The intertwining of DeFi and smart contracts

To understand how the two concepts collide, we will briefly explain the mechanism of decentralized finance (DeFi).

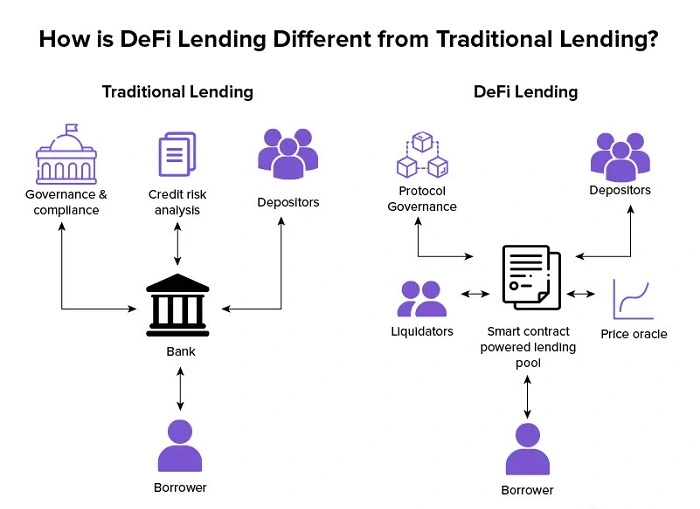

The idea behind it is to utilize blockchain technology to remove traditional intermediaries such as banks, funds, stockbrokers, or lawyers. DeFi supports a peer-to-peer network based on how both parties adhere to written requirements, not just based on trust.

To make it work, DeFi relies on 3 components:

- A blockchain platform that can store all transactions, acting as a decentralized and immutable digital ledger for DeFi.

- Decentralized applications (dApps) act as a bridge connecting DeFi with the blockchain platform to operate lending, borrowing, and trading.

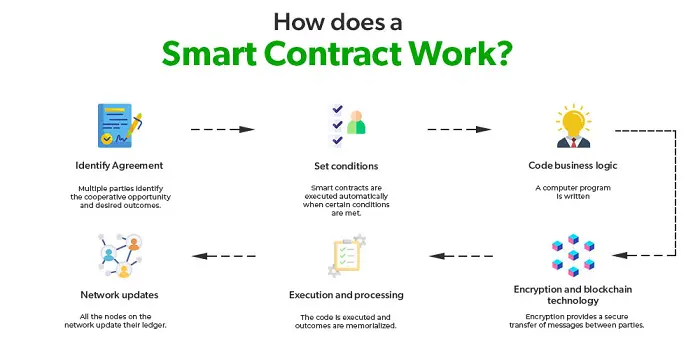

- Finally, there are smart contracts. These self-executing contracts will automatically execute the agreement’s actions, completely removing the need for intermediaries. Smart contracts enforce financial activities such as exchanging, trading, lending, yield farming, and staking.

You can clearly see that smart contracts are a part of DeFi or even the backbone of its operation. Without smart contracts, the idea of DeFi wouldn’t be true and couldn’t function.

The roles of smart contract in DeFi

As an indispensable part of DeFi, here’s what smart contracts do:

Automating financial processes

Smart contracts help automate financial processes. Once the pre-programmed conditions are satisfied, the smart contract will be executed automatically. This minimizes contract execution time, reduces human errors, and creates a seamless and highly secure financial process.

Eliminating dependencies

Smart contracts eliminate dependence on financial intermediaries, a crucial factor in centralized financial markets. Instead, they act as a middleman for banks and legal enforcement.

Therefore, they optimize costs and transaction speed, avoiding third-party fraud. Smart contracts allow users to take more control over their financial transactions.

Role in decentralized exchanges and lending platforms

Two popular applications of DeFi market are Decentralized exchanges (DEX) and DeFi Lending platforms.

Smart contracts store all the transaction hashes and traders’ information. Transaction details can be queried across peer-to-peer nodes in the Defi ecosystem, while trader information is confidential, creating a transparent and secure lending platform.

Real-life examples how smart contract operate in DeFi

One of the best DeFi smart contracts examples I know is the story of our client, who worked with us to build a P2P lending platform, NFT marketplace, and crypto wallet called DeFi for you.

