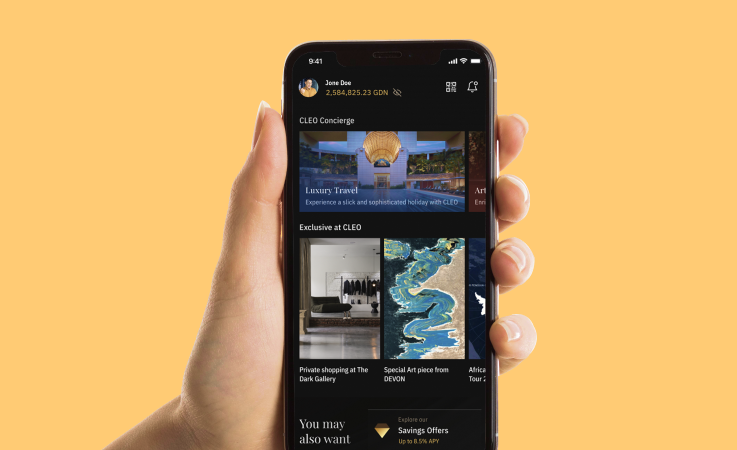

Picture a financial app that isn’t just about money but about enriching a high-end lifestyle. CLEO is that specialized platform designed for ultra-high-net-worth individuals, offering a personalized financial experience beyond the ordinary. It’s not just about transactions; it’s about creating a world where financial aspirations align seamlessly with exclusive lifestyle preferences.

Challenge

Charting a new course in banking innovation

CLEO’s founders, with an intricate understanding of banking intricacies and a profound connection to the Ultra High Net Worth Individuals (UHNWI) in Southeast Asia, envisioned an innovative digital banking experience. However, the challenge loomed large – transforming these visionary ideas into a tangible, secure, and dependable digital banking ecosystem.

Chosen for expertise and ethos

Our team’s profound comprehension of the banking sphere set us apart among contenders. Selected for our technical acumen and partnership ethos, Synodus brought a promise of unparalleled innovation. Our collaboration ensured CLEO, an avant-garde digital banking platform. This bespoke solution seamlessly merged traditional banking with elite wealth management, leveraging cutting-edge technologies.

Our solution

Let’s take a glimpse into our transformative voyage.

