If you’re building a DeFi product, you already know how fast this space moves – new protocols, new liquidity pools and new ways to engage users. But with that speed comes risk. And not just the kind that exploits smart contracts or drains a pool overnight. The real DeFi risk for startups often lies in what those incidents do to your users’ trust, investor confidence, and long-term product vision.

As of November 2025, total value locked (TVL) in DeFi has reached around $131.8 billion, up nearly 60% from $83.3 billion a year earlier. Growth like that attracts builders, users, and capital. But it also attracts exploits. For a founder, this creates a difficult balance: How do you keep innovating without becoming the next cautionary headline?

We’ve observed that many startups only think about risk management after launch. But in DeFi, trust is the product. From your seed round to onboarding your first thousand users, anticipating potential risks and planning for them early strengthens your position in the market.

In this blog post, we‘ll cover the main risks that DeFi products face and show how startups can manage these risks to build user trust, investor confidence, and a strong foundation for growth.

Common risks in DeFi development

Broadly, the most common DeFi risk factors fall into three group: technology & operational, market & financial, and regulatory & trust risks. Below is a quick summary table.

| Risk category | Examples | Business impact |

|---|---|---|

| Technology & operational | Smart contracts, oracle & data feed, front-end/ UX, operational & infrastructure. | Lost funds, failed transactions, reduced trust. |

| Market & financial | Liquidity, market & price, economic & protocol design. | Losses, token collapse, mass withdrawals. |

| Regulatory & trust | Governance, regulatory & compliance. | Fines, restricted operations, damaged reputation. |

Technology & operational risks

This is where most DeFi startups stumble first. Technical and infrastructure issues are often invisible until they cause real damage – a DeFi protocol risk such as a smart contract exploit, a malfunctioning oracle, or downtime during a critical moment.

A single bug in your smart contract logic can drain funds in minutes, and once deployed on-chain, these contracts can’t be easily patched. External oracles and data feeds, if manipulated or unreliable, can feed false prices that trigger unintended liquidations or arbitrage losses. Even the front end, often treated as secondary, can be exploited through phishing or DNS hijacks, creating DeFi security risks and loss of user assets.

Beyond code, operational risks matter too. Node misconfigurations, validator outages, or a failed deployment can take the platform offline and instantly erode user trust. For an early-stage project, that loss of confidence is often harder to recover than the funds themselves. Implementing runtime monitoring and regular audits can help detect and mitigate these risks before they escalate.

Market & financial Risks

Even with perfect code, DeFi products are still exposed to liquidity risk, market volatility, and pressures on protocol economics. When markets move too fast or liquidity providers exit suddenly, your entire economic model can break, creating DeFi economic risk.

Liquidity risks are common in lending or AMM protocols. When liquidity dries up, users face slippage, failed withdrawals, or unstable yields. Price volatility can trigger liquidation cascades, damaging investor confidence and driving waves of withdrawals. If your tokenomics or incentive design isn’t sustainable, for example, rewards that inflate too quickly or governance tokens with no real utility, the token value may collapse, taking your project’s credibility with it.

In short, these market and financial risks can turn an innovative idea into an unsustainable product if not managed from the design stage.

Regulatory & trust risks

These are the layer that founders often underestimate – regulation and trust. DeFi is evolving faster than global compliance frameworks can catch up, which means the legal ground beneath your product is constantly shifting.

Governance models, especially those based on token voting, can be manipulated through large holders or flash loan attacks, creating power imbalances that hurt decentralization and community trust. At the same time, regulators are tightening oversight on AML/KYC, consumer protection, and broader DeFi compliance. Without a clear compliance-by-design approach, projects risk delistings, legal penalties, or blocked expansion into major markets.

And when something goes wrong, a hack, a data leak, or a poor response to users, it can impact your trust and reputation. In DeFi, investor trust and user confidence are your most valuable currency.

How startups can manage DeFi risks

For startups building in decentralized finance, risk management is an ongoing process that shapes how secure, compliant, and trustworthy your DeFi platform becomes. Here are several ways to mitigate these risks.

1. Build security into the development lifecycle

Security can’t wait until after launch. Start with smart contract audits and automated testing pipelines before deployment. External audits from credible firms can uncover vulnerabilities early and validate your code’s integrity. And with the right defi development partner, you can turn these insights into a secure, compliant, and investor-ready DeFi product.

Beyond audits, founders should apply modular architecture and upgradeable smart contract patterns where possible. This allows flexibility for bug fixes without breaking decentralization. Incorporating protocol monitoring and on-chain alert systems (such as Forta or OpenZeppelin Defender) helps you detect anomalies before they become major exploits.

Outcome: Fewer vulnerabilities, fewer exploits, and more confidence from users and investors alike.

2. Design sustainable tokenomics and liquidity models

A secure protocol still fails if its economics aren’t sustainable. Liquidity management should be built into your protocol design, not handled reactively. Plan for potential liquidity risk scenarios, such as sudden withdrawals, token devaluation, or low trading volume, using treasury buffers and diversified liquidity pools.

