The differences between crypto exchange and wallet

Comparison table of crypto exchange vs wallet

The critical difference between crypto exchange and crypto wallet lies in function, security, and control. Exchanges facilitate trading and provide liquidity, while wallets focus on the secure storage of cryptocurrencies. Exchanges control the private keys, while wallets give users complete control over their assets. More specifically:

| Feature | Crypto exchange | Crypto wallet |

|---|---|---|

| Explanation | Platform for buying, selling, and trading cryptocurrencies | Secure storage solution for digital assets |

| Advantages | – Revenue from trading fees, listing fees, and other services – Ability to trade a wide variety of tokens | – Better security, as users have complete control over their assets – Users can store their cryptocurrencies offline for more security |

| Disadvantages | – Centralized nature makes them more prone to risks like hacking and regulatory actions – Exchange must earn user trust with funds and data. | – Less convenient for frequent trading compared to exchanges – Technically demanding to use securely |

| Function | A marketplace for executing trades and managing cryptocurrency transactions | Secure digital asset storage |

| Security | – Controls the private keys, which could lead to risks if they get breached or face technical problems | – Gives users complete control over their private keys, reducing the risk of others accessing their crypto |

| Accessibility | – User-friendly interfaces make them more accessible for beginners to use | – May require technical knowledge for transactions |

| Fees | – Charges fees for trades, deposits, and withdrawals | – May charge network fees for transactions |

| Liquidity | – Provides high liquidity, allowing for quick trading | – Don’t provide liquidity |

| Business model | – Revenue from trading fees, listing fees, and other services | – Revenue from fees for additional features or partnerships |

| Target audience | – Traders, investors, and institutions | – Individuals seeking more control over their crypto assets |

| Technical expertise | – Requires a strong technical team for building and maintaining a secure platform | – Can be less technically demanding but still requires knowledge of blockchain technology |

| Regulatory compliance | – Must comply with various regulations, including KYC/AML and securities laws | – May have fewer regulatory burdens but still need to adhere to relevant laws |

These features provide a foundational understanding of how crypto exchange or wallet operate differently. We can explore each aspect in more detail to delve deeper into these distinctions.

The key differences

1. Functionality

Crypto exchanges: These platforms serve as marketplaces where users can trade various cryptocurrencies. They provide liquidity and facilitate price discovery, making them essential for active traders. Users can execute trades based on real-time market data.

Crypto wallets: Unlike exchanges, wallets are designed primarily for the secure storage of cryptocurrencies. They allow users to send and receive digital assets while giving them complete control over their private keys.

Note: This distinction highlights how exchanges focus on trading while wallets emphasize security.

2. Security

Exchanges: Centralized exchanges hold users’ funds and private keys, which can lead to vulnerabilities if the platform is hacked. While they implement security measures like two-factor authentication and cold storage, they remain attractive targets for cyberattacks.

Wallets: By allowing users to manage their private keys, wallets significantly reduce the risk of unauthorized access. Cold wallets (hardware wallets) offer enhanced security by storing keys offline.

Note: User control is essential for protecting digital assets. This difference highlights its significance.

3. Accessibility

Exchanges: When comparing crypto wallet vs exchange, exchanges typically feature user-friendly interfaces that cater to beginners and provide constant access to funds, making them convenient for frequent trading.

Wallets: While they can be accessed anytime, using them securely may require more technical knowledge, especially when managing private keys and executing transactions.

Note: While exchanges prioritize ease of use for trading, wallets demand a more cautious approach from users.

4. Fees

Exchanges: Users incur various fees related to trading activities, including transaction fees on trades and withdrawal fees.

Wallets: Generally charge network fees for sending transactions but don’t impose additional fees for holding assets.

Note: This fee structure illustrates how exchanges monetize trading activity compared to the more straightforward cost model of wallets.

5. Liquidity

Exchanges: In the cryptocurrency exchange vs wallet debate, exchanges offer higher liquidity, enabling users to buy or sell assets without significant price impact quickly.