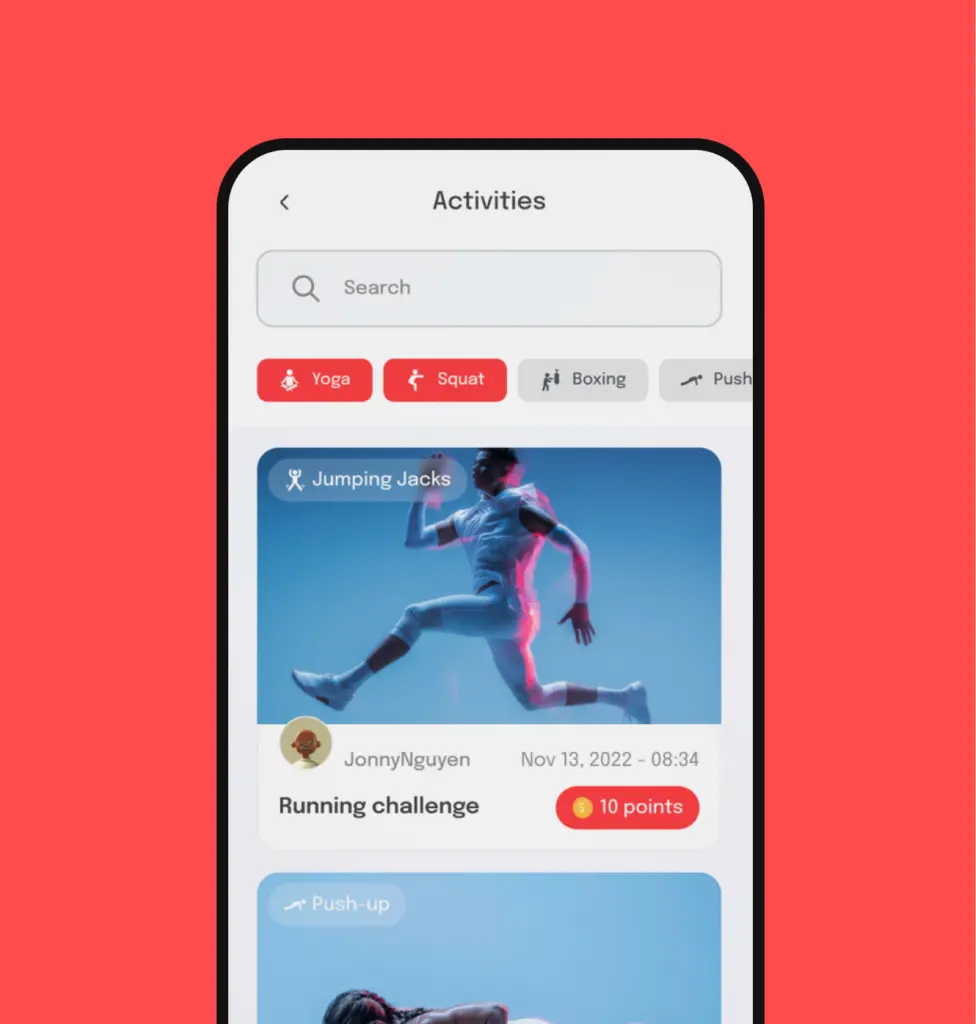

- Tailored private banking ecosystem: Shaped by exhaustive market research and astute product planning led by a proficient market researcher and senior product manager, our approach crafted a bespoke Private Banking ecosystem.

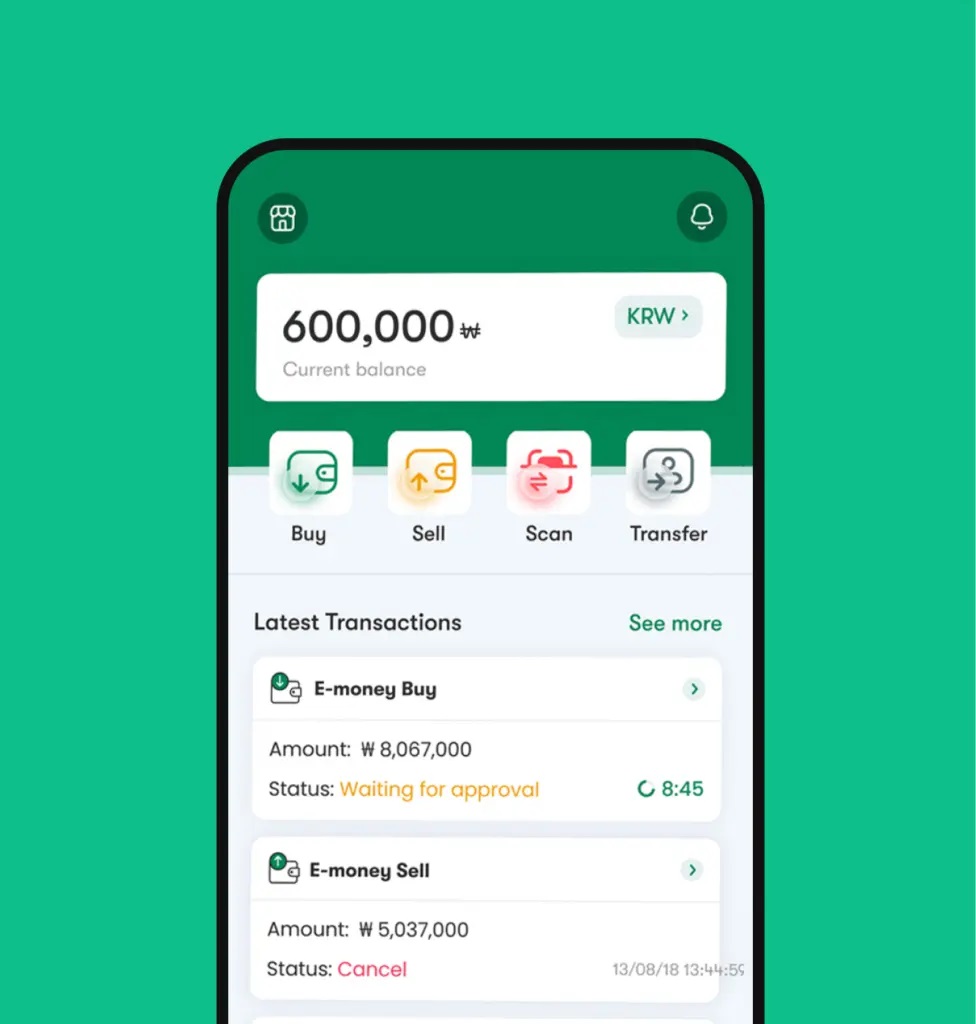

- Central bank-endorsed stable coin & custom private bank: Engineered a Stable Coin authorized by the Central Bank, enabling the creation of a Custom Private Bank exclusively designed for High-Net-Worth Individuals (HNWI), aligning precisely with market insights.

