A mid-sized commercial bank faced a daunting challenge as it aimed to integrate finance, HR, and CRM functions efficiently. Ultilizing Synodus’s own low-code platform, the bank transformed its disparate systems into a unified ERP solution. Within a year, the bank experienced unparalleled efficiency gains, marking a remarkable evolution in banking operations.

Challenge in functions management

Challenges

The bank’s endeavor to fortify its financial processes confronted several hurdles:

- Cost-prohibitive solutions: Traditional ERP systems proved excessively expensive for a mid-sized institution.

- Lack of tailored solutions: Existing tools lacked customization crucial for the financial sector’s stringent regulations and rapid developments.

Synodus offered a breakthrough

Cutting-edge technology stacks: Leveraging Synodus’ low-code platform, cloud-based infrastructure, microservices, and Kubernetes ensured optimal performance.

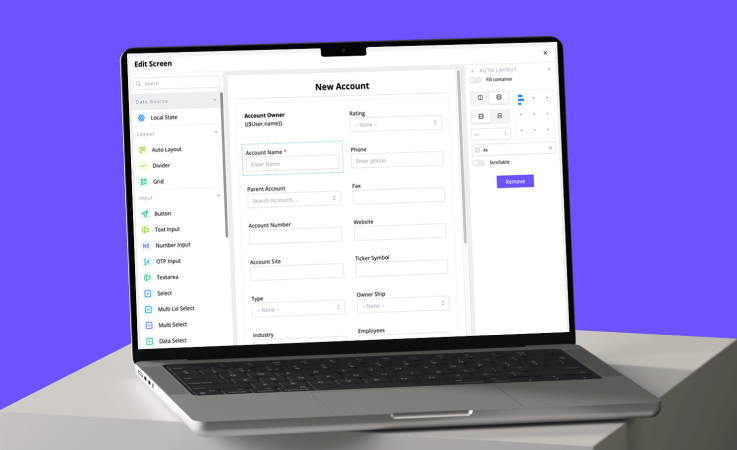

Customizable, pre-built components: Synodus provided adaptable elements like Tables and Charts, reducing development time and costs significantly.

Our solution

Technical solutions

- Modular ERP architecture: Design microservices-based architecture for independent development, deployment, and scaling of banking functions.

- Cloud infrastructure & Kubernetes: Host on Azure, leveraging Kubernetes for scalability and cost-efficiency.

- Custom development & integration: Develop tailored solutions using modern programming languages and frameworks for seamless integration with existing systems.

- Pre-built components & customization: Implement user-friendly interfaces with pre-built customizable components, reducing development time and costs.

- Security & compliance: Implement robust security measures, including encryption and role-based access control, to ensure compliance.

- Continuous improvement & support: Establish a roadmap for continuous improvement, incorporating user feedback and evolving regulatory requirements.

