Project summary

In a landscape dominated by giants, our client, a RegTech startup, sets their sight on an underserved market, bringing affordable Anti-Money Laundering (AML) compliance to low-margin sectors. Despite being novices in RegTech, Synodus undertook the challenge with an agile mindset and commitment to deliver. In just 9 months, we not only crafted a groundbreaking platform but also slashed our client’s initial budget by 30%.

Challenge

The founder, with over 30 years in Anti-Money Laundering (AML), soon spotted a niche overlooked by big RegTech firms. These giants mainly cater to well-established financial institutions, neglecting smaller companies.

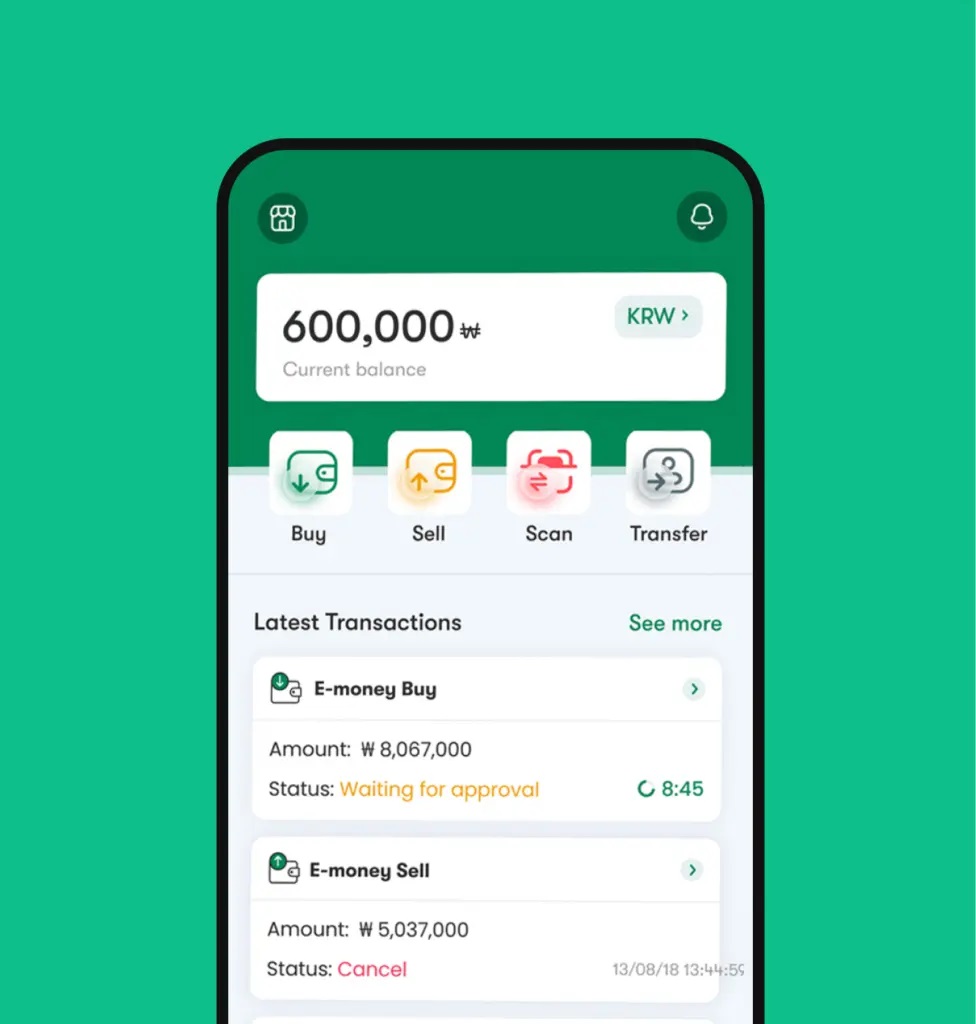

Seeing this untapped potential, our client launched a RegTech startup, offering compliance solution tailored for remittance services, micro-finance firms, and rural banks, to combat money laundering and related crimes.

The last piece he needed was a tech partner that can assist him throughout the product life cycle, adapt to high-level requirements and work within a startup budget.

Our solution & approach

How to be cost-effective?

For us, this project was a challenge. At that point, we had never done any RegTech-focused projects, despite having worked with multiple Fintech companies with strict regulations.

Yet, we secured the deal by offering a solution that underscored our commitment to product quality using value-based delivery model. This strategy balances cost and quality, ensuring an in-budget solution that matches our client’s complex requirements.

To reduce costs, we eschewed traditional roles like Project Manager and Quality Control. It did feel a bit risky. Like how will we ensure the final quality and deadlines without a dedicated quality team?

To ease it down, we combined it with the Agile & Scrum methodology, in which we decide how much our client must pay based on the deliverable and its value. This structure emphasizes customer value and is directly tied to effective work. It incentivizes our team to maintain a high focus, as our revenue is directly impacted by our performance.

For starups, having a trustworthy partner is an absolute dream. Synodus can be your right match!