Avoid overpromising yields or inflationary rewards that can’t be sustained long term. Incorporating risk-adjusted yield models, circuit breakers, or dynamic fees can help stabilize user returns and prevent liquidity drains.

Outcome: Stable TVL, predictable returns, and a healthier ecosystem for long-term growth.

3. Adopt a compliance-by-design mindset

Even if you’re decentralized, you’re not invisible to regulators. Emerging frameworks around DeFi compliance, AML/KYC, and tax transparency are shaping how projects can operate globally. By adopting compliance-by-design, founders can protect their project’s scalability and future fundraising potential.

Work with legal advisors or compliance partners early — not after you’ve launched. Even small steps, like optional KYC for institutional users or region-based access controls, can demonstrate proactive responsibility to investors.

Outcome: Easier partnerships, smoother listings, and less regulatory uncertainty down the line.

4. Protect users and build transparent communication

As mentioned, trust is your greatest asset in DeFi. When users lock their assets in your protocol, they’re effectively trusting your code and your team. Make transparency a habit: publish audit results, explain governance changes clearly, and communicate fast during incidents.

Some projects also partner with DeFi insurance protocols (like Nexus Mutual or Unslashed) to provide users with additional coverage against hacks or failures. Other projects explore DeFi passive income as an opportunity to attract and retain users.

Outcome: Stronger user confidence, positive reputation, and higher investor trust.

5. Treat risk management as an ongoing culture

Finally, encourage your team to think about risk at every layer: product, design, economics, and user education. The most successful DeFi startups embed risk-awareness into their product roadmap and community governance from the start.

Outcome: Long-term resilience and a project that can evolve safely as the DeFi landscape matures.

When embedding risk-awareness into every layer, startups not only build resilience but also create practical lessons we can learn from. Let’s look at some real examples of how DeFi projects have handled risks.

6. Real case studies of startups handle DeFi risks

1. Compound

Compound is a decentralized lending protocol that allows users to borrow cryptocurrencies. This successful DeFi project highlights how the above-mentioned practices can be implemented effectively.

The DeFi risk management strategies:

- Secure governance: Compound has implemented a governance model where COMP token holders vote on protocol changes. This decentralized approach helps distribute decision-making power and reduces the risk of centralized control.

- Audits and security practices: Compound regularly undergoes security audits by reputable firms like OpenZeppelin to identify and mitigate potential vulnerabilities. They also have a bug bounty program to incentivize external security researchers to find and report bugs.

- Oracle mechanisms: Compound uses secure and reliable price oracles to ensure accurate and tamper-proof asset price feeds, mitigating price manipulation risks.

Takeaway: Compound’s success emphasizes the importance of a multi-pronged approach to risk management. Distributing control, prioritizing code security, and employing reliable data sources are crucial for DeFi projects to thrive.

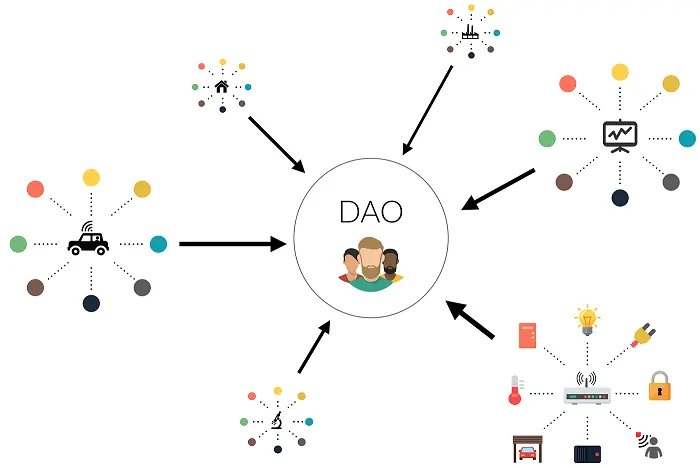

2. The DAO

The DAO, a pioneering project on the Ethereum blockchain, serves as a stark reminder of the consequences of inadequate management of DeFi risks. Launched in 2016, The DAO aimed to create a community-governed venture capital fund. Yet, its story ended abruptly due to a critical security flaw.

Here are some key takeaways about The DAO’s failed projects and lessons learned:

- Security Breach: In 2016, The DAO was hacked due to a vulnerability in its smart contract code, resulting in the loss of $60 million worth of Ether. The incident highlighted the importance of rigorous security audits and testing before deploying smart contracts.

- Lesson: This failure underscored the need for comprehensive security practices, including formal verification methods and third-party audits, to identify and address vulnerabilities before attackers can exploit them.

Conclusion

Navigating the decentralized finance space requires a keen understanding of the inherent risks involved. This blog post has explored developers’ common challenges in DeFi development and provided valuable DeFi risk mitigation strategies.

By prioritizing robust practices for DeFi risk management, such as smart contract audits, rigorous testing, and multi-signature wallets, developers can build trust and foster a secure user environment. Moreover, staying informed about DeFi regulations is crucial for ensuring compliance and minimizing legal risks.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.