Wallets: Don’t provide liquidity since they are primarily storage solutions rather than trading platforms.

Note: Exchanges facilitate market activity, while wallets serve a different purpose.

6. Business models

Exchanges: Generate revenue through transaction fees, listing new tokens, and providing additional services like margin trading.

Wallets: May charge fees for premium features or partnerships but primarily focus on providing secure storage solutions.

Note: This contrast in business models reflects their differing roles in the cryptocurrency ecosystem.

7. Target audience

Exchanges: Cater to traders looking for quick transactions and diverse asset options.

Wallets: Appeal to individuals prioritizing security and control over their digital assets.

Note: Understanding these target audiences helps clarify why each platform exists within the broader cryptocurrency landscape.

Should you build a crypto exchange or crypto wallet?

Before diving into either, you should understand the nitty-gritty. Think about the difference between crypto wallet and exchange, what customers are asking for, and the regulatory landscapes associated with each option. This will help startups in the fintech and blockchain space make the best choice for their cryptocurrency business.

Crypto Exchange

Best for:

- Startups looking to facilitate users’ trading of cryptocurrencies.

- Companies aiming to generate revenue through trading fees or other financial services.

- Businesses focused on creating liquidity and allowing users to buy, sell, and exchange different crypto assets.

Things to consider before building:

- Regulatory compliance: Crypto exchanges are subject to strict regulations that vary by country. You must invest in legal expertise to ensure compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) laws.

- Security measures: As exchanges handle large volumes of user funds, security is critical. You’ll need robust measures to prevent hacks, including cold storage, encryption, and multi-factor authentication.

- Liquidity & Volume: For a successful exchange, you need high trading volumes and liquidity. This might require partnerships or attracting institutional investors early on.

- User trust: Building a reputation for transparency and reliability is vital, as trust is crucial in users choosing an exchange.

Crypto Wallet

Best for:

- Startups focusing on secure storage of cryptocurrency for users rather than trading.

- Companies that want to offer a non-custodial solution where users control their private keys.

- Businesses aiming to provide users with a simple interface for managing their crypto assets, like sending, receiving, or holding coins.

Things to consider before building:

- Security and privacy: Wallets must ensure the security of private keys with features like encryption, hardware support, or biometric login. Decide whether to offer custodial or non-custodial wallets, as each has different security responsibilities.

- Compatibility & Support: You must decide which blockchains and tokens the wallet will support, from Bitcoin and Ethereum to newer or specialized tokens.

- User experience (UX): Wallets should be simple and intuitive, especially for non-technical users. Consider whether you want to add features like transaction history, token swaps, or staking.

- Transaction fees: If your wallet allows transactions, you must factor in blockchain network fees and how they impact user experience.

Want a crypto wallet or a crypto exchange? – Synodus can do it all

With over 9 years of experience in blockchain development, Synodus brings a unique combination of technical expertise and deep market insight to help clients build successful crypto exchange and crypto wallet platforms. Our services are designed specifically for ambitious startups and innovative businesses that are ready to make their mark in the fast-evolving crypto space.

At Synodus, we understand that one-size-fits-all solutions don’t work in this competitive market. That’s why our crypto exchange and crypto wallet development services are fully customizable to align with your specific business goals, whether you’re looking to launch a centralized or decentralized exchange, or develop a secure, user-friendly wallet for your customers.

