Our client, a Fortune 500 player in aircraft equipment leasing, successfully hallmarked their brand name through the years. Catering to domestic and international airlines, the business thrived with unwavering dedication, yet certain cumbersome were unveiled.

Challenge: Data conundrum cast shadow on executive’s decision-making

The risks from fumbling over million-dollar leasing contracts can interrupt any operation. One reason causing this is not accurately identifying how a customer can attain timely payments and liquidity resources.

Unfortunately, our client often found themselves running around this financial data. The manual calculation was so time-consuming and error-prone that it slowly killed the executive’s performance.

Inconsistencies in tracking payment histories made it difficult to form a clear customer profile, and the lack of a centralized data hub added to the chaos.

All this created a constant flux that clouded the decision-making, leaving the executives relying on emotional biases and personal opinions rather than factual analysis.

Recognizing the bottlenecks, our client realized they needed a smart scoring system as soon as possible.

Our solution

How we got selected

As Microsoft’s Gold Partner in Data and expert in custom development, we promised to alter this messy database into a scoring system that yields meaningful information.

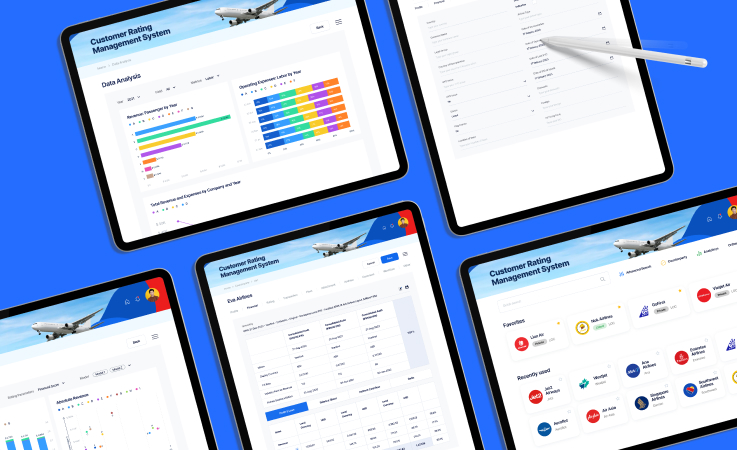

This background positioned us perfectly for the overhaul: revamping their rating and leasing system, focusing on:

- Making it automatic with accuracy.

- Making it flexible where our client can adapt to market dynamics and unstable customer behaviors.

Data + Tech

All this madness was rooted in a decentralized data system. And that’s where our focus starts first. We underwent an extensive collection phase from all internal and external sources.

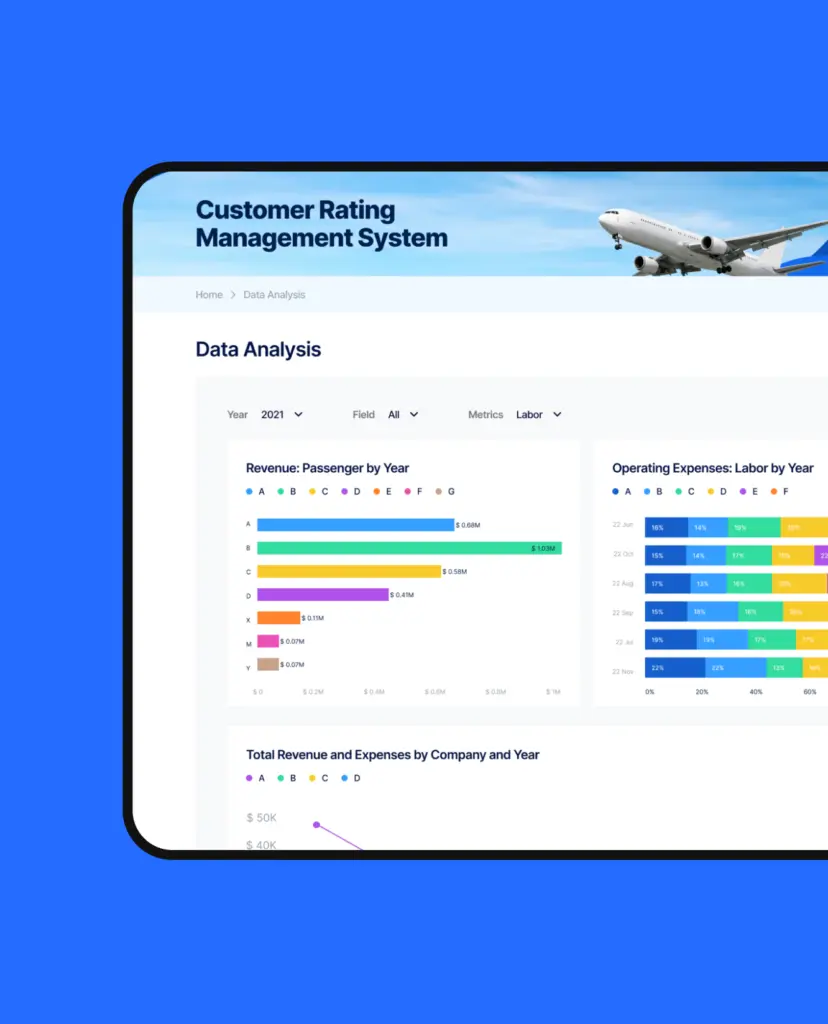

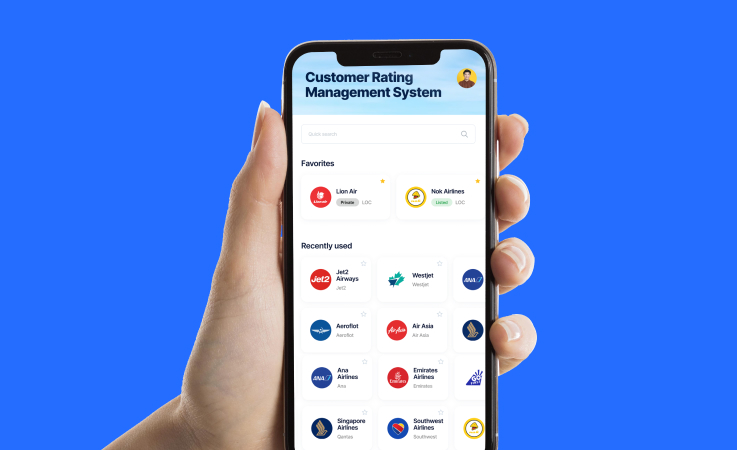

Using the automated credit scoring system, our client can track transaction history, financial records and data. From there, executives can retrieve required information in the palm of their hand at any time.

Moreover, the system smartly categorizes customer profiles based on criteria set by our clients. This rating system can be modified according to our client’s needs and industry dynamics, ensuring they always stay ahead of the curve.

With a real-time feedback loop, they can also swiftly address any issues and make precise decisions based on instant customer insights.

Are you having the same problem?

Move faster, lead better

Embracing the automated rating system, our client recorded impeccable results.

In the blink of an eye, what used to be a laborious 10-day ordeal now unfolds in a swift 2 days, prompting blazing-fast customer services.

The data hub is now at every executive’s fingertip, equipping them with clarity to make low risk leasing plans and better solve their customer problems.

Having technology and data as sidekicks is a game-changer for your decision-making.

A custom system, made specifically to fit your business model and customer base, might be the ultimate choice to erase any bottlenecks.

(*) We take our clients’ confidentiality seriously. While we have either modified names or refrained from disclosing them, the results are real.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.