The platform is built on the Ethereum and Binance Smart Chain, with an extensive use of DeFi smart contracts:

For the P2P lending module, DeFi smart contract automatically can:

- Transfers assets between peers for lending, borrowing or payment once conditions are met.

- Tokenize assets into digital types.

Combined with AWS Key Management Service (KMS), we created a robust encryption mechanism, making sure everything is safe and sound in its place.

For the crypto wallet, we use a cross-chain architecture to make the DeFi smart contract interoperate with diverse blockchain platforms and wallets for seamless transactions. It also acts as a place to store the metadata.

For the NFT marketplace, relying on Solidity smart contracts, we make sure the NFT is fast and secure.

Looking for someone to help with the development of DeFi smart contracts?

Benefit of smart contract in DeFi

Smart contracts have a lot more advantages over traditional contracts and become a guarantee of safety and effectiveness in DeFi deals. Here are some salient benefits:

Cost reduction

Smart contracts eliminate third-party involvement, thus reducing transaction costs since there are no intermediary costs. This is a considerable advantage, especially in cross-border transactions where exchange rates are exorbitant.

Transparency and security

Smart contracts inherit the transparency and security of blockchain technology. Therefore, the financial activities of the DeFi smart contracts are always transparent, as nodes of the blockchain system can verify transactions.

Efficiency and automation

Smart contracts are self-executing contracts, so once pre-programmed conditions are met, they will automatically execute the terms, eliminating delays and complications in traditional contracts.

Accessibility

Smart contracts eliminate the involvement of third parties, thus increasing user accessibility.

DeFi applications create a global peer-to-peer ecosystem, facilitating easy access, which is especially beneficial for those who can barely access financial intermediaries or services.

Types of smart contracts in DeFi

To best accommodate each type of DeFi application, there are various types of DeFi smart contracts as well.

1. Lending and borrowing contracts

Smart contracts play an important role in peer-to-peer lending without the involvement of banks. The lender determines the interest rate terms, collateral requirements, and other loan agreements through the smart contract, which will self-execute the terms if all conditions are met.

2. Decentralized exchange (DEX) contracts

DEX smart contracts allow users to trade cryptocurrencies directly from peer-to-peer. The smart contract will manage order matching, escrow, and trade settlement. There is no danger of delay, scam, or loss.

3. Insurance contracts

Not just serving the finance industry, you can also use DeFi smart contracts to minimize the risks of the insurance world. They will define insurance terms and automate the payout process to reduce slow response rates and insurance fraud.

4. Automated market marker contract (AMM contract)

AMM Smart contracts provide liquidity solutions for a virtual asset, playing an important role in the price-setting mechanism. Not only will the asset increase in liquidity, but automated market makers will profit from price differentials. They also earn income by providing liquidity solutions and executing market orders.

5. DeFi yield farming contracts

This type of DeFi smart contract will store and manage the distribution of rewards and incentives once a user interacts with liquidity provision. Additionally, you can also use it to optimize yield farming strategies. You can learn about Yearn.finance for this DeFi smart contract example.

What are the challenges of smart contracts and DeFi?

As both DeFi and smart contracts being a new technology, there are still many concerns on its reliability, security and long-term scalability.

Security vulnerabilities

Smart contracts overcome many disadvantages of traditional contracts, but by no means are they fool-proof.

Security vulnerabilities are one of the biggest problems with smart contracts. Million-dollar losses, notably DAO hacks, are all related to smart contract security vulnerabilities.

In high-value or important transactions, it even requires smart contract auditing to minimize the risks of security vulnerabilities and malware. One solution is to constantly audit your smart contract, make sure there’s nothing exploitable.

Regulatory challenges

DeFi smart contract’s decentralized and anonymous nature is an advantage, but it also presents a major challenge in managing authorities.

Especially in transactions using cryptocurrency, smart contracts have a hand in illegal transactions such as illegal trading of drug, weapons, pornography, theft and even contract killing. Therefore, it is difficult for countries to find management solutions for smart contracts at the present time. Some choose to ban them firsthand to completely remove all risks.