Our comprehensive solutions

1. Innovative crypto wallets

We create wallets that users trust and love:

- Decentralized wallets: Putting control directly in users’ hands

- Mobile and web wallets: Seamless transactions, anywhere, anytime

- NFT and tokenized asset wallets: Riding the wave of digital collectibles

2. Powerful crypto exchanges

Launch your exchange with confidence:

- White label platforms: Your unique brand, backed by our robust technology

- P2P decentralized exchanges: Direct user-to-user trading, maximizing efficiency

- Smart contract-enabled DEX: Automation and security at the forefront

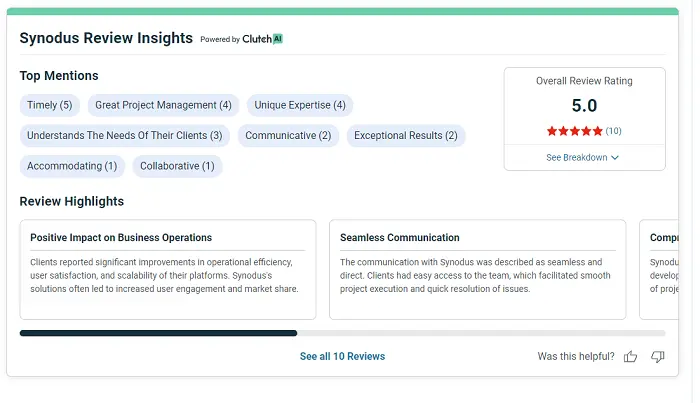

Our crypto wallet and crypto exchange success stories

Our track record speaks volumes about our capabilities. Let’s look at 2 projects that showcase how Synodus transforms ideas into market-leading solutions, whether they’re crypto exchange or wallet options.

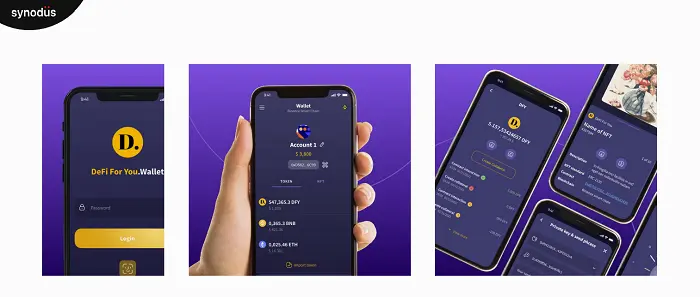

Defi for you’s game-chaning crypto wallet

Project overview

Synodus developed a decentralized crypto wallet integrated into the DeFi For You platform. This innovative solution streamlined user actions like signing transactions and fund approvals, eliminating the need for users to switch between multiple apps.

Challenges

The project faced several challenges, including ensuring robust security for private keys, achieving interoperability with various wallets and blockchains, maintaining scalability to handle increased transaction volumes, enhancing user experience, and ensuring compliance with regulatory standards.

How Synodus addressed the challenges

To tackle these issues, Synodus implemented advanced encryption and secure storage using WalletCore for private keys. The wallet was integrated with major platforms like Metamask and TrustWallet to ensure seamless interoperability. Layer-2 protocols and load balancing techniques were used to enhance scalability. An intuitive UI/UX design was created for easy wallet setup and management, while compliance with KYC/AML and GDPR regulations was prioritized.

Results & Impacts

The result was a secure, user-friendly decentralized wallet that allowed for smooth transactions across multiple cryptocurrencies, significantly enhancing the user experience on the DeFi For You platform while meeting regulatory requirements.

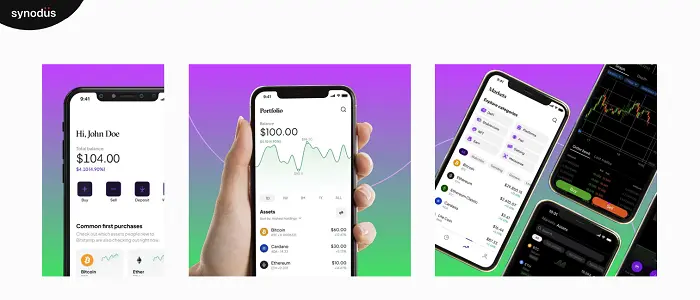

White-lable crypto exchange success

Project overview

Synodus partnered with a visionary blockchain startup to develop a White Label Crypto Exchange solution, enabling rapid integration of a decentralized exchange. This initiative aimed to reshape the decentralized finance landscape and boost user engagement, with a project timeline of just five months.