ERP functions and key features

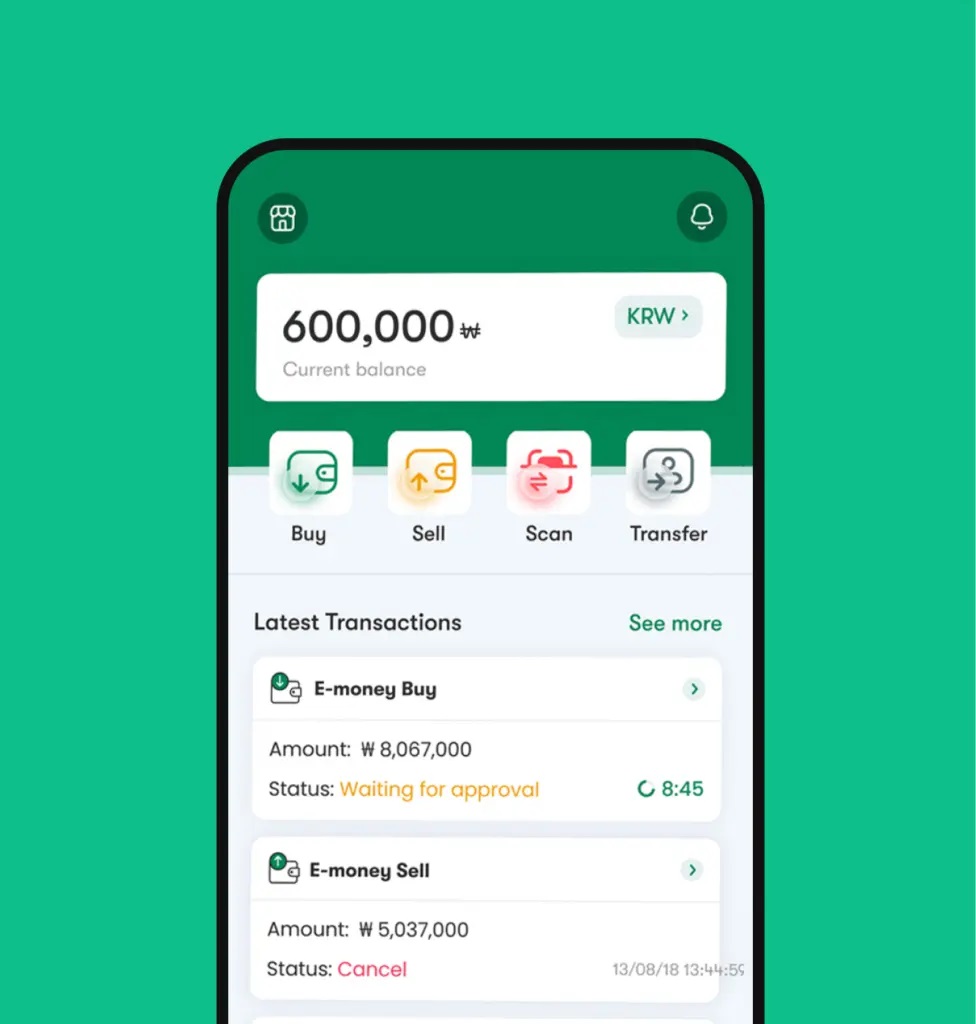

Finance module

Low-code financial reporting:

- Drag-and-drop reporting tools for generating financial reports.

- Customizable templates for regulatory compliance.

Automated transaction workflows:

- Visual workflow builders for automating payment processing.

- Configurable rules engine for transaction routing.

Budgeting & forecasting wizards:

- Intuitive budget planning tools.

- Forecasting wizards with AI-powered analytics.

Risk management dashboards:

- Dashboard widgets for displaying risk indicators.

- Configurable risk assessment forms.

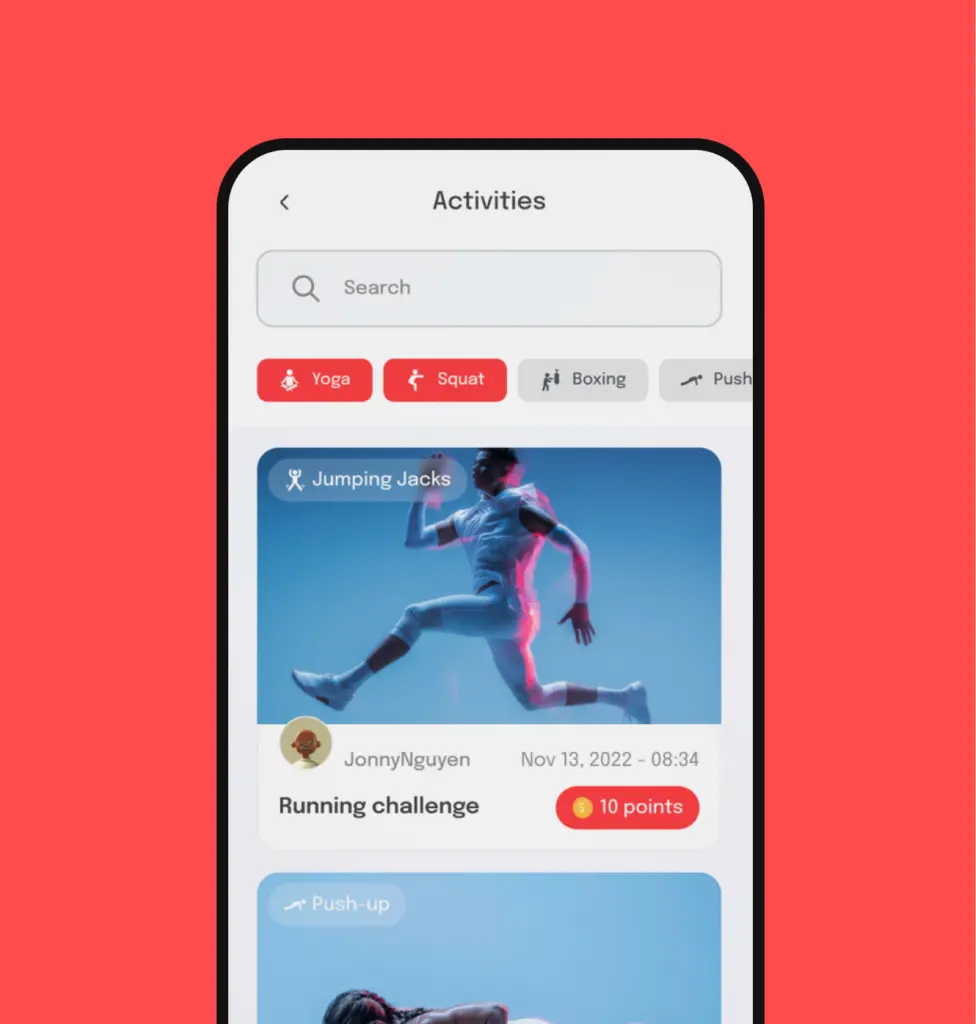

HR module

Employee self-service portals:

- Low-code portal creation for managing personal information.