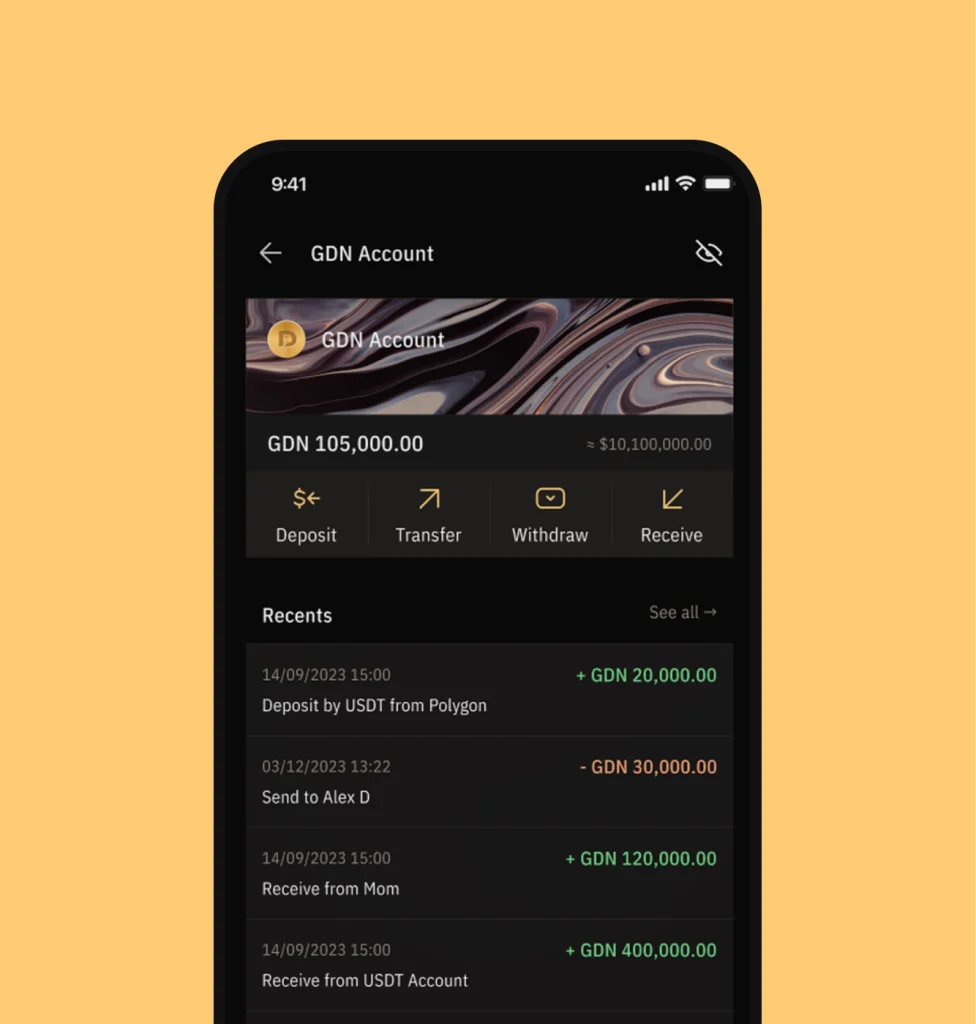

- Cutting-edge tech stack & blockchain integration: Leveraged advanced technologies and seamless integration with diverse blockchain networks (Bitcoin, Polygon, Tron, etc.) ensuring a secure, intuitive, and innovative Private Banking experience.

- Integrated services for enhanced client experience:

- CASA account management: Seamlessly integrated within the platform for effortless transactions and crypto management tailored to HNWI preferences.

- Savings & secure lending: Developed secure and personalized savings and lending services tailored precisely to the needs of affluent clients.

- Efficient payments: Leveraged IDC/ICC for secure and swift transactions, seamlessly integrated into the platform.

- Tailored concierge service: Embedded a bespoke concierge service, offering personalized assistance and lifestyle management, meeting the discerning needs of affluent clientele.

Result & impacts

Navigating the tumultuous early startup phase, our team iterated and refined the product extensively. Through resilience and collaboration, we forged a pioneering Private Banking platform.

In the nascent seed stage, our prototype garnered encouraging market feedback. As we journey towards product development, these positive signals drive our momentum, affirming our path to crafting an innovative solution that resonates with the market’s needs.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.