Challenges

The client faced significant challenges, including the need for swift market entry amidst growing demand in the decentralized finance sector. Regulatory complexities posed compliance concerns, while resource constraints made in-house development impractical. The client sought a solution that would help them navigate these challenges with agility and confidence.

How Synodus addressed the challenges

Synodus provided a customizable white-label solution that allowed for rapid deployment of the exchange, bypassing the lengthy development process. The platform was tailored to align with the client’s brand identity, ensuring a unique user experience. Advanced security features, including multi-signature wallets and regular audits, safeguarded user assets. The solution was designed for scalability to accommodate growing user volumes and provided ongoing support to adapt to evolving regulations.

Results & Impacts

Empowered by Synodus’s white-label solution, the client experienced a 150% boost in user engagement, established regulatory confidence, and accelerated their time-to-market. This swift integration transformed their presence in the decentralized finance arena, elevating them from a newcomer to a formidable industry player.

The two case studies demonstrate that partnering with Synodus leads to successful crypto solutions, showcasing how effective security, rapid deployment, and customization can significantly enhance user engagement and market presence.

When you partner with Synodus, you’re experiencing the same level of achievement for your crypto business.

Check out our portfolio for how our development services have helped clients speed up their launches, boost efficiency, and exceed customer expectations.

Why partner with Synodus?

Choosing Synodus provides clients with the following advantages

- Significant cost savings: Up to 73.71% reduction in development costs

- Accelerated time-to-market: Swift project initiation and clear milestones

- Market-aligned products: Our experts ensure your offering meets real market needs

But how do we consistently deliver these advantages? The secret lies in our innovative approach to project management and development.

1. Our hybrid model

Synodus applies a hybrid model to deliver a more cost-effective and efficient solution for businesses.

First, the initial phases (like planning, setting the scope, involving the project manager, tech lead, QA, BA, and design) follow the ODC (Offshore Development Center) model. Then, after the project direction is clear, the actual development follows a fixed-cost model where businesses pay for each milestone.

This approach not only reduces costs compared to traditional ODC or fixed-cost models but also improves efficiency by ensuring the entire plan is finalized before development begins, minimizing risks and optimizing the process.

2. Reasonable prices

Synodus operates a development team in Vietnam, which enables us to offer competitive pricing. Our hourly rates range from $16 to $30, significantly lower than the average rates for cryptocurrency exchange development in the market, which range from $25 to $150 (based on our research on reputable B2B review sites like Clutch). Choosing Synodus could save you up to approximately 73.71% on development costs per hour compared to the average market price.

3. Ability to seliver quickly

We will contact you within 24 hours to discuss your goals, needs, and constraints. A senior business analyst and technical lead will then analyze your requirements and craft a customized roadmap. Within just 5 working days, you’ll receive a detailed proposal with a technical assessment, and project onboarding will begin within 14 days.

4. Blockchain mastery

Our team of over 250 dedicated professionals not only follows trends but also sets them. With cutting-edge blockchain expertise, we build secure and impenetrable exchanges.

5. Tailored architecture

One-size-fits-all approaches need to be revised. We build custom exchanges tailored to your needs, helping you stand out in a competitive market.

6. UX that converts

In crypto, complexity kills adoption. Our intuitive interfaces turn novices into power users, which maximizes engagement and liquidity.

7. Compliance without compromise

We make it easy to stay on the right side of the law. We go above and beyond legal requirements, earning the trust of your customers and government regulators.

Conclusion

In conclusion, navigating the startup dilemma of whether to build a crypto exchange or a wallet requires careful consideration of your business goals and market demands. Each option offers unique advantages and challenges, making it essential to evaluate your resources, target audience, and long-term vision.

Ultimately, the right decision can propel your business forward, allowing you to capitalize on the growing opportunities in the crypto landscape. Choose wisely to seize the opportunities that lie ahead.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.