- Workflow builders for HR task automation.

Recruitment process automation:

- Drag-and-drop interfaces for managing job postings.

- Template-based onboarding workflows.

Centralized communication hub:

- Platform for employee interactions and collaboration.

- Integration with HR processes and event management.

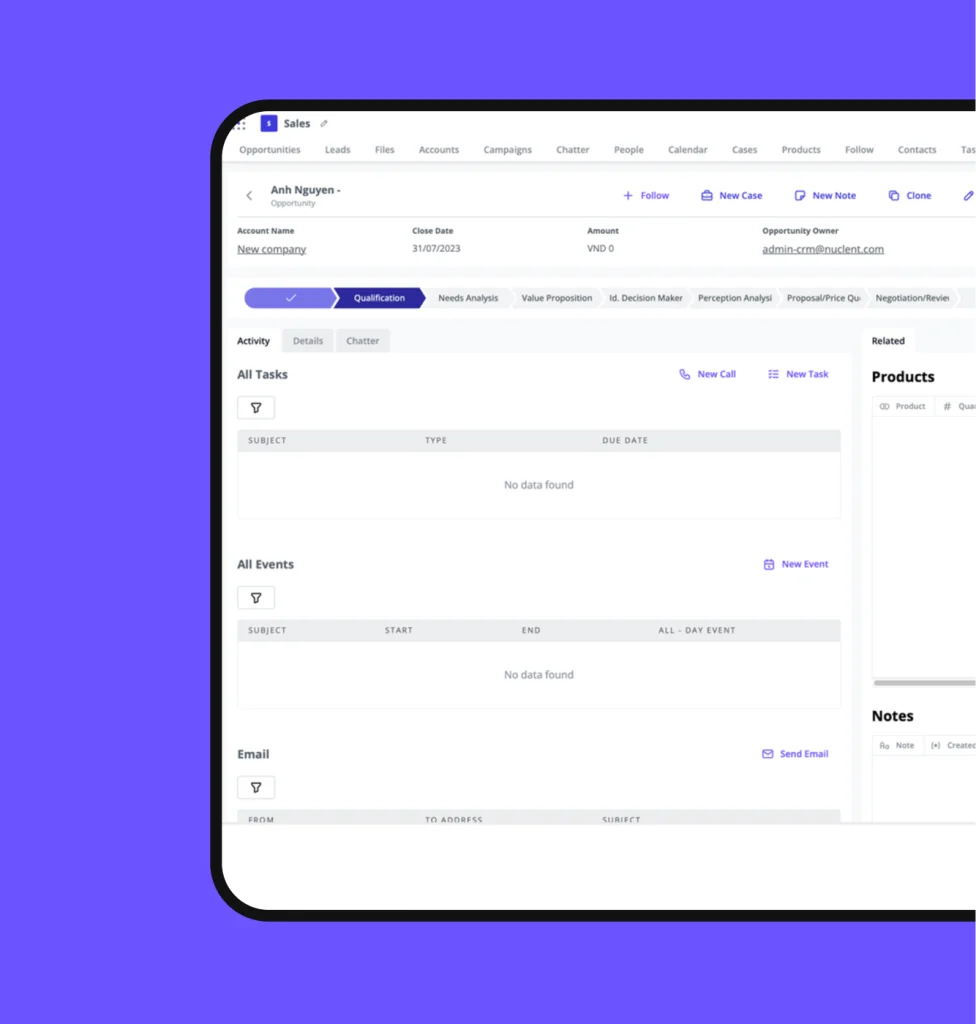

CRM module

Customizable customer profiles:

- Low-code forms for capturing and editing customer data.

- Dynamic customer segmentation.

Sales & marketing campaign builders:

- Visual campaign builders for executing marketing campaigns.

- Lead scoring configuration.

Service desk automation:

- Low-code ticketing system for customer query handling.

- Integration with communication channels.

Results & impacts

The HR module’s proof of concept yielded promising outcomes:

- Enhanced employee engagement: The communication hub fostered collaboration and knowledge sharing.

- Operational efficiency improvements: Streamlined workflows reduced administrative burdens and ensured payroll accuracy.

- Positive employee reception: Smooth transition and high user acceptance indicated early success.

- Foundation for future impacts: Early successes set the stage for broader organizational transformation

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.