One way is to work with someone who understands the law and blockchain. They can consult you on what to do and how to use smart contracts in DeFi. That’s what we do at Synodus!

User education and adoption

Even with traditional contracts, users need to have certain knowledge to avoid risks in contracts. With smart contracts, this knowledge is at the next level. It doesn’t stop at understanding the law but also coding, blockchain, and technology.

The complexity of DeFi smart contracts and other elements in the blockchain ecosystem are the biggest barriers to entry. To popularize smart contracts, users need comprehensive education about the technology, its benefits, and its risks.

The future of DeFi smart contracts

Despite all the problems, the DeFi world keeps expanding with new features and trends, aiming to reduce all the above challenges and make it a complete solution.

For DeFi smart contracts, here are what to watch out:

- Cross-chain compatibility: Writing a cross-chain smart contract can improve its interoperability between blockchain platforms, making transferring assets much more seamless and convenient. This will be the next trend as more and more blockchain platforms support smart contracts, instead of them being made exclusively for one blockchain.

- Hybrid smart contract: On the other hand, many go for a hybrid DeFi smart contract, combing off-chain data and on-chain infrastructure to make it more adaptive and support real-time decision making. One notable way is to utilize decentralized oracle networks to feed off-chain data to smart contracts.

- Automated market makers (AMMs) evolution: The development of AMM not only helps increase the liquidity of assets, benefits Automated Market Makers from price differential and creating liquidity tools, but also benefits traders from competitive prices, enhancing the trading experience in DeFi

- Non-fungible tokens (NFTs) in DeFi: Integrating NFTs into the DeFi ecosystem as a unique financial tool for digital asset transactions opens many monetization opportunities for account holders. This trend will soon come as smart contracts are the backbone of both NFTs and DeFi.

- DeFi insurance and risk management: Smart contract auditing, insurance and risk management for DeFi will become trends soon to protect users from security vulnerabilities and asset loss.

- Integration of real-world assets: Tokenization of real-world assets such as real estate, commodities, and stocks helps DeFi go into the traditional financial market. Once again, DeFi smart contracts are the main enablement of this.

Steps of DeFi smart contract development

DeFi smart contract development can be a hassle task. But if you approach it the right way, the process is much easier than building other types of blockchain applications. The biggest constraint to watch out for are the security and legal state of your DeFi smart contracts. You need to find a suitable DeFi smart contract development company or a qualified in-house team to finish the task.

Here’s how we – a leading DeFi smart contract development company – do it:

- Define requirements. We send you a list of questions to evaluate your requirements and objectives to implement smart contracts

- Research and planning. In this step, our team of blockchain experts and legal consultants will discuss the best strategy to approach the project and make sure the proposed solution meets DeFi protocols and blockchain regulatory.

- Create a POC and technical design. From the information we gathered, our team will plan the DeFi smart contract architecture, functions, operational logic, suited techstack and user interaction. From there, we make sure it aligns with your business requirements and that you are on board with the POC.

- Development. A combination between building and constant testing to meet the project’s deadline.

- Security auditing. The final step to guarantee your DeFi smart contract is secure and ready to be deployed, using both manual and automated testing tools.

- A seamless deployment of the DeFi smart contract into your existing architecture. Followed by another phase of maintenance and support, if you require.

This process has helped us successfully deployed dozens of smart contracts for our clients, including DeFi for You. Want to know how we will handle your case? There are 250+ competent blockchain developers awaiting at Synodus!

FAQ on DeFi smart contract

From a few weeks to 4 months depending on the complexity of your DeFi smart contracts and the size of your DeFi application as well. For an exact timeline, you should consult with a blockchain expert, such as Synodus.

Basic DeFi smart contract development services may start at $3,000. It can be higher if your project is complex. For detailed estimation, you can read this guide on calculating your own smart contract cost!

Yes, you should constantly audit your DeFi smart contracts, especially before the deployment and before any important upgrade of your DeFi applications.

Solidity, Rust, Vyper, Clarity and Yul are the most common ones. Solidity is the most popular programming language for DeFi smart contracts, as it is made for Ethereum Virtual Machine.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.