanced security & fraud protection

- Multiple third-party integrations

Whether building from scratch or modernizing legacy systems, RND Point ensures seamless digital finance experiences across web and mobile.

Case study: Rescue and relaunch of a digital wallet app

A fintech client approached RND Point with an incomplete e-wallet app built on outdated technology and poor backend architecture. The team conducted a full code audit, resolved major development issues, and rebuilt the app for better security and performance. Within 6 months, they launched a smooth, secure wallet experience and supported a full rebranding campaign to enhance the app’s market appeal.

How do you choose an e-wallet app development company?

Experience and expertise

Choosing a company with the right experience can make or break your project. Startups often face unexpected challenges such as MVP delays, scaling issues, or integration failures. An experienced provider not only knows how to navigate these hurdles but also has a proven track record of fintech app development company projects and similar e-wallet apps. Look for portfolios, case studies, and client reviews that show their ability to deliver real-world solutions under tight timelines.

Security & regulatory compliance

E-wallet deal with highly sensitive financial data. Any lapse in fintech app security or compliance can result in fines, reputational damage, or loss of user trust. The company you choose should follow PCI-DSS, GDPR, and KYC standards and implement security best practices from day one. Ensure their team understands regulatory requirements, builds secure architecture, and can handle ongoing updates to maintain compliance.

Tech stack

A productive, scalable, and secure app depends on the tech stack. Make sure your development partner is proficient in front-end and back-end technologies, cross-platform frameworks like React Native or Flutter, and server-side solutions like Node.js, Java, or Go. If your app requires payment gateway integrations, API ecosystems, blockchain features, or AI-powered fraud detection, confirm that the team has hands-on experience in these areas.

Customizability and scalability

The e-wallet you build today should evolve with your business tomorrow. Apps that cannot adapt risk losing users to more flexible competitors. Your chosen company should be able to implement custom features such as multi-currency support, loyalty programs, and modular architecture that allows future enhancements. Scalability planning ensures the app performs reliably as user numbers grow.

Cost and budget

Low development costs can come at a hight price – delayed delivery, compromised security, or subpar UX. Choose a company with transparent pricing, a strong reputation, and proven results. A trusted partner balances cost with quality, helping you launch a secure, scalable, and high-performing e-wallet app without hidden fees.

If you’re looking for a trusted partner that balances quality with cost transparency, consider Synodus. With extensive experience in e-wallet development, secure architecture, scalable solutions, and custom integrations, we help startups and fintechs launch apps that meet business goals while maintaining user trust and regulatory compliance.

Conclusion

Partnering with a suitable e-wallet app development company is key to success in the fast-growing digital payments space. The firms listed here offer top-tier expertise, security, and innovation to bring your payment solution to life. Partner with one of these leading developers in 2026 to build a seamless, future-ready e-wallet app for your business.

FAQs

E-wallet application development costs vary widely depending on the app’s features, platforms, and the team you hire. They start at $10,000 for a simple MVP and exceed $250,000 for advanced versions.

3 to 6 months is the typical timeframe to build a fully functional eWallet mobile app, depending on your business needs, project complexity and features set.

An eWallet app development company should comply with key standards like PCI-DSS, ensure data privacy (e.g., GDPR), implement multi-factor authentication, secure data transmission and storage, protect against fraud, and conduct regular security audits and updates.

Yes, you can hire an eWallet development team from overseas. Many top firms offer remote services, providing access to skilled developers globally. This approach is often cost-effective and efficient, but ensure the team has strong communication, a solid portfolio, and works within compatible time zones for smooth collaboration.

Common mistakes include choosing inexperienced vendors, ignoring security and compliance, and underestimating technical complexity. Focusing only on low cost or skipping UX testing can also harm adoption. Partnering with an experienced e-wallet development company helps ensure a secure, scalable, and user-friendly app

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.