Project summary

Our client, a retired VP of Technology, embarked on his entrepreneurial mission after noticing a niche where most PaaS solutions favored large banks, leaving smaller ones with costly or risky options.

Seeking a strategic partner that can deliver technical expertise and business consultation, his wish was attained with Synodus. The result was extraordinary, with the successful launch of an all-around digital banking platform.

Challenge: A too-niche requirement

The first monumental challenge was how to architect a banking PaaS catering to the operating model of smaller financial companies. This includes security, scalability, user-friendliness and openness to integrate with their core banking.

Because of that, he needed a qualified partner that understands the intricacies of the banking sector and the Asia-Pacific market and is committed to supporting all growth stages.

Our solution & methodology

How we got selected

After extensively scoured the globe, our client shortlisted potential partners from Vietnam, India, Poland and Philippines. Standing between strong peers, we knew that mere expertise wouldn’t be enough.

Understanding the pressure in growing the first batch of customers, we suggested a dual strategy of product development and business expansion, starting with foothold in North America before entering the APAC market. This would allow our client to refine their application with valuable feedback. This idea made us stand out, solidifying Synodus as key tech partner for the startup.

Build the concrete with high-level approach

The goal is to craft a nimble and scalable digital bank. Hence, we came up with a framework that revolves around a microservice, modular, and API-first architecture to embolden our client’s requirements and expand along growth.