From requirements to deliverables: Agile at its best

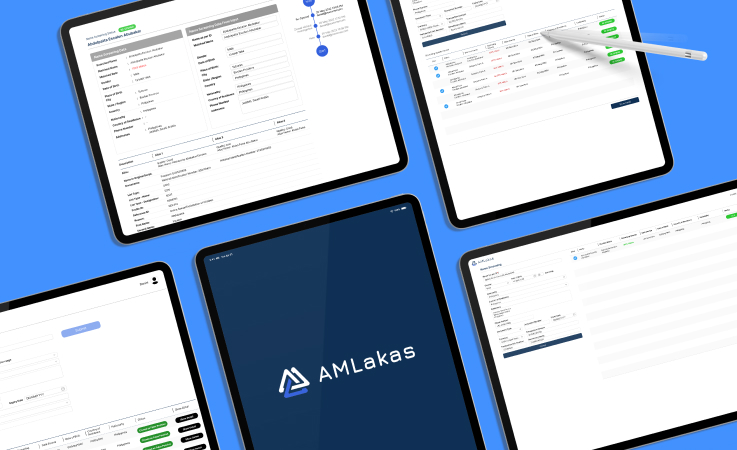

After 9 months, we crafted a microservices solution, backed by AWS to address Anti-Money Laundering obligations. The feature-rich application, showered with a friendly ReactJS interface, promised to be an assistant to small to mid-sized financial ventures.

The key offerings included:

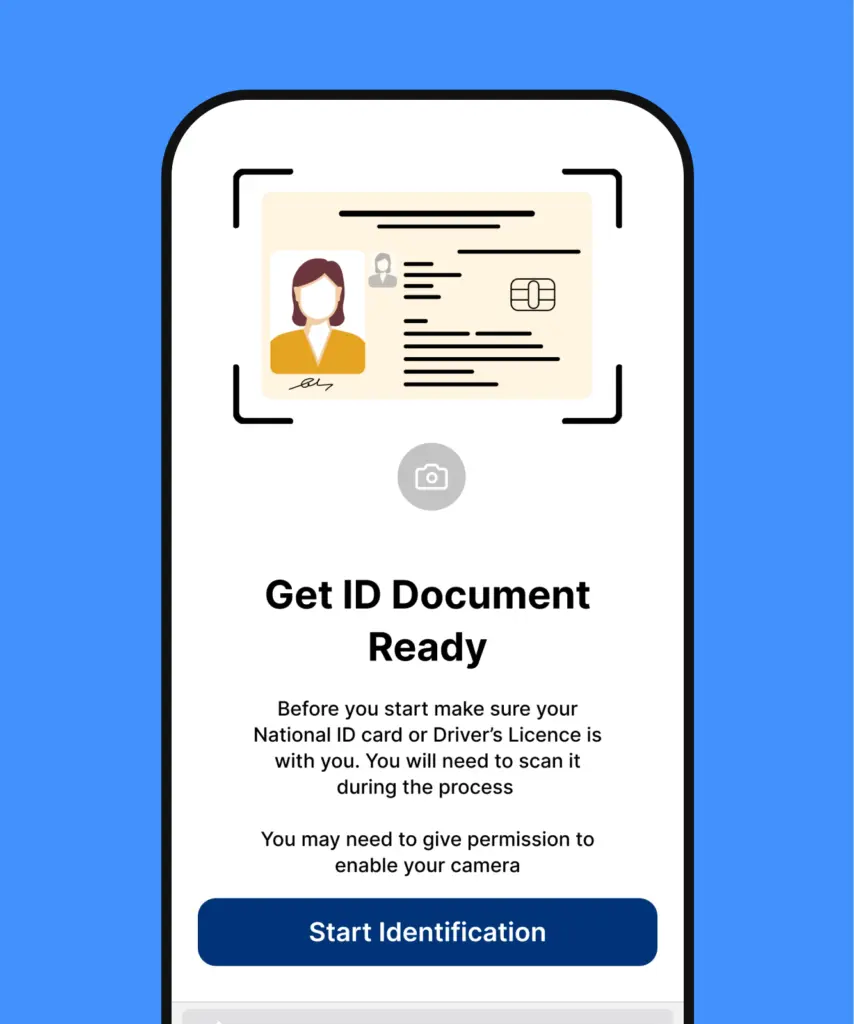

- Digital customer onboarding with identity proofing and remote guidance.

- Secondary security layer for the user-side with automated watch-list screening, Amazon RDS with encryption and Know Your Customer (KYC) processes.

- A versatile and scalable backend built with NodeJS, supported by Kafka, Redis & Kubernetes for data processing and orchestration.

- A Nature & Purpose Risk Assessment of Relationship, providing financial businesses with valuable insights into their customers’ credibility. This assessment drew from the standards of the World Bank, the Asian Development Bank, Alliance for Financial Inclusion, and the Centre for Financial Inclusion.

Notable results

We are proud of this project. Setting all the numbers aside, the idea itself is impact-driven and community-minded. With the KYC & AML solution, underbanked sectors can protect their integrity and join forces to address associated crimes.

This motivated us to support our client, both technically and financially, despite having minimal expertise in Regtech at first.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.