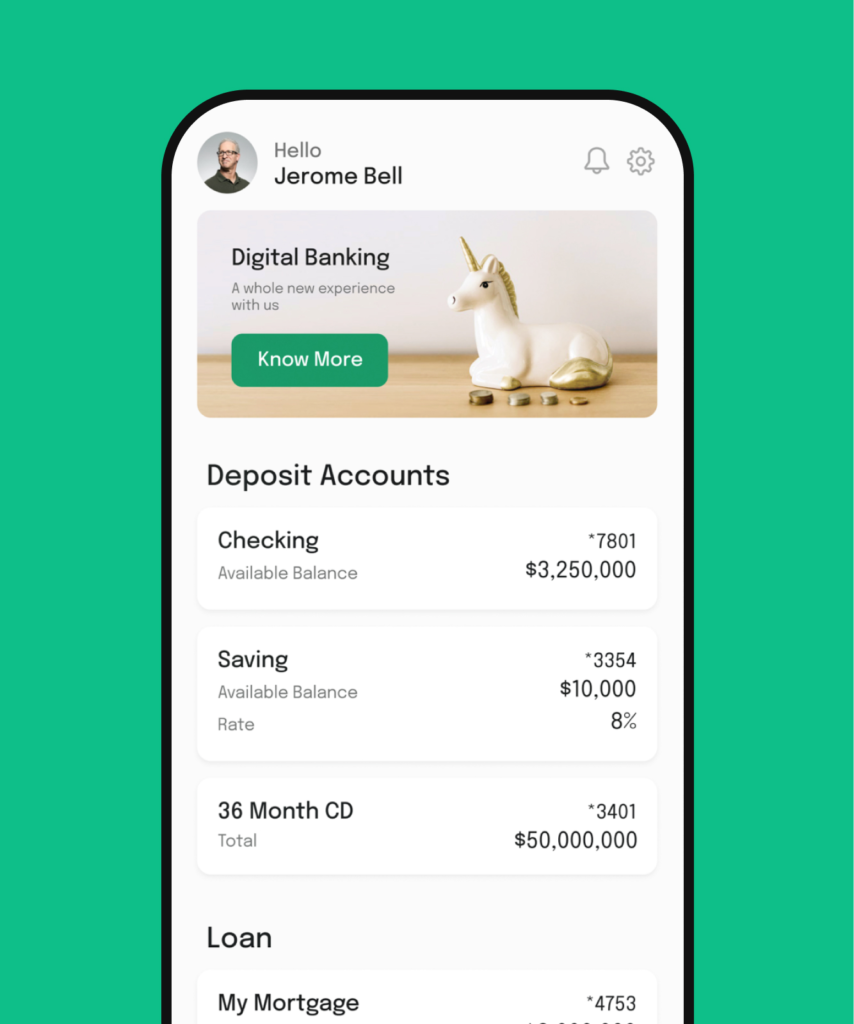

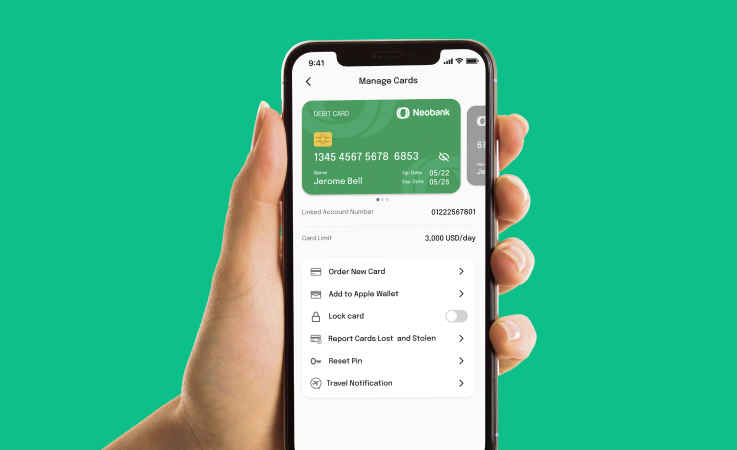

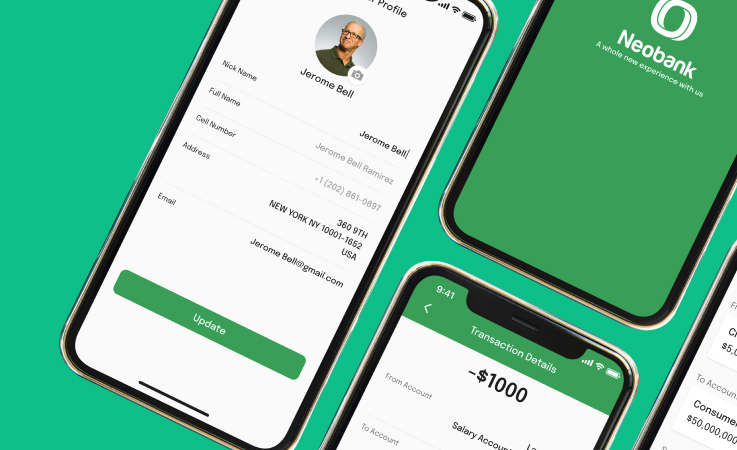

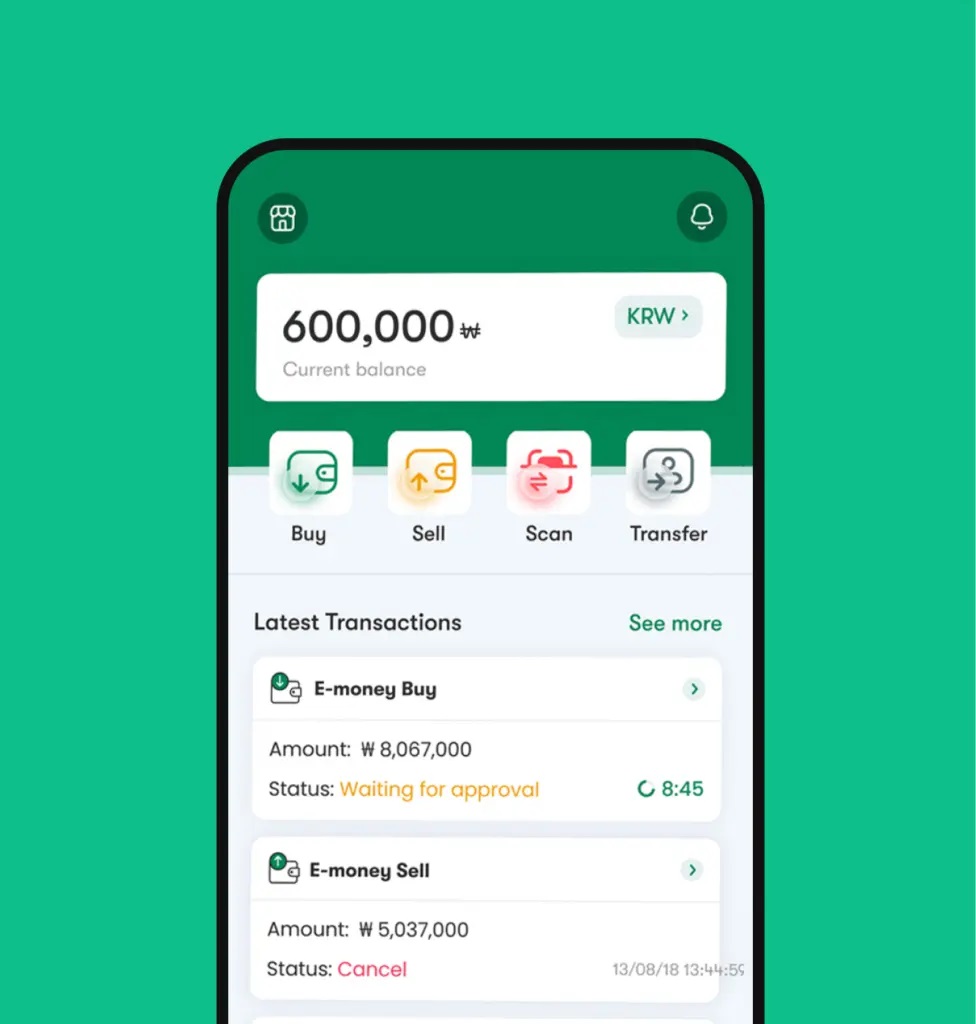

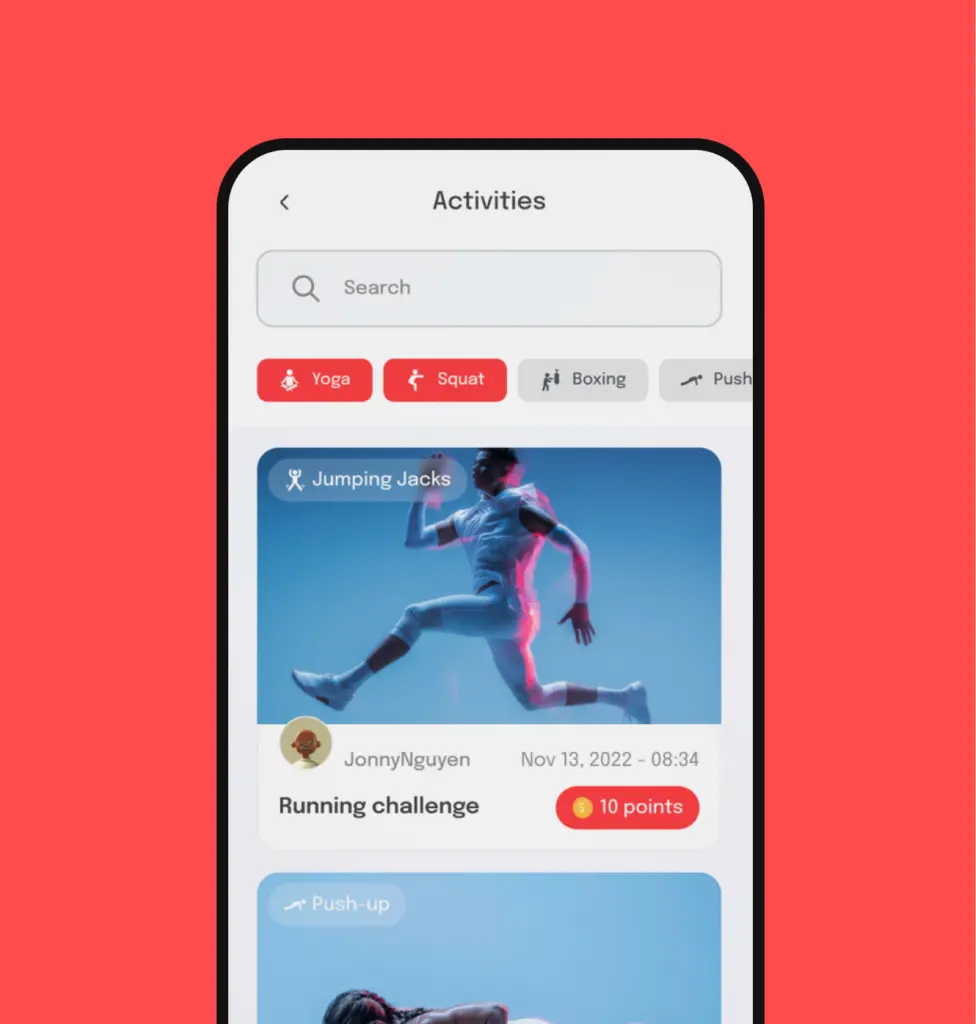

At the same time, the end-user of digital banking is the general public. As so, we prioritized friendly mobile apps and web experience that anyone can effortlessly navigate through to make transactions and open accounts.

The final product

With the right approach, we implemented Agile Scrum and Extreme Programming to increase productivity and shorten time-to-market.

The digital banking platform as a service (PaaS) offers a list of curated features, adored by not only SME financial institutions but also the Pacific end-users:

- The CASA aka Current Account Saving Account combination loved by West & SEA to effectively self-check and manage both deposits. To maximize the highest convenience for the end-user, there’re also automated interest calculation and goal-based saving options.

- Automated Lending/ Borrowing that simplifies the tedious process for banking executives and borrowers with just a few clicks.

- To guarantee swift transaction processing, the platform supports various payment options, ranging from transfer, bill payment to mobile payment.

- Our client can onboard customers in the blink of an eye with KYC and AML checks.

- Smart integration with payment gateways, credit scoring and unlimited system to expand your service offerings at will.

- Aiding in decision-making, the banking PaaS equips executives with a comprehensive set of analytic tools that monitor customer behavior and extract actionable insights.

- Ensure your digital bank complies with regional to global legal standards thanks to the platform’s flexibility and adaptability.

Powered by extensive tech stack, the digital platform prompts the highest performance in load time, while ensuring an eye-soothing look at the forefront.

Result

In a year-long endeavor, our team efficiently executed and delivered the digital banking platform on time and within budget.

This venture marked its debut in North American with a POC, capturing the interest of 3 clients and highlighting the platform’s potential for further expansion. The immediate results have enriched our partnership with the client, setting a foundation for our long-term partnership.

Seeking a “partner in crimes” for your startups?

With a clear roadmap in mind, we will keep on working with said client to scale and expand the PaaS capabilities, aiming to earn the heart of APAC market in the future.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.